from Dean Baker The Washington Post repeated a standard theme in reporting on Trump’s trade war with China, that our main concern is not the trade deficit but rather China’s alleged theft of our intellectual property. I have written about this issue before, but there is an important aspect that seems to have gone largely unmentioned, China is likely to have more at risk in this story than the United States. Using the purchasing power parity measure (clearly the appropriate one for this...

Read More »How to be a great economist

from Lars Syll The master-economist must possess a rare combination of gifts … He must be mathematician, historian, statesman, philosopher—in some degree. He must understand symbols and speak in words. He must contemplate the particular, in terms of the general, and touch abstract and concrete in the same flight of thought. He must study the present in the light of the past for the purposes of the future. No part of man’s nature or his institutions must be entirely outside his regard....

Read More »Statistics and econometrics are not very helpful for understanding economies

from Lars Syll A statistician may have done the programming, but when you press a button on a computer keyboard and ask the computer to find some good patterns, better get clear a sad fact: computers do not think. They do exactly what the programmer told them to do and nothing more. They look for the patterns that we tell them to look for, those and nothing more. When we turn to the computer for advice, we are only talking to ourselves … Mathematical analysis works great to decide which...

Read More »Book this!

from David Ruccio The premise and promise of the Republican tax cuts—officially, the Tax Cuts and Jobs Act—are that lower corporate taxes would lead to increased investment and thus more jobs and higher wages for American workers. We all knew at the time that the logic was a sham. As I explained last August, one of the likely outcomes of the kind of corporate tax cuts Donald Trump and his fellow Republicans supported—and, as we saw, eventually rammed through—would be an increase in...

Read More »Has Donald Trump already changed US trade?

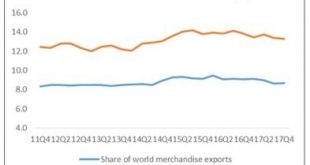

from C.P. Chandrasekhar and Jayati Ghosh There is no doubt that President Trump is upending global trade. He has unleashed a trade war with China as well as with some of the US’ s purported allies, using grounds of “threats to national security” to impose tariffs on many US imports. The likely retaliation will obviously affect some US exports in turn. The trajectory of world trade suddenly looks quite uncertain – and this will also depress investment across the trading world. So the Trump...

Read More »Econometric inconsistencies

from Lars Syll In plain terms, it is evident that if what is really the same factor is appearing in several places under various disguises, a free choice of regression coefficients can lead to strange results. It becomes like those puzzles for children where you write down your age, multiply, add this and that, subtract something else, and eventually end up with the number of the Beast in Revelation. Prof. Tinbergen explains that, generally speaking, he assumes that the correlations under...

Read More »When both men and women drop out of the labor force, why do economists only ask about men?

from Dean Baker That’s what New York Times readers were wondering when they saw Harvard Economics Professor Greg Mankiw’s column, “Why Aren’t Men Working?” The piece notes the falloff in labor force participation among prime-age men (ages 25 to 54) for the last 70 years and throws out a few possible explanations. We’ll get to the explanations in a moment, but the biggest problem with explaining the drop in labor force participation among men as a problem with men is that since 2000, there...

Read More »RWER no. 84 – special issue

Special issue on the public economy and a new public economics download whole issue edited by Michael Bernstein and June Sekera Reconstructing a public economics: markets, states and societies 2Michael A. Bernstein download pdf There is more than one economy 16Neva Goodwin download pdf The public economy: understanding government as a producer. 36 A reformation of public economicsJune Sekera download pdf Economic benefits of public...

Read More »The microfoundations crusade

from Lars Syll I think the two most important microfoundation led innovations in macro have been intertemporal consumption and rational expectations. I have already talked about the former in an earlier post … [s]o let me focus on rational expectations … [T]he adoption of rational expectations was not the result of some previous empirical failure. Instead it represented, as Lucas said, a consistency axiom … I think macroeconomics today is much better than it was 40 years ago as a result...

Read More »Utopia and work

from David Ruccio The goal of mainstream economists is to get everybody to work. As a result, they celebrate capitalism for creating full employment—and worry that capitalism will falter if not enough people are working. The utopian premise and promise of mainstream economic theory are that capitalism generates an efficient allocation of resources, including labor. Thus, underlying all mainstream economic models is a labor market characterized by full employment. Thus, for example, in...

Read More » Real-World Economics Review

Real-World Economics Review