The belief that climate change will have minimal economic impact is dangerous. It’s like thinking a small crack in a dam won’t lead to a flood. At 10°C warming, regions like Florida will be underwater. Imagine your home being swallowed by the ocean. That’s not just a distant possibility; it’s a looming reality. We must take drastic action now to mitigate these effects. Ignoring this is like watching a forest fire spread while holding a garden hose....

Read More »Blog Archives

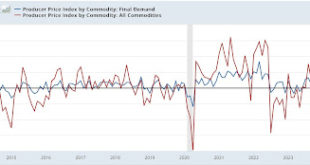

Producer prices remain tame

Producer prices remain tame – by New Deal democrat Producer prices for final demand (blue) rose 0.1% in July, while upstream raw commodity prices (red) rose 0.7%, close to their highest monthly increases in the past two years: In the larger pre-pandemic scheme of things, the one month rise in commodity prices is not a matter of concern at this point. On a YoY basis, final demand producer prices are up 2.2%, while raw commodity prices...

Read More »An Upcoming White House Decision May Jeopardize Americans’ Access to Life-Saving Drugs

I have been picking up more healthcare commentary which depicts the difficulty in providing healthcare at a sustainable cost. This brief commentary depicts one of the problematic issues for people. I believe this sentence makes the issue very clear. Copay accumulators are programs health plans use to prevent copay assistance from counting toward patients’ deductibles or out-of-pocket maximums. They do not count towards a deductible which the patient...

Read More »Swiss franc rally supercharged by search for safe havens

I am a recipient of the SwissInfo (SWI) news and have been for a long time. Out of southern Germany I would duck down to Switzerland to tour when I was not working. A different economic outlook in Switzerland as compared to the US. Maybe someone can add to the story of the European economy? Swiss Franc rally supercharged? by Georgios Kefalas SWI swissinfo.ch, The wave of risk aversion that ripped through markets at the start of the...

Read More »Biden Administration Proposes Rule To Ban Medical Debt From Credit Reporting 2

by Sheela Ranganathan, Maanasa Kona Health Affairs There is a growing interest among policymakers to protect patients from medical debt and its negative downstream effects, in April 2023. Three of the three credit reporting agencies (CRAs)—Equifax, Experian, and TransUnion voluntarily agreed to stop reporting any medical debt under $500. In April of this year the Consumer Financial Protection Bureau (CFPB) found that, despite these changes,...

Read More »“Taxes drive Money”: What does this mean in MMT?

This is a very important point since one criticism of my last post is the view that “only taxes levied by the state and the need to pay those taxes in the state-issued fiat money drive the demand for, and value of, that fiat money and its use as a general medium of exchange in modern nations” is not actually held by L. Randall Wray, the most prominent academic advocate of MMT. So it turns out that, on this issue, I have to eat some humble pie!Rather, the view I forumlated seems to be held...

Read More »How empirical is ’empirical’ macroeconomics?

At a first glance, DSGE models seem to imply total ignorance because representative agents (or representative groups of agents with limited heterogeneity) featuring objective utility functions populate the literature. At a second glance, however, it becomes obvious that “methodological individualism” prevails and even dominates. To understand this dominance one only has to once again note that the representative agent has fixed properties only within any given model, or paper....

Read More »Fiscal flows about to peak for this cycle.

This is a window where you want to be raising cash.

Read More »Major macroeconomic policy reform is needed to reduce the reliance on monetary policy — Bill Mitchell

There is some commentary emerging that is finally starting to question the reliance on monetary policy (setting interest rates) as the primary macroeconomic policy tool with fiscal policy forced into a passive role. In Australia, this debate has intensified in the last week following the hubris from the new Reserve Bank governor, who thinks her role is to sound like a ‘tough guy’ dishing out threats of ever increasing interest rate rises even as inflation falls. There was an Op Ed in the...

Read More »Deirdre McCloskey’s shallow and misleading rhetoric

from Lars Syll This is not new to most of you of course. You are already steeped in McCloskey’s Rhetoric. Or you ought to be. After all economists are simply telling stories about the economy. Sometimes we are taken in. Sometimes we are not. Unfortunately McCloskey herself gets a little too caught up in her stories. As in her explanation as to how she can be both a feminist and a free market economist: “The market is the great liberator of women; it has not been the state, which is after...

Read More » Heterodox

Heterodox