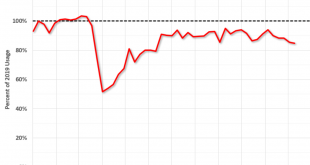

Still massively elevated: Orders are about back to where they were but remain at sub 2018 levels: Still soft and sales lost during the dip not recovered: Sales continue to shift from passenger cars:

Read More »Personal income and spending

Personal income went up with the crisis due to Federal transfers of the Cares Act, which subsequently faded: Personal income excluding government support continues to lag behind prior levels: Even with the higher levels of total personal income consumption has lagged and most recently decreased as government benefits expired: A part of consumption comes from buying on credit, and with employment down, fewer people qualify for credit. So while the additional income reduces...

Read More »Trade, architecture billings, Covid chart, bank lending

Promising: No recovery yet:

Read More »Unemployment claims, consumer sentiment, household debt

No problem here seems:

Read More »Retail sales, Industrial production, Real estate loans

Fading back to trend: Up a bit but still depressed: Mortgage applications may be up some but not bank lending for real estate:

Read More »Unemployment claims, rig count, nat gas prices

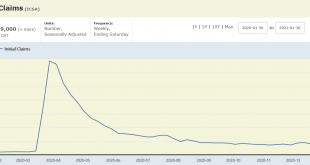

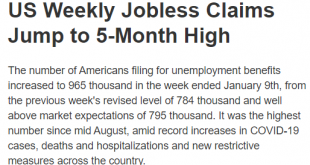

It’s bad and getting worse:

Read More »JOLTS, Gasoline, Small business index

Longer-term stagnation setting in:

Read More »ADP, unemployment claims, trade

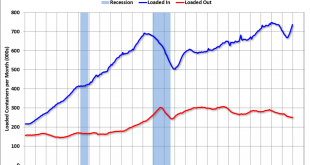

This is not good: Imports going up with stimulus funds as jobless claims remain high:

Read More »Consumer confidence, construction spending, gasoline

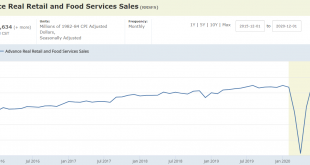

Not adjusted for inflation. Most recently showing an increase:

Read More »Gasoline, New home sales, Personal income, Personal consumption

still weakening: November new home sales fall more than expected, builder stocks drop Continues to fall back as benefits fade and employment remains weak: Weakening after failing to return to trend as benefits fade and employment remains weak:

Read More » Mosler Economics

Mosler Economics