With the Breaking Into series we will explore US agriculture, the least complex, the most complex, the failures, frustrations, sustainability, costs, and future of each topic that makes up modern agricutlure. On this episode we are going to explore a more complex, yet still small, system of farming for profit, Small Plot Farming. Small Plot Farming in a name can seem inadequate, small, not useful in the bigger picture of global agribusiness, but...

Read More »What News was in My In-Box

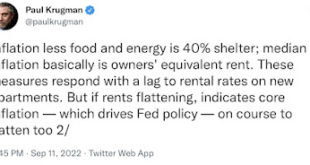

A lot of informational news deposited in my In-Box this week. Nothing this week is taken from anywhere else. I think last week, I included one news article from the outside. Political, Economic, Healthcare news are my mainstays. The usual economics and business news coming from different sources. Yes, inflation is still an issue. I do not believe Powell will not give us a soft landing he thinks he is capable of doing. One issue will help...

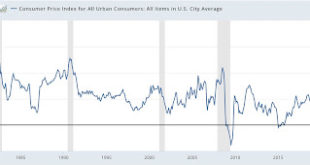

Read More »August CPI: sharp gains in housing and new cars offset declines in used cars and gas

August CPI: sharp gains in housing and new cars offset declines in used cars and gas – by New Deal democrat Following up on yesterday’s post, let’s cut to the chase: Total CPI +0.1% Energy -5.0% Used vehicles -0.1% New vehicles +0.8% Owners’ equivalent rent +0.7% (biggest monthly gain since 1990) YoY inflation declined to +8.3% from its recent +9.0% peak: The 0.7% increase in owner’s equivalent rent was the biggest monthly...

Read More »Previewing CPI

Previewing CPI No economic news today. Tomorrow the August CPI will be reported. Recall that in July there was no inflation whatsoever. In August last year prices increased 0.3%, so any number lower than that will lower YoY CPI from its July level of 8.5% (June’s 9.0% YoY inflation having been the peak). The big bugaboos for consumer inflation have been housing, vehicles, and gas. So let’s take a look at each. Yesterday, for the first time,...

Read More »Breaking Into Agriculture: Episode 1, Market Gardens

With the Breaking Into series we will explore US agriculture, the least complex, the most complex, the failures, frustrations, sustainability, costs, and future of each topic that makes up modern agricutlure. On this episode we are going to explore one of the more simple ways to get into professional agriculture, Market Gardens. Market Gardens by another name are simply backyard gardens where the output is more than the habitants of land can...

Read More »Combating Nativism and Making America Stronger

Combat Nativism and Make America the Most Welcoming Country in the World Some findings from the Roosevelt Institute: “New report: Combat Nativism and Make America the Most Welcoming Country in the World” – Roosevelt Institute In 2020, natural disasters forced more than 30 million people to migrate across the globe. by 2050, climate change impacts could bring this number up to 216 million.Mass migration is happening against the global backdrop...

Read More »Will The Iran Nuclear Deal Ever Get Reestablished?

“Will The Iran Nuclear Deal Ever Get Reestablished?,” Econospeak It (Iran Nuclear Deal) keeps looking like it might, but then no obstacles have appeared yet. President Biden promised to undo what I have long argued was the worst foreign policy mistake made by Donald Trump. He should have just done it right after he took office, but he made a bunch of extra demands and the negotiations went nowhere. Then the moderate Rouhani government was...

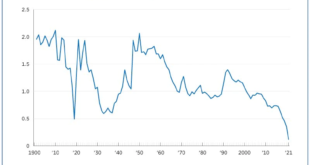

Read More »The spending transition from goods to services

The spending transition from goods to services – by New Deal democrat Today is the last day for a very light economic week of news. One item worth addressing is the relative state of consumer purchases of goods vs. services in this pandemic recovery, because it appears to be unique. Let’s start with the ISM non-manufacturing report, which was released on Tuesday. Unlike the manufacturing report, which bounced back slightly into expansion...

Read More »China and the Debt Crisis

by Joseph Joyce China and the Debt Crisis Sri Lanka is not the first developing economy to default on its foreign debt, and certainly won’t be the last. The Economist has identified 53 countries as most vulnerable to a combination of “heavy debt burdens, slowing global growth and tightening financial conditions.” The response of China to what will be a rolling series of restructurings and write-downs will reveal much about its position in the...

Read More »What News was in My In-Box

As usual, what I found in My In-Box. Things I would like to write, have barely enough time to read, and pass them on to AB readers. Nothing here on the present battle between the DoJ and a neophyte Federal judge who lacks broad based experience as a federal prosecutor and in civil trials. I had an article, read it, and did not realize what I had read and who it applied to at the time. Then the storm hit. The text as written by an attorney who...

Read More » Heterodox

Heterodox