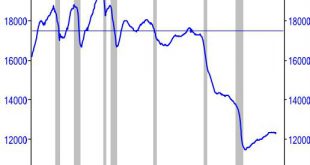

Global trade is awful. Really, it is. For the last five years, trade volumes have been growing at their slowest sustained rate since the early 1980s. Here's a horrible chart from the World Trade Organisation's latest forecast: And in the last year, things have got worse: Import demand of developing economies fell 3.2% in Q1 before staging a partial recovery of 1.5% in Q2. Meanwhile, developed economies recorded positive import growth of 0.8% in Q1 and negative growth of -0.8% in Q2....

Read More »Reshoring is hype

This chart has been doing the rounds on Twitter (h/t @dbcurren). It shows manufacturing employment in the USA. See that huge drop? That's the drain of manufacturing jobs to South East Asia.And see that uptick since 2010, that appears to be tailing off? That's the return of manufacturing jobs to the USA. What they call "reshoring".Reshoring is hype, isn't it?Related reading U.S. reshoring: over before it began? - ATKearney (pdf)

Read More »Betrayed Again: TPP’s Unconvincing Economic and National Security Arguments

Voters of all stripes have recognized the Trans-Pacific Partnership (TPP) as another betrayal of working people, and they have resoundingly rejected it. Despite that, President Obama continues to push it, to the extent of possibly seeking passage in a “lame duck” session of Congress. President Obama’s pushing of the TPP is recklessly irresponsible politics that [...]

Read More »The titillating and terrifying collapse of the dollar. Again.

In-depth analysis on Credit Writedowns Pro. You are here: Weekly » The titillating and terrifying collapse of the dollar. Again. This post was originally published at China Financial Markets. By Michael Pettis Foreign perceptions about the Chinese economy are far more volatile than the economy itself, and are spread across a fantastic array of forecasts. On one extreme there are still many who hold the view that overwhelmingly dominated the consensus just four...

Read More »The Importance of China’s New VAT

In-depth analysis on Credit Writedowns Pro. You are here: Political Economy » The Importance of China’s New VAT By Marc Chandler Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach for a few years. The reform extends it from manufacturing and a few services in a pilot...

Read More »Donald J. Trump: A Class Act all the Way!

Words unnecessary...[embedded content]

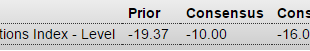

Read More »GDP, Trade, Personal income and outlays, Consumer sentiment, China deficit spending, 7DIF, US surveys, German business morale

Revised up but for the worst reasons possible- unsold inventories were higher. Also, consumption expenditures were a bit lower, and note the deceleration of GDP growth on the chart. And in all likelihood Q1 GDP is now being reduced by inventory liquidation substituting for production: GDPHighlightsAn upward revision to inventory growth made for an upward revision to the second estimate of fourth-quarter GDP, to an annualized plus 1.0 percent rate for a 3 tenths increase from the initial...

Read More »NY Mfg survey, Home builder’s index, oil losses, Japan, China trade, euro trade

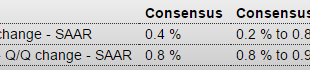

A lot worse than expected and still deep in contraction: Empire State Mfg SurveyHighlightsFor the seventh straight month, the Empire State report is signaling significant contraction for the manufacturing sector. The general business conditions index for February came in below low-end expectations, at minus 16.64 vs even deeper contraction of minus 19.37 in January. New orders, at minus 11.63, are in contraction for a ninth month in a row while employment, though improving to minus 0.99...

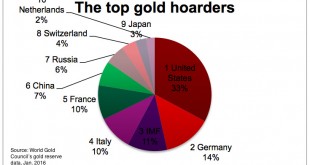

Read More »China and Russia buying gold

Seems it’s always a central bank story. Goes up when they buy, down when they sell. Furthermore gold buying is supported by how it’s accounted for. That is, it doesn’t count as deficit spending or part of the pubic debt, even though the ‘taxpayer’ has to pay interest on the funds spent, just like any other deficit spending. Gold purchases are accounted for not as an ‘expense’ as ‘normal’ govt spending, but as purchases of an asset that remains on the balance sheet at ‘cost’. And yes, the...

Read More »Why China cares about Japan’s negative rates

In-depth analysis on Credit Writedowns Pro. By Frances Coppola originally posted at Coppola Comment Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate...

Read More » Heterodox

Heterodox