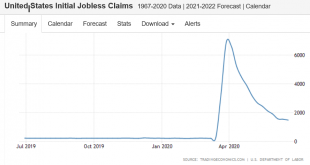

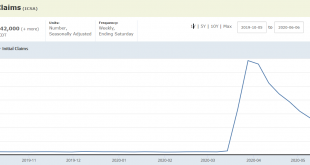

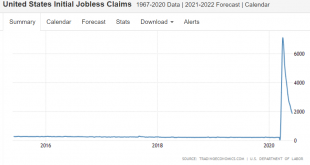

Still increasing at an alarming rate: The number of Americans filing for unemployment benefits eased to 1.480 million in the week ended June 20th, well above market expectations of 1.300 million, as companies continued to cut jobs more than a month after non-essential businesses resumed operations following closures in mid-March due to the coronavirus pandemic. The latest number was more than double its peak during the 2007-09 Great Recession, lifting the total reported since...

Read More »PMI, New and existing home sales, Vacation plans

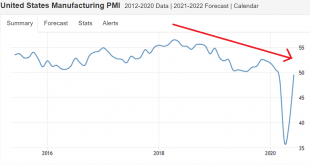

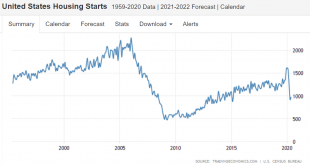

Note that it had already been decelerating from the tariffs before the virus hit. And it’s still been in contraction after 3 months: Services are contracting a bit faster than manufacturing: Still way down even with lower rates:

Read More »GDP forecasts, Bank loans

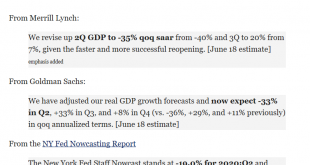

33% is about a 2 trillion drop in income/sales for q2. The fiscal adjustments may be a bit shy of that. More revisions next week: Peaked and decelerating hard:

Read More »Housing starts, Unemployment claims

Big drop from historically depressed levels: Still alarmingly high: Leveling off at very high levels:

Read More »Payrolls, Gasoline, Rigs, Recession awareness

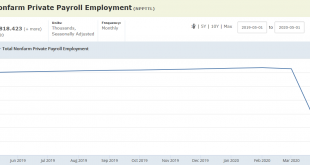

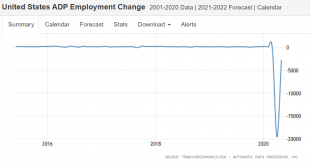

Private payrolls are reported down by about 23.5 million employees: “While there are numerous theories as to why economists were so far off, one explanation was widely discussed on Friday. The jobless claims data and the ADP private payrolls report did not pick up what analysts call “hidden hiring.” Firms put their employees on “government payroll” for a couple of months with full intentions of bringing them back.”

Read More »GDP forecasts, Consumer sentiment, Debt service vs profits, Seattle real estate, Bank loans

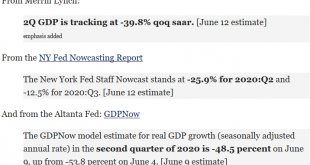

-40% is about a $2.5 trillion loss for the quarter, which is more than the fiscal adjustments for the same quarter, which means to me a very slow start for q3 unless further fiscal adjustments are made: Not as low as the 2008 recession, as Federal transfers have been supporting consumer buying plans: This does not include the private equity deals financed via debt that assumed earnings would more than cover debt service: Seems it’s all downhill from here for a while:...

Read More »Unemployment claims

Over 1.5 million new claims for unemployment comp last week, still an alarming rate of decline. Never even got up to 700,000 in the 2008 recession: Total collecting benefits continues at over 20 million.Never even got to 7 million in the 2008 recession: Not to mention this, bringing the total to over 30 million workers:

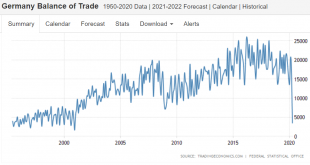

Read More »Optimism index, German trade, Fed Atlanta

And global trade had already been collapsing: Revised June 9 but still forecasting down nearly 50%:

Read More »Jobless claims, Layoffs, Trade, Vehicle sales, Miles driven

Massive losses piling up, even with gov funding for employers to keep employees on the payroll. And this number doesn’t include those who lost their jobs and aren’t eligible for unemployment comp. Massive layoffs continue even with gov funds to employers to keep employees on the payroll: Tariffs still in place and talk of increasing them… A bit of a bounce but still at depression levels: Well below depression levels:

Read More »ISM servces, GDP, ISM NY, Oil prices

Private payrolls fell by over 2 million after the PPP was in place to keep workers on the payroll. This is a forecast for Friday’s employment release: After a large contraction the rate of contraction naturally slows down, but it’s still contracting: If this turns out to be the case, it’s a drop of some $3 trillion of sales/income which is a larger drop than the increase in federal deficit spending: Below 50 is contraction: This increase will show up as an increase in...

Read More » Heterodox

Heterodox