Reading the first few paragraphs of Last War Brain by Noah Smith, I thought I would strongly disagree with his post and decided to write an attempted rebutal. I find that I agree almost 100% and can mainly complain about what I assert is a bit of bait and switch. As always I advise readers to just click the link. Noah is a much better writer than I am (low bar) so my effort to summarize and explain might best be skipped (skip to ***) Noah argues...

Read More »Trying To Make Sense Of The Confusion

Trying To Make Sense Of The Confusion On the one hand Russian media is telling Russians that Russian troops will leave Belarus when exercises there end on Feb., 20, coinciding with the end of the Winter Olympics, and also sends out videos of troops supposedly being pulled back. OTOH, US officials declared based on reported satellite evidence that 7,000 more troops have gone to “the Ukrainian border” with a chance of Russia invading Ukraine very...

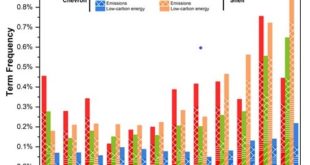

Read More »An Environmental Mismatch Between Discourse, Actions, and Investments

This is a follow-on to Dan’s commentary on living on the East Coast or in the Southwest region of the country. I live in an area of the Southwest which is not experiencing the harsher impact of climate change. Even so, the higher temperatures create a drier atmosphere, thirsty for moisture, which it draws from a region’s soil, rivers, lakes and the snowpack. This atmospheric demand, called a vapor pressure deficit (“VPD” for short), has reached...

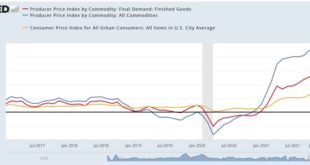

Read More »A note on producer prices and (possibly) cooling inflation

A note on producer prices and (possibly) cooling inflation One point I make from time to time is that, with seasonally adjusted data, YoY comparisons can miss, or at least lag, turning points. We *may* have such a situation developing with producer prices as evidenced by this morning’s report (Feb. 15). On a YoY basis, producer prices for finished goods (red in the graph below) are up 12.5%, while commodity prices are up 19.3%. Consumer...

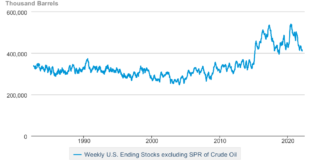

Read More »Global Oil Shortage 440,000 barrels, OPEC Falls Short 743,000 barrels

RJS, Focus on Fracking; Global oil shortage at 440,000 barrels per day in January as OPEC’s output falls 749,000 barrels per day short; 2021’s oil shortage revised to 1.5 million barrels per day OPEC’s January Oil Market Report Thursday of the past week saw the release of OPEC’s February Oil Market Report, which includes details on OPEC & global oil data for January, and hence it gives us a picture of the global oil supply & demand...

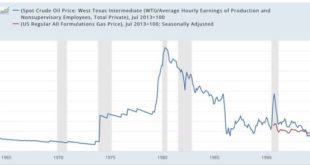

Read More »The return of the “Oil Choke Collar”!

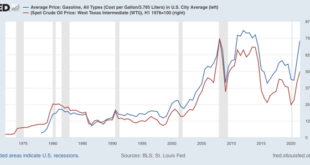

The return of the “Oil Choke Collar”! For the first five years after the end of the Great Recession, one of the staples of my analysis was the concept of the “oil choke collar.” By that I meant that typically recessions had occurred after there was a sudden and sharp upward spike in the cost of gas, inflicting such pain that consumers cut back drastically on other spending – causing a prompt economic downturn. But what if, instead, gas prices rose...

Read More »The Russian invasion of Ukraine

Things Getting Very Worrisome Yes, signs regarding a possible Russian invasion of Ukraine have gotten much worse in the last few days. I am hearing from my wife that Russian media are now claiming there are lots of US troops in Ukraine. Such a claim, not even backed up by some fake video, would clearly serve as an excuse for an invasion. There are also reports out of the Russian media that Putin feels that he was not treated well in Beijing....

Read More »Inventory Fell Again Adding 3-4 weeks to Previous Interim Lows

RJS: Oil supplies at a 10 year low; SPR at a 19 year low; total oil & products supplies at 7 1/2 year low after across-the-board draw The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending February 4th indicated that after a drop in our oil imports, a jump in our oil exports, and an increase in our refining, we again had to pull oil out of our stored...

Read More »Gas prices sound a consumer warning

Gas prices sound a consumer warning I got a note yesterday from a fellow forecaster pointing out that crude oil prices have once again made new 7 year highs. This is something I also highlighted in my “Weekly Indicators” column on Saturday. As I write this on Wednesday morning, West Texas Intermediate Crude trades at slightly under $90/barrel, yet another new 7+ year high. How much trouble does this portend for the economy? Potentially, a...

Read More »Ezra Klein on MMT

I find myself disagreeing completely with Ezra Klein. This is very unusual and I feel compelled to blog about it (note you should not feel at all compelled to read this post which is self therapy). I am commenting on a twitter thread here. I am going to cut and paste a lot (because I hate Twitter and don’t want you to go there (as I do many times a day)). It began with Larry Summers who wrote “There are things MMT says that are true and...

Read More » Heterodox

Heterodox