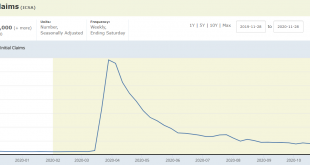

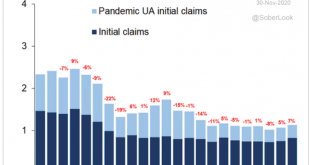

Stubbornly way high and rising some: Very high and coming down only as they expire: Familiar dip and partial recovery pattern:

Read More »Retail sales, architecture billings

The pace is sort of coming back to trend line: Familiar pattern as weakness continues:

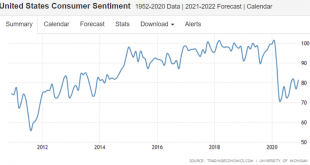

Read More »Consumer sentiment, Optimism, Industrial production

Still depressed: Tariffs turned this one south before covid did its thing:

Read More »Real estate loans, restaurants, gasoline

Some housing indicators may be looking up but not this one: Other indicators sagging as well as the economy starts to go over the fiscal cliff as benefits expire:

Read More »Claims, employment, commercial real estate leading index

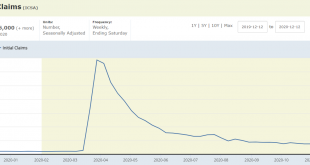

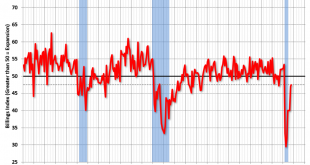

New claims still severely elevated:

Read More »Jobless claims, pending home sales, durable goods orders, construction spending

These continue at extraordinarily high levels: Still working its way lower, and never has had much of a recovery since the 2008 collapse. This chart isn’t inflation adjusted, so it’s that much worse than it looks:

Read More »Unemployment claims, Personal income, Transfer payments, Savings, Consumption, Light vehicle sales, Consumer confidence

Still climbing. This is not good: This is bad too: Working it’s way lower as benefits expire and employment growth sags: Savings added by fiscal adjustments are running down: The economy has generated a lot less personal income than it would have generated without the covid crisis: Same with consumption, which is about 70% of gdp: Fading: Fading:

Read More »Euro zone services, gasoline demand, restaurants, hotels

Bad relapse after inadequate fiscal adjustments:

Read More »Jobless claims, Existing home sales, Euro construction

Still extremely high and now going higher: The large dip in sales was followed by a recovery, so the total sales over that time are about on track: Back into contraction:

Read More »Architecture billings, Housing starts, Real estate loans

Still in contraction: One unit starts are up but not enough to make up for the dip yet: And housing remains historically depressed, and more so when factoring in population growth: And lending growth has turned negative:

Read More » Mosler Economics

Mosler Economics