Settling in at pre-Covid levels, and the fiscal collapse depresses growth: Down, but still above 50: Still trending lower from the post-Covid fiscal collapse:

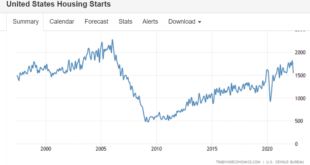

Read More »Housing starts, sales managers index, mortgage purchase index, sales managers index

After a post-Covid recovery spike, we have settled back to pre-Covid levels, which was well before the rate hikes: Applications have softened. This is the first up-week since the rate hikes: In many ways, we have yet to recover from the oil capex collapse of about 7 years ago:

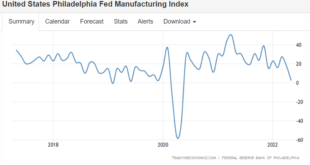

Read More »Philly Fed, labor demand, bank loans

Manufacturing settling down to ‘neutral’ after peaking well before the rate hikes as post-Covid shortages are alleviated: Labor demand also peaked well before the rate hikes: Still no sign rate hikes have slowed lending ;) About Author by WARREN MOSLER

Read More »Housing starts, industrial production, small business index

Growth overall remains sluggish as the economy becomes dependent on private sector credit expansion (private sector deficit spending) to offset the too tight post-Covid fiscal policy. Fed rate hikes add interest income to the economy as gov pays more interest on the $30+ trillion of public debt, which, if anything, supports rather than dampens demand or credit expansion, but it does contribute to higher prices which further reduces the real, inflation adjusted value of the...

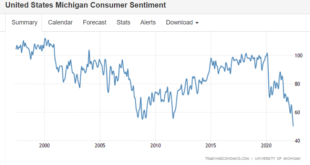

Read More »Consumer sentiment, Federal receipts, CPI

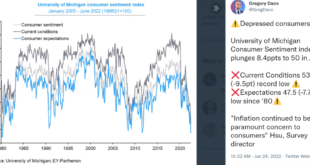

The post-Covid fiscal deficit reduction continues to take its toll: Higher prices automatically result in a spike in tax receipts: Higher prices, now largely from energy prices pushing up costs, reduce the inflation adjusted value of the public debt, which acts like a tax on the economy: With the rate of CPI increase above the rate of deficit spending, the effect is that of a budget surplus: Spiking energy prices as Saudis set prices ever higher shift $ from consumers...

Read More »Employment, ISM services, vehicle sales, oil price

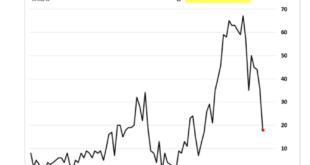

Leveling off at approximately pre-Covid levels. The growth rate slowed as deficit spending dropped: Still in expansion but it has come way down with the post-Covid war.Drop in deficit spending that has been driving the general deceleration: Not looking good. The parts shortage is largely over, so it is about a lack of demand as deficit spending falls and prices in general rise faster than incomes: Oil prices (not money supply, for example) continue to drive headline...

Read More »Personal consumption and expenditures

Pretty much back on the pre-Covid trend line: But income is on the decline: So consumers are spending more than their incomes, mainly through borrowing:

Read More »Richmond Fed, unemployment claims, vehicle sales, Philly state coincident indicator

Employment is still growing. Wages aren’t keeping up with prices so people are taking jobs out of necessity and to get healthcare: No sign of recession yet:

Read More »Philly Fed Manufacturing, home sales, miles traveled

Post-war collapse theme intact: Falling back to the pre-Covid war trend line: We’re back burning fuel with abandon:

Read More »Retain sales, homebuilder sentiment, housing starts

Not growing when adjusted for inflation: Down but still high vs historical data: Trend still intact: Trend still intact:

Read More » Mosler Economics

Mosler Economics