“A global house-price slump is coming,” The Economist, edited. I find this article to be interesting although I do not agree with much of it. Prices are an issue; but so are interest rates. Much of the costs of housing can also be from house manufacturing waste. I was watching my new home being built. The scrap is horrendous. The do-overs because of a lack of critical path are numerous. Quality is inspected into homes and not built into a home. I...

Read More »Climate chaos: notes on Interesting Stuff

Lifted from notes from David Zetland’s news letter Interesting Stuff: The sustainability challenge is not population as much as consumption. Me in 2009: “A sustainable economy is like a sustainable lifestyle: Minimize your consumption, put something away for a rainy day, and MAKE SURE that you are selling good quality at a good price.” NYT 2022: “By any standard, American lives have become excessive and indulgent, full of large homes, long trips,...

Read More »21st century delights

I bought a bottle of Belgian beer here in Rome. The guy behind the counter guessed I was from the USA (might have been my Joementum t-shirt) and said something which I now understand was “want a glass”. I said huh and he said “hai bisogna di un bichiere” so I said no. On my one block way home I saw 4 girls very cheerful about 6 to 8 years old. another with dad was arriving. They said that the had done “dolcetto/scherzeto” that is trick or treat....

Read More »Surviving a Stroke could be an asset

Neurorehabilitation professor and speech language pathologist at Boston University Swathi Kiran; When people have a stroke, “that does not mean they can’t think through and rationalize and objectively analyze every question,” Vox’s Keren Landman has a good article on the topic if you wish to read it. At the least, it is objective. The point of view is not flailing around with excuses of why Fetterman should not run challenging his ability to...

Read More »Donald Boudreaux pushes junk science on vaccines

Because Hayek would, right? I have previously discussed Donald Boudreaux’s penchant for encouraging vaccine hesitancy (see here, here, here). This is disgraceful, it kills people. But he’s at it again. This time he uncritically quotes a Wall Street Journal op-ed by the crank Surgeon General of Florida, Joseph A. Ladapo, arguing that young men should not be vaccinated against COVID. (Boudreaux’s headline states that Ladapo is opposed to...

Read More »Open thread October 28, 2022

Open thread October 25, 2022 – Angry Bear (angrybearblog.com)

Read More »Facts about the ACA marketplace for 2023

I think I have this initial chart big enough so you can see it. I should not have to explain this as it is apparent what is happening with ACA (PPACA) healthcare insurance. The pricing decrease and stability shown is due to Joe Biden’s ARPA enhancing subsidies. The ARPA lower cost results are also increasing enrollment 21% from last year. The premiums will remain in place for three-years. And this too is inflationary as everyone spends money to...

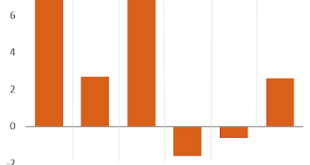

Read More »Q3 GDP: good news for now, bad news for the future

Q3 GDP: good news for now, bad news for the future – by New Deal democrat I have to keep this note brief, since I am on the road. As you presumably already know, real GDP was positive for the Third Quarter, up 2.6% at an annual rate: Subject to revisions in the next several months of course, but for the moment, this puts to rest ideas that the US economy was in a recession earlier this year, since the decline was very shallow and not...

Read More »Understanding Inflation using Gasoline Prices

Seems that gas, fuel, gasoline is being used as a marker to understand just how horrible we have it as a result of the current inflation. It’s just sooooooooooo terrible. I’ll just say this. As a marker of inflation and our personal economic experience all it shows is how terrible we are at remembering. Unfortunately for us, such a bad memory leads us to terrible voting decisions. Though, it does allow for easy emotional manipulation of the citizenry...

Read More »The Treasury yield curve has now almost totally inverted

The Treasury yield curve has now almost totally inverted – by New Deal democrat One of the few leading indicators not flashing red for recession has been the short end of the Treasury yield curve, which has been relentlessly positive – until now. While the 10 year minus 2 year Treasury spread has been negative for months, the 10 year minus 3 month had remained positive. But twice in the last two weeks the 3 month Treasury has yielded more...

Read More » The Angry Bear

The Angry Bear