The issue of the Tax Cuts expiring will be arriving at everyone’s doorstep come the end of 2025. They do not give an exact date so i will go with EOM December 2025. Does someone making close to or more than $400,000 annually deserve a continuation into 2026 and beyond? Not sure. I think the 1 percenter should be paying more tax. My wife and I paid some high taxes (what we would call high) when we were under $200,000 annually after deductions....

Read More »Blog Archives

50 Years In, Most SSI Recipients Live in Poverty. That is a Policy Choice . . .

by Stephen Nuñez Roosevelt Institute Excellent piece by Stephen Nuñez on SSI and it not adjusting or growing with the changes in economic needs from 50 years ago. Indeed, for the few dollars given out, SSI appears to penalize people rather than assist them. It is ripe for a change to be more supportive of the millions of beneficiaries using it. This year marks the golden anniversary not just of Nixon’s resignation or the Happy Days premiere,...

Read More »Dags ifrågasätta Riksbankens självständighet!

I förra veckans avsnitt av Starta Pressarna fortsätter debatten om Riksbankens självständighet och hur vi hittar rätt balans mellan finans- och penningpolitik. Medverkande i det här avsnittet är — förutom Daniel Suhonen och Max Jerneck — Per Molander och Lars Calmfors. En intressant och initierad diskussion — men när det gäller frågan om Riksbankens självständighet skulle yours truly dock vilja hävda att det finns fler goda skäl att ifrågasätta den än vad Molander och...

Read More »LA Woman

Great breakdown of a great song (by The Doors) by these 2 Millennial black bros… never understood the song as a metaphor for the city of Los Angeles but yeah I get it now… makes it even better…[embedded content]

Read More »You will remember this in six months.

I am giving you the beginning of a major move that no one else sees.

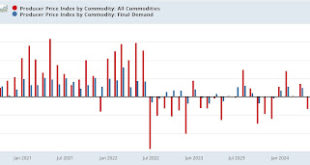

Read More »September producer prices almost entirely benign; very little upward pressure in the pipeline

– by New Deal democrat Sometimes producer prices lead consumer prices; sometimes they don’t – but in the sense that sometimes there is no lag at all before increases show up in consumer prices. In any event, overall the message from the producer price index this morning was benign, with very little pressure “in the pipeline” for consumer inflation.To begin with, raw commodity prices (red) declined -1.2% in September, continuing their 2+ year...

Read More »Private practice docs are cutting off Medicare patients

The old model of a single doc running a practice is disappearing in America. Between the overhead and the reduced compensation, this model of health care delivery looks increasingly anachronistic.When I started as an assistant professor at a medical school in 1987, there was a lot of money sloshing around. Patients and their insurance companies would pay a premium to be seen by docs in an academic health care practice. Managed care put an end to that,...

Read More »Brenner’s satisfactory

from Peter Radford “Mathematics is the art of the perfect. Physics is the art of the optimal. Biology, because of evolution, is the art of the satisfactory”. That’s Sydney Brenner speaking. He should know a thing or two. He won a Nobel Prize. It’s a shame, is it not? Economies are always changing. Not just in terms of innovation and all the normal things we think of as change, but also in more simple terms: in the people making up an economy change. They are born and they die. And...

Read More »The Case for Kamala Harris . . . The Atlantic’s endorsement

Catch some good articles in The Atlantic. Usually take this on a long flight to read. He is all set for Halloween. The Atlantic came out for Kamala Harris. Guess they do not think much of the orange one. Scare the kids on Halloween and keep the candy. This is just a partial. If you like it, I can post the rest. It is a good read. The Atlantic, for the fifth time in its 167-year history, is endorsing a candidate for president: Kamala Harris....

Read More »Housing Affordability in the U.S.

One of several articles I picked up on over the last few days. and decided to post at Angry Bear. Younger people are having to overextend themselves financially to buy housing. Not so different than a few decades ago. Except they are more in debt and more apt to go bankrupt due to a lost job, etc. Income does not appear to be keeping up with the price of housing and loan interest rates. Or perhaps, mortgage increases have outstripped income? A...

Read More » Heterodox

Heterodox