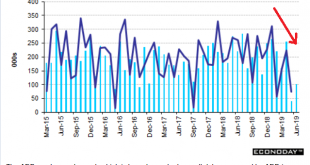

Light vehicle sales peaked a while back: Been helping to support the $US: Eurozone Retail Sales Fall Unexpectedly Retail trade in the Euro Area fell 0.3% in May, following a 0.1% drop in April and missing expectations of a 0.3% growth, as sales declined for all main categories. Among the bloc’s largest economies, Germany’s retail trade decreased for the second month, while gains were recorded in France and Spain. Year-on-year, retail sales rose 1.3%, also missing...

Read More »Payrolls, Durable goods, ISM services, CEO confidence, Fed comment, Trump comment on currencies

Another indicator turning south, and this is a big one, as it’s the source of most consumer income: Familiar pattern? As if rate cuts would help output, employment, or earnings, all of which are decelerating: Dow rises 100 points and heads for record close amid expectations for the Fed to lower rates He’s the dummy, of course, along with the all the others, including all of the Presidential contenders, who don’t understand that imports are real economic benefits, and...

Read More »Construction, Bank loans, Earnings

Been working its way lower and into contraction ever since the collapse in oil capital expenditures late in 2015, like a slow motion train wreck: There’s been a history of getting a spike up before the collapse: Companies are warning that earnings results are going to be brutal KEY POINTSWith earnings season looming, 77% of companies issuing pre-announcements say their profit picture will be worse than Wall Street is expecting.That’s the second-worst quarter on record...

Read More »China, UK, US, Euro zone

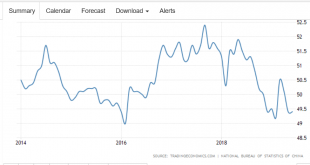

Global collapse continues, though you’d never know it watching the stock market: China Inflation Rate Slows to 6-Month Low The official Non-Manufacturing PMI in China unexpectedly inched lower to 54.2 in June, the lowest in six months, from 54.3 in the previous month and missing market consensus of China Factory Activity Shrinks More than Estimated The Official NBS Manufacturing PMI in China unexpectedly was unchanged at 49.4 in June 2019 and missing market expectations of...

Read More »Rail traffic, Business confidence, UK imports, Trade news

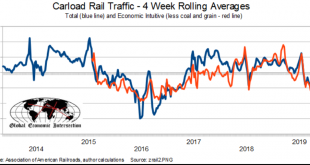

Deep in contraction: Looks to be below 2008 levels: So looks like the current tariffs remain. As previously suggested, the US President is narrowly focused on the money he’s collecting, as the tariffs remove $US net financial assets from the global economy and discourages transactions with the US. That is, it all functions as a transactions tax on the global $US economy: Trump says he agreed with Xi to hold off on new tariffs and to let Huawei buy US products Trump and Xi...

Read More »Reposting a prior comment

Here’s a comment I wrote and posted several years ago. I’d like to add that I also see the Transition Job policy, along with a 0 rate policy, as what I call the ‘base case for analysis’ of a state currency: “With ‘state currency’There necessarily is,Always has been,Always will be,A buffer stock policy.Call that the MMT insight if you wish. So it comes down to ‘pick one’-1. Gold2. Foreign Exchange3. Unemployment4. Employed/JG/ELR5. WheatWhatever!I pick employed/JG/ELRAs it...

Read More »Chicago PMI, Personal income and consumption, Trade comment

Bad: Highlights In the first sub-50 reading in 2-1/2 years, the Chicago PMI fell more than 4 points in June to miss Econoday’s low-end expectations. Deterioration in June was wide with only employment showing improvement. But further gains for employment in this sample are in question given contraction in new orders and a second straight month of contraction for backlog orders. In contrast to the general weakness, input prices are rising with some members of the sample...

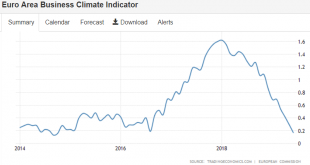

Read More »Euro area surveys, Goldman index, GDP, Corporate profits, Chem index

Most all euro area indicators still in collapse due to tariffs: Production held up even as consumer spending slowed: Highlights The outcome was expected but not the mix. The third estimate of first-quarter GDP rose 3.1 percent and is unchanged from the second estimate. But consumer spending did not live up to expectations, at only a 0.9 percent growth rate in the quarter vs 1.3 percent in the prior estimate and expectations for 1.3 percent. Making up the difference is an...

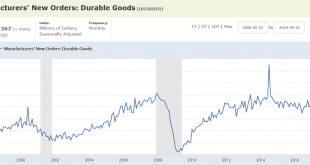

Read More »Durable goods, Austria PMI, Trade, Trump comments

Now in contraction year over year: US Durable Goods Orders Drop for 2nd Month New orders for US manufactured durable goods fell 1.3% in May, after a 2.8% plunge in April and much worse than market expectations of a 0.1% drop. Transportation equipment, down three of the last four months, was mostly responsible for the decline. Meanwhile, the so-called core capital goods orders rose 0.4%, recovering from a 1% decline in April. Highlights Net exports are not improving which...

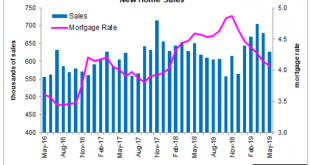

Read More »New home sales, Housing prices, Richmond Fed, Consumer confidence

Back down from already depressed levels even as mortgage rates fall: US New Home Sales Fall Unexpectedly Sales of new single-family houses in the US dropped 7.8% from the previous month to a seasonally adjusted annual rate of 626 thousand in May, compared to market expectations of a 1.9% increase, as purchases plunged in the West and Northeast. It was the lowest sales since December despite lower mortgage rates and solid job market. US Home Price Growth Eases to 7-Year...

Read More » Mosler Economics

Mosler Economics