Noah Smith (and many others) is irritated by a puff piece about Stephanie Kelton and modern monetery theory MMT by Jeanna Smialak in the New York Times. I am not interested in Smialak’s article. I think that Noah sums up his critique here very well “The article then demonstrates that it has little notion of what separates MMT from mainstream thinking: ‘M.M.T. theorists argue that society should feel capable of spending to achieve its goals to...

Read More »Can Ukraine Become A New Austria?

Can Ukraine Become A New Austria? In this Sunday’s Washington Post, columnist David von Drehle suggests that a way out of the difficult Russia/Ukraine situation would be for Ukraine to become like what happened with Austria in 1955 and since; it formally became officially neutral, not joining either NATO or the Warsaw Pact, and has remained so since. For Ukraine, this would in effect grant Putin his demand that Ukraine not join NATO, although...

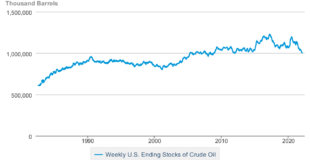

Read More »Oil at 10-year Low, SPR at 19-Year low, Total oil & products supply at 7 1/2-year low

Oil supplies at a 10 year low; SPR at a 19 year low, total oil & products supplies at 7 1/2 year low; Omicron hit to demand leads to largest 5 week increase of gasoline inventories in 32 years RJS: The Latest US Oil Supply and Disposition Data from the EIA, Focus on Fracking US oil data from the US Energy Information Administration for the week ending January 28th indicated that despite a jump in our oil imports and a drop in our oil...

Read More »Against the Stability and Growth Pact

The stability and growth pact regulated the fiscal policy of Euro bloc countries. It is currently suspended, because of Covid. There is an ongoing discussion of whether to reactivate it when the epidemic ends or whether to replace it with something else. I strongly advocate eliminating it and replacing it with nothing. Very very rounghly, the pact limited cyclically adjusted public budget deficits to 0.5% of GDP. The possibility of suspending...

Read More »Another excellent job report

January jobs report: huge gain in wages, huge upward revisions to past few months, limited Omicron impact Here are the three issues I was looking to see addressed in this jobs report: 1. Would last month’s “poor” 199,000 number of new jobs be revised higher? 2. Is wage growth holding up? Is it accelerating?3. In December, big decreases in the number of initial jobless claims were not reflected in a better jobs number. Would the big increase in...

Read More »Writing about free time

“What they create [in their free time] has something superfluous about it.” I am finding it difficult to proceed with writing about free time because I am not having enough opportunity to talk out these questions with people in person. (Comments on Sandwichman’s post over at Econospeak is worth a thoughtful pause and and consideration…Dan) Tags: free time...

Read More »The Trident that Killed Aphrodite: Communism, Corruption, and Conscience

Green groves feed the townspeople crafting their wares for the benefit of an enlightened populace, the amber fields of grain are milled for bread for the troops to keep our sovereign democracy intact. The greatest of civilizations are measured by the strength of their army, the complexity of the structures that they construct, yet history tends to gloss over the fuel that stokes the fires of the greatest civilizations, the tended lands that feed...

Read More »Moral Hazard and Bank Bailouts

My mind goes back to 2008. I was recently tempted to ask why bad loans by banks are a public problem. I was tempted to say that the bank made the loan, so it is their problem. If enough debtors default that the bank fails, so what? Then I remember the very appealing logic of the argument that, while other banks are free to save Lehman if they choose, no public money should be involved. That didn’t work out very well. The tempting pure market let...

Read More »What is the difference between targeting and universalism?

Tax churn. Or so I will suggest. There are two basic ways to improve the economic position of disadvantaged Americans using the income tax system. The first approach, targeting, uses refundable tax credits to put more money in the hands of lower-income households. Subsidies decrease for households with higher earnings. The second approach is to use a Universal Basic Income, which gives refundable tax credits to everyone, regardless of...

Read More »My long leading forecast through the end of 2022

by New Deal democrat My long leading forecast through the end of 2022 My long leading forecast that goes 12 months out is now up at Seeking Alpha. I am as nerdy as can be, and follow the same indicators over and over, no matter what their message. And their message has been changing over the past 6 months. To find out what that means for the latter half of this year, click on over and read the article. As usual, this will equip you...

Read More » Heterodox

Heterodox