Looks a lot more negative since the October 5 Saudi price cuts than the futures markets. These price are more indicative of prices of physical oil vs financial portfolio activities:Note the lack of results of ‘monetary policy’: China’s October factory, services surveys show economy still wobbly Nov 1 (Reuters) — Activity in China’s manufacturing sector unexpectedly contracted in October for a third straight month, an official survey showed on Sunday, fuelling fears the economy may still be...

Read More »Home Buyer Index, China GDP

Builders are expecting improvement, but seems actual buyers walking in the door remains depressed: Housing Market Index Sales expectations in the next six months rose 7 points to 75, while current sales conditions rose 3 points to 70. Buyer traffic, however, didn’t move, sitting at 47— the only component still in negative territory. Regionally, on a three-month moving average, the West registered a 5-point gain to 69, and the Northeast, Midwest and South each rose 1 point to 47, 60 and 65,...

Read More »China trade, WRKO interview

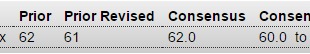

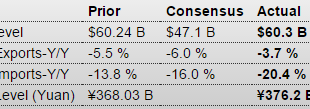

Total trade is down, but the surplus is still high and holding, which ultimately supports the currency: China : Merchandise Trade Balance Highlights Every month China’s trade data are reported in both the renminbi and U.S. dollars by the National Bureau of Statistics. The renminbi report comes out first, followed about an hour later by the more closely-watched U.S. dollar report. Since the August 11 devaluation of the renminbi there is a wider discrepancy between the two sets of data...

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More »Website 10th Anniversary: 10 Things I Got Right

Ten years ago (September 2005) I launched my website. To mark this anniversary, here are ten postings that I think got it right. Many of them are included in my book, The Economic Crisis: Notes From The Underground (2012). 1. Keynesianism: what it is and why it still matters (September 18, 2005). My first post. [...]

Read More »Everything’s under control, China edition

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which...

Read More »If we don’t understand both sides of China’s balance sheet, we understand neither

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally published on 1 September 2015. With so much happening in China in the past month it seems that there are a number of very specific topics that any essay on China should focus. I worry, however, that we get so caught up staring at strange clumps of trees that we risk losing sight of the forest. What happened in July this year, and again in August, or in June 2013, or a number of other times, were not unexpected shocks...

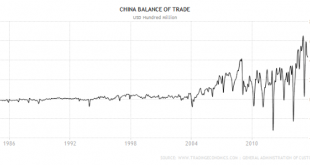

Read More »“Quantitative Tightening” is a myth

(But that doesn't mean we don't have a problem).Deutsche Bank has frightened everyone by warning that if China sold substantial quantities of US Treasuries (USTs) to support the yuan, this would amount to a substantial tightening of US monetary policy.The reason why China accumulated USTs in the first place was because of its trade surplus: The excess of exports over import sucked dollars into China, where the People’s Bank of China (PBoC) exchanged them for domestic currency (yuan). The...

Read More »Do markets determine the value of the RMB?

In-depth analysis on Credit Writedowns Pro. By Michael Pettis Last Tuesday the PBoC surprised the markets with a partial deregulation of the currency regime, prompting a great deal of discussion and debate about the value of the RMB. Part of the discussion was informed by a consensus developing in one part of the market that the RMB is no longer undervalued but is in fact overvalued. Why? Because if left to the “market”, that is if the PBoC stopped intervening, the excess of dollar supply...

Read More »China’s stock markets and revisiting 2011 predictions

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally written on 31 Jul 2015 I plan to post a new entry very soon but before doing so I wanted to say a few things about the stock markets, which continue to be insane (but not unexpectedly so) and then repost a blog entry that is nearly five years old. By the time I published my latest (July 17) blog entry Beijing had managed to stop the panic with the use of what I called “brute force”, by which I meant that there was...

Read More » Heterodox

Heterodox