from Lars Syll For all scholars seriously interested in questions on what makes up a good scientific explanation, Alan Garfinkel’s Forms of Explanation (Yale University Press 1990) is a must-read. A lot of recent work done within different realist schools in theory of science — e.g. Roy Bhaskar, Andrew Collier, Richard W Miller and Tony Lawson — issue not so little from questions and problems posed by Garfinkel. Especially his advocacy of contrast explanations and critique of...

Read More »Will China go nuclear on patent and copyrights?

from Dean Baker Since Donald Trump has apparently discovered that the US imports more than it exports from China, we can put tariffs on more goods than China can. This means that China has to look to other measures to counter Trump’s trade war. Most coverage of this issue has neglected to mention China’s strongest alternative measure. The nuclear option, in this case, would be to stop honoring US patents and copyrights. This would be hugely costly to US corporations, especially if they...

Read More »Clueless or Just Plain Stupid?

from Peter Radford Here we are deep into the dark forest known as the Trump administration and half my friends are still grappling with the 2016 election result. How come America elected an erstwhile tyrant? How come a boatload of voters look quite happy tossing so-called democracy overboard? Well, as you know, I have a simple answer. Money. Or, more precisely, the lack of it. If there is one characteristic of contemporary America that stands in stark contrast to those happier times a few...

Read More »On randomness and probability in economics

from Lars Syll Modern mainstream economics relies to a large degree on the notion of probability. To at all be amenable to applied economic analysis, economic observations have to be conceived as random events that are analyzable within a probabilistic framework. But is it really necessary to model the economic system as a system where randomness can only be analyzed and understood when based on an a priori notion of probability? When attempting to convince us of the necessity of founding...

Read More »From trade war to class war: screw Pfizer’s drug patents

from Dean Baker Wars always have unpredictable outcomes. It is unlikely that George W. Bush anticipated that the Iraq war would destabilize the Middle East for two decades, and possibly quite a bit longer. World War I resulted in the collapse of four European empires and emergence of the Soviet Union as a world power. In this vein, we can hope that something positive may emerge from Donald Trump’s ill-conceived trade war. Specifically, it may lead the United States and the world to...

Read More »The Permanent Income Hypothesis

from Lars Syll Milton Friedman’s Permanent Income Hypothesis (PIH) says that people’s consumption is not affected by short-term fluctuations in incomes since people only spend more money when they think that their lifetime incomes change. Believing Friedman is right, mainstream economists have for decades argued that Keynesian fiscal policies, therefore, are ineffectual. As shown over and over again for the last three decades, empirical facts totally disconfirm Friedman’s hypothesis. The...

Read More »Class struggle according to liberals

from David Ruccio Liberals like to talk about all kinds of social ills and identity-laden tensions—but not class struggle. That’s their persistent and enduring blindspot. Except, it seems, when it comes to Donald Trump. Thomas B. Edsall is a good example. Over the years, he’s produced a series of solid, insightful surveys of liberal research and analysis on a wide variety of economic and political topics. But he hasn’t written much if anything about class—until his latest, titled “The...

Read More »Economics for the 21st century

from Lars Syll 1. Change the goal: from GDP growth to the Doughnut. For over half a century, economists have fixated on GDP as the first measure of economic progress, but GDP is a false goal waiting to be ousted. The 21st century calls for a far more ambitious and global economic goal: meeting the needs of all within the means of the planet. Draw that goal on the page and – odd though it sounds – it comes out looking like a doughnut … 2. See the big picture: from self-contained market to...

Read More »Utopia and technology

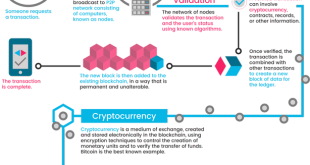

from David Ruccio Forget Bitcoin. It’s the underlying technology, blockchain, that is generating the most excitement. Even utopia! Bitcoin is a digital currency that was invented in 2009 by a person (or group) who called himself Satoshi Nakamoto. His stated goal was to create “a new electronic cash system” that was “completely decentralized with no server or central authority.” After cultivating the concept and technology, in 2011, Nakamoto turned over the source code and domains to...

Read More »Italian situation is highly worrisome!

Considering the present architecture of the Eurozone – there is according to Erwan Mahé no obvious way to solve the Italian Euro crisis… From: Erwan Mahé I sent this little collage on 25 May, via IB Bloomberg chat, as the BTP began to decline, since it seemed to sum up the best attitude to take towards the near hysteria afflicting the Italian debt market at the time. From a high of 132.88 on Monday 25 May, it plunged to as low as 120.10 the next day, reflecting a full one per cent rate...

Read More » Real-World Economics Review

Real-World Economics Review