I have thoughts on a typically interesting essay by Brad DeLong. It was sent to project syndicate and also my e-mail inbox. I think I should not quote it at length without paying. His claim is that, whether or not one likes industrial policy, we need it now. Given the 700-word limit, he doesn’t discuss Biden’s industrial policy and how it seems to be working. I will try to define industrial policy not as anything by laissez faire but specifically...

Read More »Initial claims still positive, moving into very challenging YoY comparisons (plus a note about the PPI)

– by New Deal democrat If residual post-pandemic seasonality has been affecting jobless claims statistics, the real acid test is going to begin next week, as for the next 7+ months, any number higher than 220,000 is almost always going to be higher than one year ago. In the meantime, for this our last week of the seasonal downtrend, initial jobless claims rose 2,000 to 230,000. The four week moving average rose 750 to 230,750. Continuing...

Read More »One Would Think Low-Cost Stores Would Know How to Adapt During Poor Economic Times . . .

Apparently, the larger WalMarts, Target, etc. know how to do so. The lower cost rivals(?) which should have greater appeal to its targeted customers are struggling. ~~~~~~~ Dollar General and Dollar Tree need a ‘new playbook‘ to compete . . . In the world of retail, Walmart, Target, and Costco continue to thrive with their blend of quality and convenience. Low-cost rivals Dollar Tree and Dollar General face declining consumer...

Read More »Trillions in Taxes Dodged by Ultra-Rich Could Fund the Social Security Trust Fund

Without a doubt, there are simpler ways to resolve the funding of Social Security going beyond 2035. Bruce Webb, Dale Coberly, and Angry Bear have discussed the topic enough times. They have also been verbally attacked by others for suggesting the Northwest Plan is a way to secure Social Security up till 2100 or close to it. Social Security belongs to the citizens, the people due to the way it is funded. There is no reason it can not continue to...

Read More »TSMC and Intel building Plants in Phoenix

An update on what is happening here is Arizona. There is more than just TSMC building in the Phoenix area. Intel has a couple of plants under construction also. TSMC has good news as it looks to make chips in the U.S. Taiwan Semiconductor Manufacturing Company’s production trials in Arizona are yielding results similar to its factories in Taiwan. Trial production yields at Taiwan Semiconductor Manufacturing Company’s factory in Arizona are...

Read More »Covid Metrics Ending Week August 31

r.j. sigmund‘s notes on Covid Metrics It appears all US Covid metrics are now heading down except for deaths, but we can expect deaths to head lower in a week or two as well, as the reduced numbers of those who are newly infected work through the health care system…among the CDC’s “early indicators” “test positivity”, or the percentage of tests for Covid that were positive, fell to 16.3% during the week ending August 31st, after test positivity ...

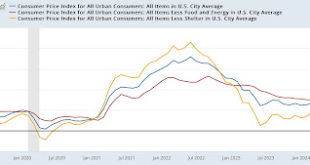

Read More »The Fed and the Press Should Stop Inflating Inflation Expectations

by Steve Roth Originally Posted at Wealth Economics (June 2023) Recent headline inflation prints are below the Fed’s target, and falling. That news is a powerful tool for controlling expectations, but the Fed’s not using it. 1.5%. That’s the latest headline inflation rate in the U.S. per the May CPI release, and also according to a three-month average of three different inflation indexes that use somewhat different data, baskets, and...

Read More »The Expected Inflation Imp

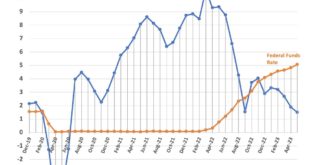

I think the imp is my most noticed contribution to the economic discussion. Brad DeLong mentioned the fact that I mentioned him, but called him the inflation expectations imp . Then Paul Krugman mentioned him shortening the name to “the expectations imp”. Alot of time has passed since then during the slow recovery from the great recession. The Federal Reserve OPen Market Committe (FOMC) cut the Federal Funds Rate to the lower limit of 0 – 0.25% but...

Read More »August CPI: further important progress towards 2% YoY level, marred (only) by a surprise uptick in shelter

– by New Deal democrat August CPI, with the conspicuous exception of shelter, continued to come in tame. And the list of other “problem children” decreased by 1, as only food away from home (restaurants) and transportation services (motor vehicle insurance and repairs) remain. Let’s get the headlines out of the way: – Headline CPI continued increased 0.2% for the month, and decelerated to 2.6% YoY, its best showing since February of...

Read More »Another Perspective of the Harris-Trump Meeting

I was hoping Prof. Heather Cox-Richardson would comment on the Harris-Trump meeting. In her first sentence Prof. Heather states it all about Trump’s approach in meetings. She discusses Clintons and Biden’s foibles in the next two sentences. The following paragraph states it all . . . “how to counter Trump’s dominance displays while also appealing to the American people. “ Candidate Kamala Harris accomplished her mission last night with her...

Read More » The Angry Bear

The Angry Bear