My take is that our President is focused on the $US he’s collecting from the tariffs which he construes as ‘winnng’: Markets more fearful about trade war, but still see chance for phase one deal and tariff rollback

Read More »Housing, Eurozone construction, Singapore, Consumer comfort, Air freight

You can see from the charts how depressed this cycle has been, and how housing has stalled out overall for the last few years, and all with ultra low mortgage rates: Permits which are more volatile have ‘spiked’ back to 1965 levels when the population was about half: A relatively small economy but the drop in exports is telling: Singapore’s non-oil domestic exports (NODX) tumbled 12.30 percent year-on-year in October 2019, following an 8.1 percent drop in September and...

Read More »Corp cash allocations, DB charts, Global light vehicle sales

Corporate cash flow turning?

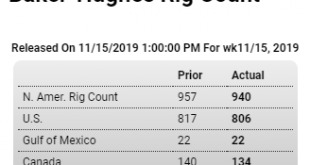

Read More »Rig count, Retail sales, Industrial production, NY Manufacturing, Atlanta Fed

More bad news for oil related capital expenditures: U.S. Rig Count Crashes Again: Loses Nearly 100 Rigs In 3 Months Highlights The Baker Hughes North American rig count is down 17 rigs in the November 15 week to 940. The U.S. rig count is down 11 rigs from last week to 806 and is down 276 rigs from last year at this time. The Canadian count is down 6 rigs from last week to 134 and, compared to last year, is down 63 rigs. For the U.S. count, rigs classified as drilling for...

Read More »Euro area industrial production, China, Japan, Powell

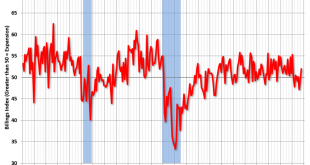

Below 0 is contraction: How about this????? Powell: U.S. debt is ‘on unsustainable path,’ crimping ability to respond to recession

Read More »Bank lending, UK, China, India

The private sector tends to be pro cyclical- tightening as the economy slows, thereby making it worse:

Read More »Rails, Wholesale sales, Earnings

Contraction continues, not to be reversed any time soon by any kind of ‘trade deal’ with China:

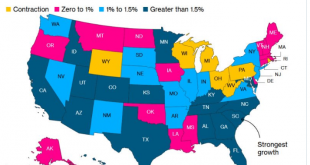

Read More »States contracting, Job openings

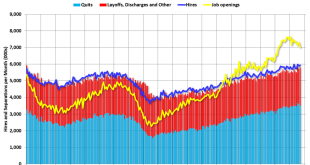

Employment, Vehicle sales, Factory orders, Headlines, US and Japan services, US and Euro area trade, Credit standards

Job openings now in full retreat: The contraction continues: Highlights Unit vehicle sales, at a much lower-than-expected annual rate of 16.5 million, proved very soft in October and will lower expectations for next week’s retail sales report. October’s pace is the slowest since April reflecting sharp slowing in light truck sales. Vehicle sales have been soft this year, averaging a 16.9 million pace versus 17.2 million and 17.1 million in the two prior years. Despite this,...

Read More »Factory orders, ISM NY, Euro area

Contraction: Highlights September factory orders fell 0.6 percent with durable goods orders falling 1.2 percent (revised from an initial 1.1 percent decline in last week’s advance data) and nondurable goods (the new data in today’s report) up 0.1 percent. Total unfilled orders have been flat this year and were unchanged in September while inventories rose 0.3 percent in contrast to shipments which fell 0.2 percent. Orders for commercial aircraft, pulled down by the grounding...

Read More » Heterodox

Heterodox