No houses get built without a permit: Highlights The good news in May’s housing starts report is centered in the present, less so in the outlook. Starts jumped 5.0 percent in the month to a 1.350 million annualized rate that hits the top end of Econoday’s consensus range and that should give a boost to residential investment in the second-quarter GDP report. Good news also comes from completions which rose 1.9 percent to a 1.291 million rate which will help feed a housing...

Read More »Housing index, Saudi oil pricing charts

A lot less than expected as the housing slump continues: Highlights Acceleration is not the indication from the home builders’ housing market index which, though at a high level, edged back 2 points in June to 68 which is at the bottom end of Econoday’s consensus range. Current sales at 75, future sales at 76, and traffic at 50 all slipped 1 point in the month. The reading for traffic is the lowest since November and is not a good sign for the homestretch of the Spring...

Read More »Industrial production, China retail sales, Miles driven, Federal interest payments, Budget charts

A weaker than expected print due to auto sales which have been volatile, but charts show it’s still chugging along at a modest pace: Highlights A big drop in autos skewed industrial production lower in May, slipping 0.1 percent and missing what was an already soft consensus by 2 tenths. Manufacturing volumes fell a very steep 0.7 percent, pulled down by a 6.5 percent monthly drop in motor vehicles that itself reflected the effects of a fire early in the month at a supplier...

Read More »Jobless claims, Retail sales, Bank lending, Fed comments

Just a reminder (from 2015) as to why claims are this low: This is not population adjusted: We haven’t yet to recover from the last recession, in my opinion due to an ongoing lack of demand: Highlights The FOMC said yesterday that household spending has picked up and indeed it has. Retail sales jumped 0.8 percent in May which easily tops Econoday’s high estimate. And the results include an upward revision to April which now stands at a 0.4 percent gain. The report shows...

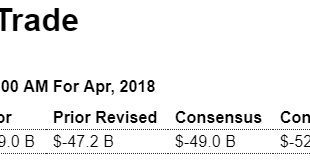

Read More »Trade, Consumer credit

The trade deficit narrowed but due to a drop in consumer spending on imported cell phones, which doesn’t bode well for retail sales, which are under pressure from the reduced growth of real disposable personal income. And the widening trade gap with the euro area is fundamentally euro friendly even as fears of Italian politics are frightening portfolio managers: Highlights Helped by a dip in cellphone imports, the nation’s trade gap narrowed sharply in April to a much...

Read More »Debt securities and loans, Vehicle sales, Manufacturers orders

Another indication of low aggregate demand this cycle: Continuing to weaken: Recovering from the dip but still has a ways to go: This component had previously leveled off at about today’s level: Actual shipments recovering but still not looking so good: Inventories correcting but remain elevated:

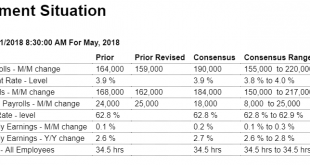

Read More »Employment, Construction spending

Above expectations and indicative of continuous modest growth. However, I have trouble making it all ‘add up’. More comments below: Highlights Employment growth is strong and it is not entirely without wage pressure. Nonfarm payrolls rose 223,000 in May to just top Econoday’s high estimate while the unemployment rate moves down a tick to a new expansion low of 3.8 percent. The monthly gain for average hourly earnings came in at the high end of expectations, up 0.3 percent...

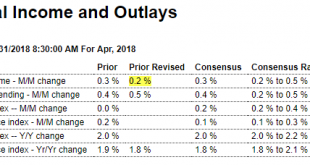

Read More »Personal income and outlays, Corporate profits, Trade, Bank lending, Corporate debt

Spending was up, but unfortunately due to higher gas prices, which were paid for by further dipping into savings that were already far too low. So looks to me like q2 is off to a very uncertain start after a weak q1: Highlights Income isn’t quite as soft and spending isn’t quite as strong as they look while inflation readings are modest and steady. Income rose 0.3 percent in April but the wages & salaries component shows a solid 0.4 percent gain. Spending jumped 0.6...

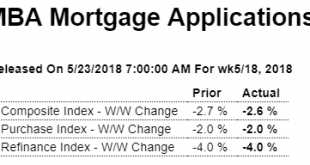

Read More »Mtg purchase apps, New home sales, Architecture billing index, China

Weakness continues: Housing, while growing modestly, remains very depressed historically: Highlights Month after month the new home sales report shows its volatility behind which, however, slight strength is evident. Sales in April came in 15,000 short of Econoday’s consensus, at a 662,000 annualized rate with revisions pulling down the prior two months by a total of 30,000. Yet compared to the prior report, when sales beat expectations by 64,000 and when upward revisions...

Read More »Retail sales, Mtg apps, Housing starts, Industrial production, Wage growth tracker

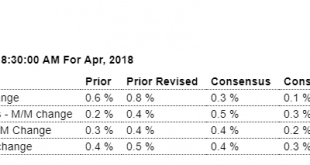

Pretty much as expected. These numbers are not adjusted for inflation, which is running around 2%: Highlights Consumer spending was weak in the first quarter and the first look at the second quarter is no better than moderate. Total sales rose an as-expected 0.3 percent in April which pretty much tells the story of the month. Vehicle sales, despite a decline in previously reported unit sales, did post a rise of 0.1 percent in the month which is very respectable given the...

Read More » Heterodox

Heterodox