“Patagonia: Life Imitates Theory,” Econospeak by Peter Dorman When Yvon Chouinard, the founder of Patagonia, completed the transfer of that company’s ownership to an environmental trust fund, it was front-page news across the country. It came as something less than a shock to me, however, because I had described a very similar structure in a paper I wrote a few years ago about “pluralist social ownership”. First, it’s interesting what...

Read More »September consumer inflation; function of fictitious “owners’ equivalent rent”+ new cars

“September consumer inflation: primarily a function of the fictitious “owners’ equivalent rent” plus new cars” – by New Deal democrat Since last November I’ve been hammering the fact that the official CPI measure of housing inflation, “owners’ equivalent rent,” seriously lagged, as in by a year or more, actual house prices as measured by the most popular housing indexes. At the time I wrote that OER was only up 3.1% YoY and core inflation...

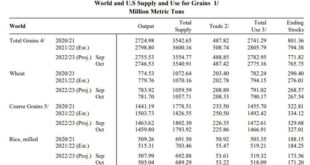

Read More »The WASDE Is Out, May the Kernels Fall Where They Will

USDA has now dropped the World Agricultural Supply and Demand Estimates in the much awaited October reporting. In a simple one liner, here is the gist of it – lower soy and corn yields this year (drought and lack of fertilizer – we saw this one coming), but wheat supply down, but higher than last year. Wheat is essentially a weed and has conditional consideration mostly to weather and also if the crop was planted, looks like we’re ok here. Here...

Read More »“What News was in My In-Box”

Latest mixed bag of articles for the week touching on many topics. The very first article implies there was a grant to the Wuhan, China facility. Not sure why that would occur considering all the ruckus which occurred in the past. There is also an article on the Jacksom Mississippi water issues. Jackson is a fair size town. Kind of wonder why that is even occurring. There is also an article about the Boy Scouts selling off their land to pay for...

Read More »Nobel Peace Prizes 2022

Nobel Peace Prizes were awarded most recently. “The Nobel Peace Prize has been awarded 103 times to 140 Nobel Prize laureates between 1901 and 2022, 110 individuals and 30 organizations. Since the International Committee of the Red Cross has been awarded the Nobel Peace Prize three times (in 1917, 1944 and 1963), and the Office of the United Nations High Commissioner for Refugees has been awarded the Nobel Peace Prize two times (in 1954 and 1981),...

Read More »NDd’s Weekly Indicators for October 3 – 7

Weekly Indicators for October 3 – 7 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. This week’s headline was easy, because OPEC’s (and in particular Russia and Saudi Arabia’s) geopolitical decision – aimed directly at the November elections in the US as well as Western support for Ukraine – to cut back production has already caused gas and oil prices to increase sharply. As usual, clicking over...

Read More »An Improvement In China’s Human Rights Record In XinJiang?

An Improvement In China’s Human Rights Record In XinJiang?, Econospeak by Barkley Rosser On October 5, 2022, the Washington Post published a front section story, “Uyghyr crackdown eases, but Xinjiang;s scars endure,” by Eva Dou and Kate Cadell. The article documents the ongoing human rights problems and a lack of transparency in Xinjiang province in China, including ongoing use of forced labor in prisons in industrial parks, in the wake of...

Read More »Taiwan Weapons

The US military has ideas about how Taiwan can protect itself from a possible Chinese invasion (and therefore deter that invasion) I think they are very good ideas. I think that the proposed program would markedly reduce the threat of a PRC invasion of Taiwan, which is the most alarming threat currently faced by the US and its allies (including the allied country Taiwan, which the US does not recognize). I ask why is this program which is well...

Read More »OPEC Aligns with Russia, “Letters from an American”

This “Letter from an American” author Prof. Heather has a different spin to it. Prof. Heather is discussing OPEC and the impact it is going to have on the US as well as other counties not having the wealth we have. One thing I did not know is, Russia is the Vice-Chair of OPEC. Or Putin has his input to OPEC. Leading up to the MBS ‘s decision to cut oil production, the market was stabilizing and prices were dropping. “October 5, 2022,” Letters...

Read More »We Really Need to Talk Fertilizer

Six billion. I have written and rewritten the first line of this over and over and over again. Six billion. That is the amount of current US dollars American farmers have to come up with this year as fertilizer prices hit highs not seen since 2008, on top of higher prices last year. The difference is that in 2008 we had a financial meltdown, a run on energy markets, and global calamity. This year, we have supply crunches due to war, restrictions,...

Read More » Heterodox

Heterodox