from Lars Syll A typical modern approach to writing a paper in DSGE macroeconomics is as follows: o to establish “stylized facts” about the quantitative interrelationships of certain macroeconomic variables (e.g. moments of the data such as variances, autocorrelations, covariances, …) that have hitherto not been jointly explained; o to write down a DSGE model of an economy subject to a defined set of shocks that aims to capture the described interrelationships; and o to show that the...

Read More »Economics as science in the world of great power politics (1800-present)

from Robert Locke Recently there has been a spate of postings and comments in the rwer blog about economics as science; they invariably deal with the relative degree of autism of orthodox economics along the lines that originally spawned the post-autistic economics movement, the rwer and the blog. The subject debated is the relative failure of an economics discipline based on the behavior of individuals in markets to guide policy formulation in the real world. For historians the birth of...

Read More »Protest this!

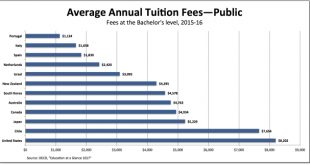

from David Ruccio Back in 2011, thousands of Chilean students participated in protests against the high cost of higher education. The most famous took place in front of La Moneda, the president’s palace, dancing to Michael Jackson’s “Thriller.” According to the latest statistics from the OECD report, “Education at a Glance 2017,” the costs of a college education in Chile were still very high in 2015-16. But they’re still not as high as in the United States, where it costs more to go to...

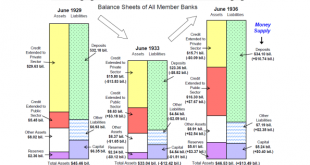

Read More »Why, to the detriment of the economics profession, MiltonFriedman ignored Hyman Minsky’s advice

Weird: fifty years after Schumpeter and one hundred years after John Stuart Mill they did not mention ‘credit’. Let alone ‘private credit’. Mill’s idea that private credit creation often decisively contributes to bubbles, and bursts, is absent from the whole thing. The Schumpeterian idea that credit financed investments lead to economic growth (and monetary changes) is alien to their concept. Even the Irving Fisher idea that there are different kinds of money with different kinds of...

Read More »Putting predictions to the test

from Lars Syll It is the somewhat gratifying lesson of Philip Tetlock’s new book that people who make prediction their business — people who appear as experts on television, get quoted in newspaper articles, advise governments and businesses, and participate in punditry roundtables — are no better than the rest of us. When they’re wrong, they’re rarely held accountable, and they rarely admit it, either. They insist that they were just off on timing, or blindsided by an improbable event,...

Read More »Water, health and wealth

Nava Ashraf, Edward Glaeser, Abraham Holland, Bryce Millett Steinberg NBER Working Paper No. 23807 Providing clean water requires maintenance, as well as the initial connections that are typically measured. Frequently, the water supply fails in the developing world, especially when users don’t pay the marginal cost of water. This paper uses the timing of frequent, unexpected water service outages in Lusaka, Zambia to identify the short-term impacts of piped water access on contagious...

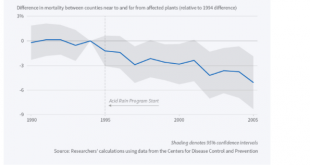

Read More »Acid rain, health and government policy

A recent meme of the fact free right in my country (the Netherlands) is the idea that the Acid Rain problem spontaneously disappeared. It didn’t. It was the government, stupids! And it is a really serious problem which did and does require attention. Source

Read More »Break this!

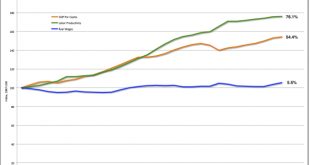

from David Ruccio David Brooks should have left well enough alone. Middle-class wage stagnation is the biggest economic fact driving American politics. Over the past many years, so the common argument goes, capitalism has developed structural flaws. Economic gains are not being shared fairly with the middle class. Wages have become decoupled from productivity. Even when the economy grows, everything goes to the rich. But then Brooks spends the rest of his column trying to convince us...

Read More »The institutional approach to labor economics

from Maria Alejandra Madi The economist John R. Commons is considered one of the founding fathers of institutional economics. He played a leading role in the developing of the labor economics field by establishing some core principles in his book Institutional Economics: Its Place in Political Economy (1934). Besides, as Kenneth Boulding (1957) stated, Commons’ ideas as a social reformer were very influential in shaping the New Deal and the American labor legislation and social security...

Read More »Stiglitz and the full force of Sonnenschein-Mantel-Debreu

from Lars Syll In his recent article on Where Modern Macroeconomics Went Wrong, Joseph Stiglitz acknowledges that his approach “and that of DSGE models begins with the same starting point: the competitive equilibrium model of Arrow and Debreu.” This is probably also the reason why Stiglitz’ critique doesn’t go far enough. It’s strange that mainstream macroeconomists still stick to a general equilibrium paradigm more than forty years after the Sonnenschein-Mantel-Debreu theorem — SMD —...

Read More » Real-World Economics Review

Real-World Economics Review