from Asad Zaman This is the second lecture on Understanding the Rise and Fall of the Gold Standard — shortlink: bit.do/azifa2 — we start with a Summary of First Lecture The first lecture discusses the Keynesian theory that the exact level of money in an economy is critically important – too little leads to recessions, while too much leads to inflations. Furthermore, domestic business cycles, and international financial crises are caused by pro-cyclical behavior of current artificial...

Read More »For-profit schools corrupt educational systems — lessons from Sweden

from Lars Syll Neoliberals and libertarians have always provided a lot of ideologically founded ideas and ‘theories’ to underpin their Panglossian view on markets. But when they are tested against the reality they usually turn out to be wrong. The promised results are simply not to be found. And that goes for for-profit schools too. The Swedish school system has somewhat oddly combined market principles such as decentralization, choice, competition, and corporate providers with an...

Read More »Walmart’s gamble and what it means for India

from C. P. Chandrasekhar Much of the writing on Walmart’s purchase of a dominant 77 per cent stake in Flipkart, touted for long as India’s answer to Amazon, is focused on its size. At $16 billion, of which $14 billion goes to buy up the stakes of investors such as SoftBank from Japan and Naspers from South Africa, it is reportedly the biggest acquisition in the global e-commerce area, and way larger than $3.3 billion that Walmart paid for US web retailer Jet.com in a deal considered the...

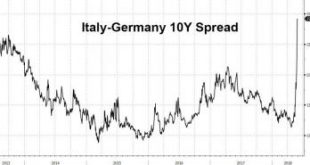

Read More »Italy — shows why the euro has to be abandoned if Europe is to be saved

from Lars Syll Investors had until recently been widely expected the European Central Bank to signal at its next meeting in two weeks’ time that it would wind down QE later in the year. Now, questions are growing about how feasible it will be to withdraw the ECB’s buying power at a time when investors are already driving Italian debt costs higher. Nearly half a decade ago, the Greek debt crisis turned into a crunch point for the bloc as a whole. The sheer scale of both the Italian economy...

Read More »Why Innovate?

from Peter Radford Every so often one of the numerous news feeds that fill my inbox contains a story that stops me short. In this era of Trump dominated news I have become numb to the corruption that he has brought in his wake and to the absurdity of his autocratic style with its contempt for the rule of law. Instead I focus on why it was that so many Americans were willing to elect someone so ill fitted to the job. The insecurities of the contemporary workplace offer a partial answer. So...

Read More »Is CORE a pluralist economics curriculum?

from Ioana Negru Core (the acronym for Curriculum Open Access Resources in Economics) is a project led by professor Wendy Carlin from UCL, UK, that aims to improve the content and delivery of the economics curriculum around the world. Other remarkable economists have been and are part of this project such as Diane Coyle and Samuel Bowles. According to the website of the project, www.core-econ.org CORE is: “a) a global community of learners, teachers and researchers; b) a problem-...

Read More »Modern division of labour …

from Lars Syll

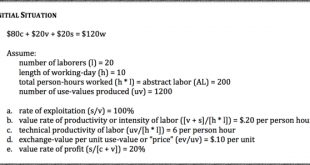

Read More »Marx ratio

from David Ruccio First there was the Great Gatsby curve. Then there was the Proust index. Now, thanks to Neil Irwin, we have the Marx ratio. Each, in their different way, attempts to capture the ravages of contemporary capitalism. But the Marx ratio is a bit different. It was published in the New York Times. Its aim is to capture one of the underlying determinants of the obscene levels of inequality in the United States today—not class mobility or the number of years of national income...

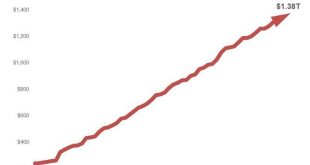

Read More »US student loan debt explosion

Behavioural economics — still too devoted to ideas it is supposedly attacking

from Lars Syll Behavioral economics is still ‘in a relationship’ with orthodox economics and, in a relationship, one makes compromises … We all know how stubborn the other side in this relationship is: standard economics will always ‘rationalize’ behavior wherever it can and will only recognize ‘irrationality’ when there is clear and convincing evidence of it. Understandably, behavioral economics devoted itself to finding this evidence – the “anomalies”, in the words of Thaler (1988),...

Read More » Real-World Economics Review

Real-World Economics Review