The details show a weakening US consumer: The US trade deficit narrowed to USD 47.2 billion in October of 2019 from a downwardly revised USD 51.1 billion in the previous month, and below market expectations of a USD 48.7 billion. It is the lowest trade gap since May of 2018. Imports slumped 1.7 percent to the lowest value in two years amid falling purchases of pharmaceutical preparations, auto parts, vehicles and cell phones Exports edged down 0.2 percent. Still working...

Read More »ADP, ISM services, Bank lending, Euro area earnings forecasts, ISM NY

US Companies Add the Least Jobs in 6 Months: ADP Private businesses in the US hired 67K workers in November, well below market expectations of 140K and compared with a downwardly revised 121K in October. The service-providing sector added 85K jobs, driven mostly by education & health; professional & business; leisure & hospitality and other services. Meanwhile, the goods-producing sector shed 18K jobs, the third straight month of falling employment and the sixth...

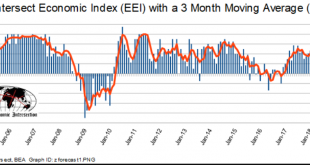

Read More »EEI Index, New tariffs, South Korea, US capex

Makes matters worse: US vows 100% tariffs on French Champagne, cheese, handbags over digital tax US capital expenditures collapsing:

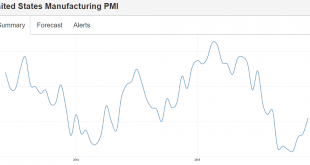

Read More »ISM Manufacturing, Construction, Mexico PMI, Germany

Contraction: Also heading south: Deceleration: China using fiscal adjustments to sustain domestic demand while redirecting trade which won’t help the US:

Read More »Euro area business climate, US small business employment, Japan retail sales, Australia

Happy Thanksgiving to all! Who would’ve thought?;) Australia Q3 Private Investment Falls More than Estimated Private capital expenditure in Australia dropped by 0.2 percent quarter-on-quarter in the three months to September 2019, following a revised 0.6 percent fall in the previous period and compared with market expectations of a 0.1 percent drop. This was the third straight quarter of decline in private investment, mainly due to a decrease in capital expenditure for...

Read More »Durable goods orders, Personal consumption and spending, Richmond Fed, Chicago PMI, Chemicals

In contraction: Deceleration that was temporarily interrupted by the tax cuts has resumed with the tariffs: The Manufacturing Activity Index in the US fifth district including the District of Columbia, Maryland, North Carolina, South Carolina, Virginia, and most of West Virginia decreased to -1 in November 2019 from 8 in the previous month, missing market expectations of 6. Shipments (-2 vs 4 in October), new orders (-3 vs 7) and backlog of orders (-11 vs 6) declined...

Read More »Trucks, Chemicals, Oil, Fed comments

America’s largest truck-engine manufacturer just announced 2,000 layoffs — and it’s another sign of the trucking ‘bloodbath’ that’s slamming the $800 billion industry Volvo announces mass layoffs due to lack of demand for trucks US Chemical Output Slows in October As Manufacturing Cools Oil Drillers Continue to Remove Rigs From Permian Basin Total US Rig Count Declines: Rigs engaged in the exploration and production of oil and natural gas in the United States totaled...

Read More »Top news, Chicago Fed, Dallas Fed, Philly Fed, Fed coincident indicators

Top news!!!;) Deceleration most everywhere: Chicago Fed National Activity Index Falls Unexpectedly The Chicago Fed National Activity Index fell to -0.71 in October from -0.45 in September and below market forecasts of -0.43. That was the lowest reading since April, as all four categories made negative contributions to the index. Production-related indicators contributed the most to decline followed by employment. In contraction as rig counts continue to decline: The...

Read More »US PMI’s, KC Fed, Euro area services, UK services, Germany services and GDP

Tariffs taking their toll and no end in sight as global deceleration continues for both goods and services. These surveys are up a bit this month but still very low and too soon to suggest a reversal: Note how this blipped up last month but then resumed the downtrend: Deceleration resumes after a small blip up last month: Germany Private Sector Contracts for 3rd Month The IHS Markit Germany Composite PMI increased to 49.2 in November 2019 from 48.9 in the previous month...

Read More »Home sales, Philly Fed, Claims, Fed staffers, US leading index, Australia

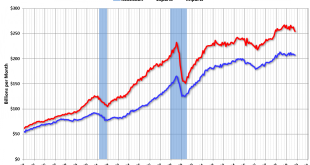

Historically depressed and rolling over: The Philadelphia Fed Manufacturing index for current general activity rose by 4.8 points from the previous month to 10.4 in November 2019, beating market expectations of 7.0. Meanwhile, the indexes for current shipments and new orders fell 17.8 points and 9.1 points respectively. In addition, the current employment index decreased 11.4 points to 21.5. Both the unfilled orders and delivery times indexes remained positive this month,...

Read More » Heterodox

Heterodox