In the Private Sector? The Protecting the Right to Organize Act is a historic proposal restoring fairness to the economy by strengthening the federal laws protecting workers’ right to unionize and bargain for higher wages and better benefits. In the Public Sector? There is no federal law protecting the freedom of state and local public service workers to join a union and collectively bargain. Numerous states have passed free rider so-called...

Read More »Red/Blue COVID Death Rate Divide did not disappear after all

So much for the Covid Gap disappearing. The difference in the death rate for Covid still exists politically. It looks like the Red/Blue COVID Death Rate Divide didn’t disappear after all, ACA Signups, Charles Gaba Last month Charles Gaba noted the partisan COVID death rate gap again. And again it had been higher in the reddest U.S. counties than the bluest counties every month since July 2020. It appeared to be on the verge of finally...

Read More »Of Patches Paint and Ploy

Up from craft workers to those of the large industrials, by the mid-20th Century unions had grown to represent large segments of American workers (density peaked at 35% of workers in 1954, membership at 21 million in 1979). From the mid-1930s through the mid-1960s they played a huge role in the nation’s politics, social order, and economy. Unions gave us the 8-hour day, weekends off, paid holidays, …, and helped end child labor. They raised living...

Read More »Interesting Stuff from My In-Box, Maybe?

More Economic and Government topics the time. Much of it due to the pandemic caused economic issue. It is interesting as to how the news varies from week to week and what becomes important. I did add reports on Ukraine’s economy for 2022. You will see percentages from ~31% to ~38% cited depending on who you read. The Housing economy in in Arizona has come to a near standstill. At an AZ State House Committee meeting, the representatives were...

Read More »Wages and Salaries are Not the Cause for High Prices

Another take on wages and salaries outpacing inflation. Not so says Robert Shapiro. Inflation Reality Check: Don’t Blame Wages and Salaries for High Prices, Washington Monthly, Robert J. Shapiro Yes, economics can be complicated, and economic reporters work under tight deadlines. There is no excuse for the media meme blaming rising wages for much of today’s inflation. The Wall Street Journal summed up this erroneous view in a recent headline,...

Read More »Updating some important coincident indicators

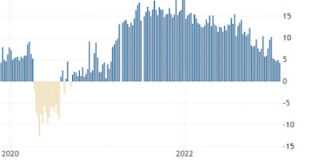

Updating some important coincident indicators – by New Deal democrat We returned to no more significant monthly data today. So here are some important coincident indicators I’ve been particularly following. Redbook consumer purchases only increased 4.3% YoY last week, the lowest number in almost 2 years. The 4 week average also declined to 4.7%, also a 2 year low: This strongly suggests that the January retail sales report, which will be...

Read More »Senators, Opioids, and EpiPens

Many things can be accomplished when you have a majority in Congress, Well. almost. For Democrats, Sinema is still growing up and trying to decide what she wants to be. Being a Democrat is boring. Sitting with Repubs is more exciting as Dems notice. There is no excitement in going along with the crowd. Gotta mix it up and grab the attention by being a decision maker or a disruptor. “I can’t deny the fact that you like me. Right now, you like me!”...

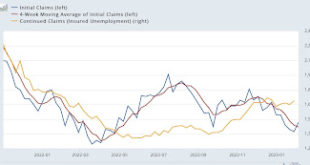

Read More »As Holiday seasonality disappears, initial jobless claims turn higher YoY

As Holiday seasonality disappears, initial jobless claims turn higher YoY – by New Deal democrat Initial jobless claims rose 13,000 last week to 196,000. The four-week moving average declined -7,500 to 189,250. Continuing claims increased 38,000 to 1,688,000. Below I show all three since initial claims first fell below 300,000 in late October 2021: Because seasonality played such a role in January’s jobs report, here are initial claims...

Read More »The Story Construction Tells About America’s Economy Is Disturbing

From the New York Times, Ezra Klein’s opinion piece, The Story Construction Tells About America’s Economy Is Disturbing Here’s something odd: We’re getting worse at construction. Think of the technology we have today that we didn’t in the 1970s. The new generations of power tools and computer modeling and teleconferencing and advanced machinery and prefab materials and global shipping. You’d think we could build much more, much faster, for...

Read More »This Is What Happens When Progressives Look the Other Way

This Is What Happens When Progressives Look the Other Way – Peter Dorman @Econospeak Recent events in Florida—the “Stop WOKE” Act, the rejection of AP African American Studies, the hostile takeover of New College—and the publication of an excellent op-ed about Diversity, Equity and Inclusion (DEI) in the Chronicle of Higher Education have me returning to a topic I blogged on several years ago, but in a new light. It was obvious, and I mean...

Read More » The Angry Bear

The Angry Bear