Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate framework is complicated, to say the least. The Bank of Japan has helpfully produced a pretty picture to...

Read More »Chinese slowdown and the world economy

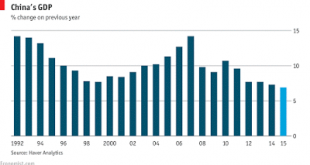

The Conference Board argues that Chinese official data should be taken with some skepticism. Nothing new there. They have adopted a new measure, which implies "Chinese economic growth at a more realistic 3.7 percent" for the recent past. In this scenario, interestingly enough, "it’s likely that the bulk of China’s slowdown has already taken place since 2011, even if unapparent in official statistics." So the picture is probably worse than the official one (as shown below, from The...

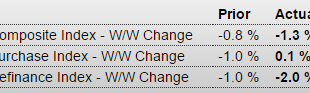

Read More »Mtg purchase apps, China trade

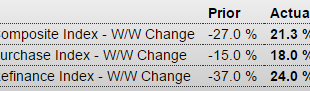

Lots of up and down right now. The chart indicates purchase apps may be up a bit but still depressed historically. MBA Mortgage ApplicationsHighlightsThe new year is seeing a surge in mortgage activity reflecting a strong jobs market and low rates, according to the Mortgage Bankers Association’s weekly report. Purchase applications surged 18 percent in the January 8 week with refinancing applications up 24 percent. These gains, however, also reflect volatility in weekly measures and largely...

Read More »Jobs, Wholesale trade, China, Rail traffic

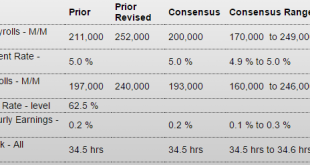

Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living: Employment SituationHighlightsThe labor market is stronger than most assessments with December results...

Read More »Bank of China, Port traffic, Redbook retail sales, Car sales early indication

This does nothing apart from supporting their policy rate: Port Traffic Grew at Slowest Rate Since Recession in 2015 Container traffic rose only 0.8% last year at the 30 busiest ports worldwide, the smallest increase since 2009, according to an estimate by AlphalinerBy Robbie WhelanJan 4 (WSJ) — Container traffic at the world’s busiest ports grew last year at its slowest rate since the recession, according to an estimate by Alphaliner, a shipping industry data provider.Demand was held back...

Read More »PMI Manufacturing, ISM Manufacturing, Construction Spending, Canada PMI, China Manufacturing PMI

Bad: PMI Manufacturing IndexHighlightsThe manufacturing PMI has been consistently running warmer than other manufacturing surveys which helps put into context the disappointment of December’s slowing to 51.2, down from 52.8 in November. The final reading for December is 1 tenth lower than the mid-month flash. Near stagnation in new orders is a key negative in the report, one that points to further slowing for the headline index in coming readings. Orders are still growing but at their...

Read More »Empire State Manufacturing, China Power Usage, Stock Buy Backs

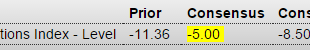

The recession continues: Empire State Mfg SurveyHighlightsNegatives are beginning to run in Empire State with the index at minus 10.74 in November, right in line with the prior four readings and well below the Econoday consensus for minus 5.00. Several components are showing extended weakness including unfilled orders, at minus 18.18 for the lowest reading of the year, and also the workweek, at minus 14.55 for a fifth straight decline and the weakest run since mid 2013. With unfilled orders...

Read More »Mtg Purchase Apps, Saudi Pricing History, China

So much for housing leading the way up- looks to have gone from flat to down: MBA Mortgage Applications For the most part Saudis have been lowering premiums and increasing discounts which causes prices to fall to get their sales up to their pumping capacity: Not without a bit of pain, which they may have come to believe inevitable due to long term supply/demand dynamics: Saudi Arabia risks destroying Opec and feeding the Isil monster (Telegraph) — The rumblings of revolt against...

Read More »Down memory lane

Since the blog is now almost 5 years old, and several issues have been discussed before, I decided once in a while to post links to old entries. This one actually with two posts one from Triple Crisis, which started the year before, and in a sense pushed me to start my own blog.Since yesterday the Donald had an op-ed in the Wall Street Journal on currency manipulation here my two cents on how much China is really a problem.Currency Wars and Global RebalancingOn China and Jobs

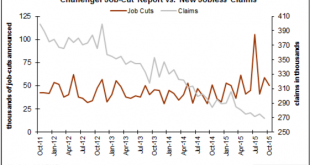

Read More »Job Cuts, Yellen Comment, Saudi Pricing, German Factory Orders, Maersk Job Cuts, China Trade Show

Down a bit but still trending higher since the oil price collapse: Seems she still doesn’t realize negative rates are just another tax: FED’S YELLEN: IF ECONOMY SIGNIFICANTLY DETERIORATED, NEGATIVE RATES AND OTHER TOOLS WOULD BE ON THE TABLE This implies the rest of Saudi pricing remains the same from November, when discounts to benchmarks were substantially increased. In general, discounts have been increased over the last few months: Saudi Arabia, the world’s largest oil exporter,...

Read More » Heterodox

Heterodox