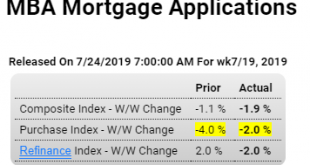

Year over year in contraction. And the chart is not adjusted for inflation: Negative: Lower rates don’t seem to be helping: Highlights The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back...

Read More »Mtg purchase apps, New home sales, US and euro area PMI’s, Trump quote

Lower rates don’t seem to be helping: Highlights The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back in the week, down 4 basis points to 4.08 percent for conventional 30-year loans. Still...

Read More »Existing home sales, Richmond Fed, UK factory orders, Chemical Activity Barometer

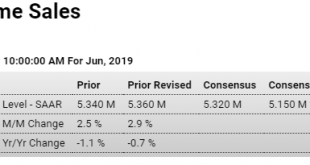

Worse than expected and in contraction year over year: Highlights The housing market firmed in the early Spring but has since flattened out. Existing home sales came in softer-than-expected at a 5.270 million annual rate in June which, however, is right in line with the 3-month average of 5.280 million. This average started the year at roughly 5.1 million. Single-family resales fell 1.5 percent in the month to a 4.690 million pace while condo sales, the second and much...

Read More »Housing starts, Architecture index, Foreign home buyers

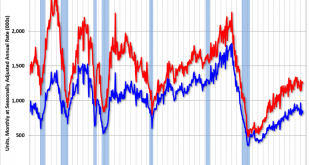

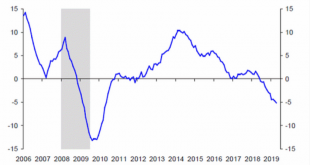

Rolled over and on the decline and from highs that were at historically depressed levels: Now in contraction: From the AIA: Design services demand stalled in June, Project inquiry gains hit a 10-year low Demand for design services at architecture firms decreased in June in comparison to the previous month, according to a new report today from The American Institute of Architects (AIA). AIA’s Architecture Billings Index (ABI) score for June was 49.1, which is down from 50.2...

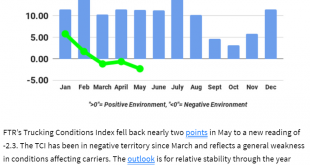

Read More »Trucking index, Tariffs, Singapore exports, Turkey retail sales

FTR Trucking Conditions Index weakens in May The President is in no hurry because he narrowly views the some $5 billion/mo in tariff revenues as a profit for the US at China’s expense, totally insensitive to the global economic downturn this ‘tax hike’ has created: Trade war to drag on as Trump says long way to go and China strikes hard-line tone

Read More »Retail sales, Industrial production, Housing index, Business inventories

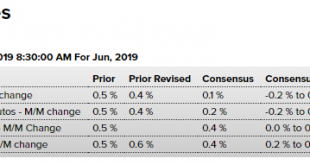

Better than expected: HighlightsTaking out a policy-insurance rate cut when the main driver of the economy is booming sounds a little counter-intuitive, in retail sales results that came in much stronger than expected in June. Total sales rose 0.4 percent in the month with ex-auto sales also up 0.4 percent — both of these hit the top end of Econoday’s consensus range. Easily surpassing the top end of the consensus range are two of the report’s key core readings with less...

Read More »NY manufacturing, China retail sales, US car sales

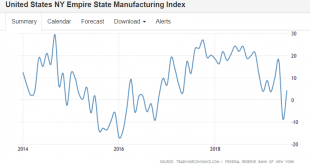

Up this month but trending lower: China has been trying to recover with fiscal adjustments: Doesn’t include pickups and other light trucks:

Read More »Manhattan home prices, Capital goods imports, Rails, Euro area industrial production, China imports

Still in contraction: China Imports Tumble in June Imports to China plunged 7.3 percent from a year earlier to USD 161.86 billion in June 2019, much worse than forecasts of a 4.5 percent drop, a further sign of weak domestic demand that could lead Beijing to add more stimulus. Purchases fell for: unwrought copper (-27.2 percent); iron ore (-9.7 percent); and soybeans (-25.1 percent) amid higher tariff on US cargoes and following outbreaks of African swine fever. By...

Read More »JOLTS, Manufacturing, rails, Recreational spending

All seems to be rolling over: This source of growth may be decelerating as well?

Read More »Employment, China, Trump speech

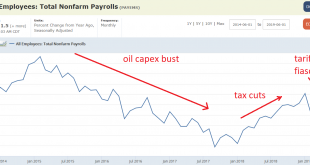

The annual rate of change continues to take a dive: Highlights There’s still time to cancel your rate-cut party. Nonfarm payrolls shot 224,000 higher in June and well beyond Econoday’s consensus range where the high forecast was 205,000. There are no flukes in this report underscored by a 17,000 jump for what has been an uneven manufacturing sector that Federal Reserve policy makers are watching with concern. Payrolls at professional & business services jumped 51,000 as...

Read More » Mosler Economics

Mosler Economics