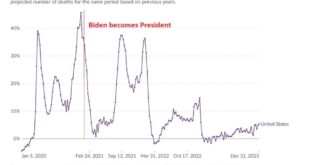

Biden’s legacy: a Summary by Noah Smith – an introduction to Noahpinion Noahpinion Joe Biden announced today that he won’t seek reelection for President. We don’t yet know who will replace him, but we know Biden’s tenure in office will soon end. Now is the perfect time to talk about Biden’s legacy as America’s 46th President. How Presidents are judged by history is a complicated question, and I don’t have much confidence in my ability...

Read More »Blog Archives

Econometric curve fitting

As social scientists — and economists — we have to confront the all-important question of how to handle uncertainty and randomness. Should we define randomness with probability? If we do, we have to accept that to speak of randomness we also have to presuppose the existence of nomological probability machines, since probabilities cannot be spoken of — and actually, to be strict, do not at all exist — without specifying such system-contexts. Accepting Haavelmo’s domain of...

Read More »De intellektuella

De intellektuella är själva redan så inprogrammerade på det som är avsett för deras isolerade sfär att de inte frågar efter annat än det som serveras dem under märket highbrow. Deras ärelystnad går bara ut på att vara orienterade i den tillhandahållna sorteringen, att komma på det riktiga slagordet. De invigdas outsiderskap är en illusion, det är bara disponibilitet. Att uppfatta dem som renegater vore än mer befängt: de döljer sin slätstrukenhet bakom hornbågar med...

Read More »Getting old and being old

Joe Biden’s withdrawal from the US presidential election has prompted me to write down a few thoughts about getting old and being old. First up, I’m going to rant a bit (in classic old-person mode) about how much I loathe the various prissy euphemisms for “old” that appear just about everywhere: “older”, “aging”, “senior” and, worst of all, “elderly”. I am, of course, aging, as is everyone alive. Similarly, like everyone, I’m older than I was yesterday and older than people who are...

Read More »Currency Hierarchy — Eric Tymoigne

In Stabilizing and Unstable Economy, Minsky noted that “[a]n economy has a number of different types of money: everyone can create money; the problem is to get it accepted” (p. 228). While governments and banks usually get the spotlight, tens of thousands of monetary instruments have been issued by localities, ecclesiastic domains, local seigneurs, taverns and other private agents in many periods of monetary history, worldwide, up to the present [see Burn (1853); von Glahn (1996); Fletcher...

Read More »Inversion

by Tom Walker Econospeak Book proposal: Marx’s Fetters and the Realm of Freedom: a remedial reading — part 2.3 Inversion Marx stated repeatedly in the Grundrisse that capital inverts the relationship between necessary and superfluous labour time. Capital both creates disposable time and expropriates it in the form of surplus value, reversing the nature-imposed priority of necessity before superfluity and making the performance of...

Read More »There will be a big surprise when the Fed cuts rates.

What they all think is going to happen, won’t. The opposite will.

Read More »A bad day for whom? The Left for one

I blink, you lose! Will Rogers supposedly said that he was not a member of any organized political party. He completed that noting he was a Democrat. That feeling is alive and well among Dems. The confusion caused by Biden's withdrawal seems to have led to many peculiar views among pundits and public intellectuals. Two typical reactions are the ones that are certain that Biden would have lost, and now with Kamala the election is in the bag, and the ones that suggest that the lefties in the...

Read More »The teaching of economics — captured by a small and dangerous sect

from Lars Syll The fallacy of composition basically consists of the false belief that the whole is nothing but the sum of its parts. In society and in the economy this is arguably not the case. An adequate analysis of society and economy a fortiori can’t proceed by just adding up the acts and decisions of individuals. The whole is more than a sum of parts. This fact shows up when orthodox/mainstream/neoclassical economics tries to argue for the existence of The Law of Demand – when the...

Read More »3 Things To Avoid Financial Crisis

The mainstream belief is that deregulated markets lead to economic prosperity. This is wrong. The 2007 housing crisis is a glaring example. Unregulated mortgage lending led to excessive debt, causing a financial meltdown. Instead, we need to regulate mortgage lending to prevent such excesses. When banks lend irresponsibly, they inflate housing bubbles. These bubbles burst, leaving ordinary people in financial ruin. Regulation can curb this destructive cycle. Another common...

Read More » Heterodox

Heterodox