2008 type of collapse: Lowest ever: Saudi OSPs are still at premiums to fair market value, and the price trend is still up. If it keeps going all heck breaks loose: The President threw the strategic petroleum reserve at it, and lots of other nations did the same, to no avail. And the calendar spreads in the futures market is indicating absolute spot shortages:

Read More »Small business optimism index, record budget surplus, commodities

This is the automatic fiscal stabilizers doing their thing to slow things down during a recovery, and they keep increasing the pressure until growth goes negative. Additionally, with some $30 trillion of public debt, an 8% increase in prices means the value of the public debt- the net money supply in the economy- has contracted by about $2.4 trillion. This is a direct ‘removal of savings’ and functions the same as a tax on savings, thereby slowing the economy. It is...

Read More »CPI

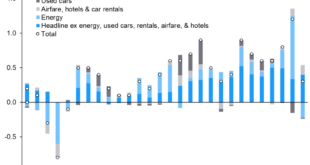

My take is we’ve had a one time upward adjustment in prices due to increased costs from Covid-related supply issues, along with supply side disruptions from the Trump/Biden tariffs. Prices seem to have begun to level off and go sideways, which would mean CPI increases returning to the lower, pre-Covid monthly increases: However, if energy costs don’t level off and instead rise dramatically, CPI will be dragged upward as well:

Read More »Employment, China

Employment generates income and spending. The gap vs the pre-covid path is closing at an ever slowing rate. And the cost of living is rising faster than wages, which exacts a toll as well. These are inflation-adjusted: This came out last week:

Read More »Personal income and spending

This series keeps drifting lower as personal income isn’t keeping up with price increases: And the economy itself isn’t growing real personal income the way it did pre-covid: Likewise, personal consumption is sluggish: People are saving less and less every month:

Read More »GDP, jobless claims

Typical post war recession type of outcome, as previously discussed: One reason for the low unemployment in the US is that for a lot of people you need a job to get health insurance:https://tradingeconomics.com/united-states/jobless-claims Reported inflation will fall rapidly unless energy prices increase from current levels,which is likely given current Saudi OSP’s and EU responses to the war:

Read More »Oil price, Radio interview, Fed Atlanta, Canada

Europe’s debtors must pawn their gold for Eurobond Redemption

And their central banks can buy unlimited amounts to support the price. Not that they would do that… Europe’s debtors must pawn their gold for Eurobond Redemption By Ambrose Evans-Pritchard May 29 (Telegraph) — The German scheme — known as the European Redemption Pact — offers a form of “Eurobonds Lite” that can be squared with the German constitution and breaks the political logjam. It is a highly creative way out of the debt crisis, but is not a soft option for Italy,...

Read More »Thinking Caps On – Grab a Coffee – Sales/Trading Commentary

From: JJ LANDOAt: May 14 2013 07:41:14 Consider the following thought experiment. These are the scenarios:A. The Treasury decides that it will fund itself 30% more in Overnight Bills and reduce issuance across the curve.B. The Fed announces it will increase QE by 30% (it will remit the net income of this activity back to the Treasury like taxes)C. Congress announces a new tax on all passive income from USTs, to holders both at home and abroad (ie Central Banks), for all...

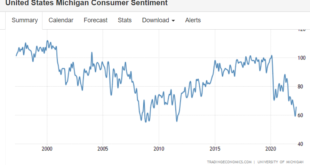

Read More »Consumer sentiment, real retail sales, industrial production, wages

A bit of an uptick but still trending lower: Sales going sideways on an inflation adjusted basis: This sector seems to be doing ok: Not keeping up with inflation so probably not causing it: Lowest income earners (no college) have been catching up some, but also lagging inflation:

Read More » Mosler Economics

Mosler Economics