As winter has begun to subside (finally) the real flurry of activity has to happen in short time, as in an every ray of sunshine has to be captured kind of thrust into the growing season. This is also the poorest time you will see farmers as they dump their entire wealth into yet another growing season. I can confirm; we’ve been running for a week straight and have committed the kids toothfairy money to compost, with no end in sight. My son will...

Read More »War, Waste, and the Myth of Progress

War, Waste, and the Myth of Progress In the introduction to One-Dimensional Man, Herbert Marcuse listed four authors — Vance Packard, C. Wright Mills, William H. White, and Fred J. Cooks — whose works were of “vital importance” to his analysis. In the text, he mentioned “the affluent society” several times, which, of course, was the title of a famous book by John Kenneth Galbraith. Galbraith, Mills, and White all cited Thorstein Veblen in...

Read More »Manufacturing continues red hot, while construction gains completely consumed by inflation

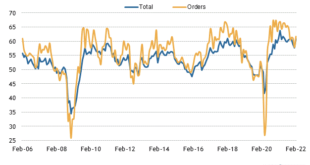

Manufacturing continues red hot, while construction gains completely consumed by inflation February monthly data started out this morning with the ISM manufacturing report. The index, especially its new orders subindex, is an important short leading indicator for the production sector. In February the index rose from 57.6 to 58.6, as did the more leading new orders subindex, which rose from 57.9 to 61.7. Since the breakeven point between...

Read More »4th Qtr GDP Revised, Growth at 7.0% – Unprecedented Revisions to Component Deflators

RJS, MarketWatch 666 Here I (run75441) am being lectured by the author, RJS. “last week you asked me to write something explaining how & why the GDP deflators were revised. So I did, expanding the paragraph I was going to write on it to six, and included it as an addendum to my usual reporting on the GDP revision at Marketwatch 666, however, three days after I sent it to you, it’s still not up on AB. I think it’s important, and that it...

Read More »No signs of the international political crisis creating any Western economic crisis at this point

No signs of the international political crisis creating any Western economic crisis at this point No important economic data today, and no significant COVID updates over the weekend. Let me make a few comments and then turn to the bond market, particularly as it reflects the international situation.I have no more insight into the Ukraine matter than probably any other well informed average citizen. It feels like the closest Russia and the US have...

Read More »Oil tops $100 . . . first time since July 2014

Oil tops $100 for first time since July 2014; SPR at a 19-year low; total oil + product supply at a 7 3/4-year low RJS, Focus on Fracking US oil price tops $100 for first time since July 2014; SPR at a new 19 year low; total oil + products supplies, including SPR, at a 7 3/4 year low; distillate supplies at 26 month low; natural gas drilling at a 26 month high You already have the petroleum status report part of this posted (ie, “EIA, Latest...

Read More »Never Mind Schrödinger’s Cat, Here’s David Bohm’s Dream

Never Mind Schrödinger’s Cat, Here’s David Bohm’s Dream I’ve had dreams of all sorts from time to time, but I don’t remember them too well. There was one dream that had a sort of philosophical content. I dreamt I was in a place that had a cat. I came into the room where this cat was talking to another cat, making a date to meet at a certain time. I said, “There’s something wrong here. What could it be? I know what it is: Cats can’t tell time!”I...

Read More »Open thread March 1, 2022

More bad faith about New Zealand COVID policy from the Brownstone Institute

According to Our World in Data, as of February 25, 2022, cumulative COVID deaths per million in the United States were 14 times higher than in Australia and 259 times higher than in New Zealand. Most of this difference was undoubtedly due to the border controls and internal lockdowns these countries used to keep COVID cases at very low levels for the past two years. A crude comparison based on cumulative death rates suggests that these policies...

Read More »Consumers still spend, real income declines, leaving them vulnerable to price shocks

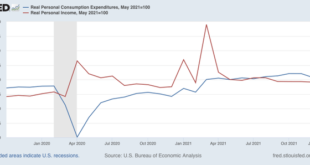

Consumers still spend, but real income declines, leaving them increasingly vulnerable to price shocks Nominal personal income was unchanged in January, while spending rose 2.1%. In real terms after inflation, personal income declined -0.5%, and personal consumption expenditures rose 1.5%, completely reversing December’s decline, and adding about 0.2%. I have stopped comparing them with their pre-pandemic levels (they are both well above that)....

Read More » The Angry Bear

The Angry Bear