Global deceleration continues:

Read More »Electronics sales, Fed indicator, Bank lending, Power generation

Tariffs: Bank lending deceleration: Real estate has gone nowhere: Gone flat this entire cycle:

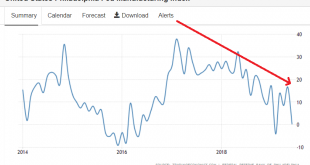

Read More »Philidepia Fed, Freight, Architecture index, Housing starts

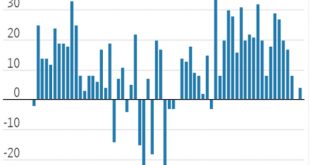

Last month’s uptick hinted at a reversal, but this month’s large move back down says otherwise: Still rolling over, and from depressed levels relative to prior cycles, and these charts are not population adjusted which only makes it worse:

Read More »NT Manufacturing, Home builder index, Earnings

Last months spike up that was hailed as a turn around now looks like an aberration: NY Manufacturing Falls The Most on Record The New York Empire State Manufacturing Index plummeted 26.4 points from the previous month to -8.6 in June, missing market expectations of +10. That was the largest monthly decline on record, due to drop in both new orders and employment, while shipments increased at a slower pace. The Trump tax cuts gave a one time boost to...

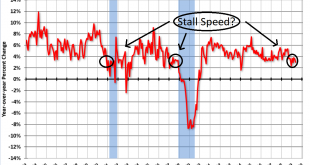

Read More »Retail sales, US Industrial Production, China Industrial Production, Morgan Stanley business conditions index

Not adjusted for inflation: Adjusted for inflation: Still looking down: Remember when last month’s spike higher was presumed to be the start of a turn around? . A Morgan Stanley economic indicator just suffered a record collapse

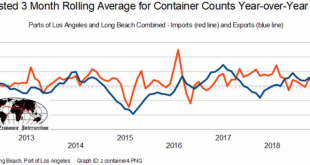

Read More »Fed recession models, Trade, Euro area industrial production

Imports and exports both decelerating: Still in contraction:

Read More »Small business optimism, JOLTS, Rail chart, Commercial real estate, Tariffs

Trump says ‘devalued’ currencies put US at a disadvantage and the Fed doesn’t have a ‘clue’ President Donald Trump said Tuesday the U.S. dollar is at a disadvantage compared to other major currencies like the euro as other central banks keep interest rates low while the Federal Reserve’s rates are higher by comparison. “The Euro and other currencies are devalued against the dollar, putting the U.S. at a big disadvantage,” Trump tweeted, adding the Fed doesn’t have “a...

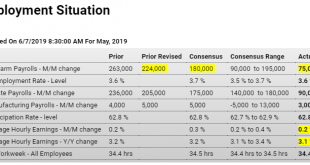

Read More »Employment, German industrial production

Now even the lagging indicators are pointing south. And lower rates from the Fed will only make it a bit worse by cutting gov. interest payments to the economy: Highlights Move up the rate-cut plans is the theme of the May employment report which shows declining growth in the labor market and topping pressure for wages. Nonfarm payrolls, at 75,000, came in below Econoday’s consensus range and include a total of 75,000 in downward revisions to April and March. Data on wage...

Read More »Manufacturing jobs, Trade, Jobless claims, Tariff news

As previously discussed, unemployment benefits have become much harder to get than in prior cycles, which means they will go up that much less as employment slows, and also that they won’t function as an automatic fiscal stabilizer to the extent they did in prior cycles, which will work to delay a recovery: Tariff update- more to come: Trump says tariffs on China could be raised by another $300 billion if necessary Former Commerce secretary: Trump’s 5% tariffs on Mexico...

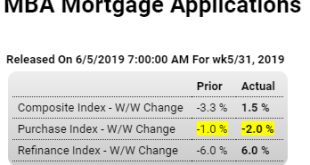

Read More »ADP, Mtg purchase apps, Vehicle sales

Employment can be a lagging indicator, so this forecast of Friday’s employment number could be verifying the rest of the weakness that’s been reported: US Private Sector Jobs Rise the Least in 9 Years Private businesses in the US hired 27 thousand workers in May, less than an expected 180 thousand and compared to April’s 271 thousand increase. It was the smallest payroll increase since March 2010, as the service-providing sector added 71 thousand jobs while the...

Read More » Mosler Economics

Mosler Economics