from Lars Syll [embedded content] The people behind the proposal in Switzerland are effectively trying to get gold back into the monetary system. This is an extremely bad idea. Eighty-seven years ago Keynes could congratulate Great Britain on finally having got rid of the biggest ”barbarous relic” of his time – the gold standard. He lamented that advocates of the ancient standard do not observe how remote it now is from the spirit and the requirement of the age … [T]he long age of...

Read More »The big bad pension scare.

On Voxeu, Hervé Boulhol and Christian Geppert published an article a about population ageing and pensions which tries to scare us: “on average in the OECD, stabilising the old-age dependency ratio between 2015 and 2050 requires an increase in retirement age of a stunning 8.4 years. This number far exceeds the projected increase in longevity and increases in retirement age driven by pension reforms alone.”. The pension age has to go up. But not for the reasons and by the amount they...

Read More »Krugman’s modelling flimflam

from Lars Syll Paul Krugman has a piece up on his blog arguing that the ‘discipline of modeling’ is a sine qua non for tackling politically and emotionally charged economic issues: You might say that the way to go about research is to approach issues with a pure heart and mind: seek the truth, and derive any policy conclusions afterwards. But that, I suspect, is rarely how things work. After all, the reason you study an issue at all is usually that you care about it, that there’s...

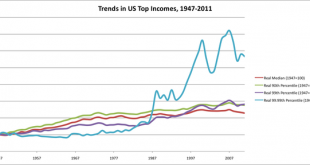

Read More »Long-term trends in U.S. income distribution – 2 graphs

Source: https://asociologist.com/2013/04/12/visualizing-inequality-in-the-us-1947-2011/

Read More »No bubbles on the horizon

from Dean Baker Ever since the collapse of the housing bubble in 2007–2008 that gave us the Great Recession, there has been a large doom and gloom crowd anxious to tell us another crash is on the way. Most insist this one will be even worse than the last one. They are wrong. Both the housing bubble in the last decade and the stock bubble in the 1990s were easy to see. It was also easy to see that their collapse would throw the economy into a recession since both bubbles were driving the...

Read More »From Wicksell to Le Bourva and MMT

from Lars Syll Comparing the limited work of Wicksell, Le Bourva, and MMT, we find that they share many similarities. Obviously, the institutions and issues being discussed have changed during the decades these scholars were writing, yet all three views agree on some fundamental issues. The methodology is quite similar, with a strong focus on balance sheets opposed to theoretical models based on assumptions that are necessary for the mathematics to work. There is also a strong consensus...

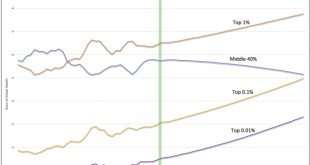

Read More »Unequal wealth of nations

from David Ruccio The premise and promise of capitalism, going back to Adam Smith, have been that global wealth would increase and serve as a benefit to all of humanity.* But the experience of recent decades has challenged those claims: while global wealth has indeed grown, most of the increase has been captured by a small group at the top. The result is that an obscenely unequal distribution of the world’s wealth has become even more unequal—and, if business as usual continues, it will...

Read More »“Health expenditure”

Source: https://en.wikipedia.org/wiki/List_of_countries_by_total_health_expenditure_per_capita#/media/File:OECD_health_expenditure_per_capita_by_country.svg Source: http://fortune.com/2018/02/09/us-life-expectancy-dropped-again/ Source: https://twitter.com/beauwillimon/status/889170390949519361

Read More »Anti-Blanchard

from Lars Syll Olivier Blanchard’s intellectual path, exploring different avenues – sometimes non-linear, sometimes even contradictory – can be considered as the personification of the controversial evolution of mainstream macroeconomic research during the last three decades … Assessing this complex intellectual path, nevertheless, also helps to understand why Blanchard’s analyses are ultimately limited by the mainstream framework, and by the role he decided to play in its defense. The...

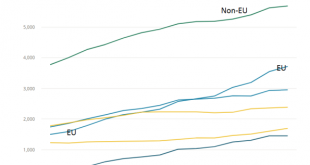

Read More »‘Free EU movement of workers’: new rules. But we need better economic policies.

Inter-EU flows of ‘labour’ have dramatically increased (figure 1, figure 2), which leads to problems in sending as well as receiving countries. New EU legislation tries to restrict the extent to which entrants can be used to circumvent existing labour laws to unfairly undercutting labour in the receiving countries (and ‘fairness’ is as fundamental an incentive to people working as their wage). This legislation is welcome. But it is too late. Or is it ‘too little’? Can sending countries...

Read More » Real-World Economics Review

Real-World Economics Review