Larger than expected: Highlights In some of the early data coming out in this period of trade disputes, the goods deficit of the July trade report totaled a much deeper-than-expected $72.2 billion. Exports of goods fell 1.7 percent in the month to $140.0 billion showing a very steep 6.7 percent month-to-month decline in food & feeds together with a 2.5 percent dip in exports of consumer goods and a 1.7 percent decline in the nation’s largest export, that of capital...

Read More »New home sales, Existing home sales, Sea containers, Wage tracker chart

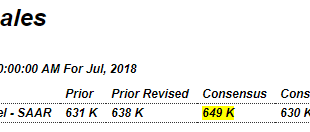

Heading lower from already depressed levels: Highlights The headline shows a decline but the message from the July new home sales report is nevertheless mostly positive. New home sales slipped 1.7 percent in the month to a 627,000 annualized rate that misses Econoday’s consensus by 22,000 and the Econoday’s low estimate by 3,000. Revisions are neutral with June revised 7,000 higher to 638,000 but with May revised 12,000 lower to 654,000. Now the good news. Supply moved into...

Read More »Retail sales, Housing starts, Philly Fed

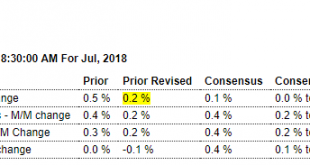

June was revised lower, so best to hold back judgement on July until August is released. Note vehicles were revised quite a bit lower for June, with the initially reported .9 jump suspect in any case: Highlights Demand for autos has cooled but not overall retail sales which rose 0.5 percent in July to easily top Econoday’s consensus range where the high forecasts were only at 0.3 percent. A downward revision to June, however, is an offset, now at a 0.2 percent gain vs an...

Read More »Consumer credit, Miles driven, Income revision

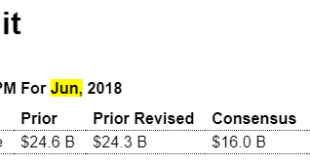

More Q2 weakness: Highlights Consumers credit came in below expectations, up $10.2 B in June as consumers held back from adding to their credit-card debt and even paid off some of it following a spending spree in the previous month. Revolving credit, which includes credit cards and which posted the biggest increase since November in the previous month, fell $0.2 billion in June. Nonrevolving credit, which tracks both vehicle financing as well as student loans, rose a...

Read More »Trade, Employment, ISM, Japan swf

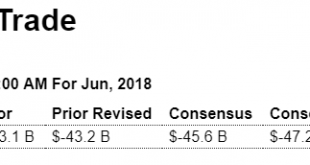

Larger than expected which also means q2 GDP will be revised down some: Highlights The nation’s trade deficit proved a little deeper than expected in June,, at $46.3 billion vs Econoday’s consensus for $45.6 billion. After a run of strength going back to February, exports posted a 0.7 percent decline to $213.8 billion in the month with a rise in service exports offset by a drop in goods exports where capital goods, vehicles and especially consumer goods posted declines....

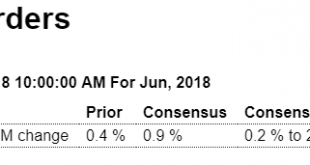

Read More »Motor vehicle sales, Factory orders

Highlights Unit vehicle sales proved surprisingly weak in July, at a 16.8 million annualized rate vs 17.2 million in June. This is the lowest rate since August last year but it will be the comparison with June that will pull down forecasts for July’s retail sales report. Vehicles were a valuable contributor to the monthly retail sales reports throughout the second quarter, but today’s results point to a flat opening for the third-quarter. Vehicle sales make up about...

Read More »Vehicle sales, Mtg purchase applications, Construction spending, Payrolls, Tesla

A lot worse than expected as sales are clearly going south: U.S. Light Vehicle Sales decrease to 16.7 million annual rate in July Read more at https://www.calculatedriskblog.com/#ZO2HJY5rKwX1XQfU.99 Highlights Purchase applications for home mortgages fell a seasonally adjusted 3 percent in the July 27 week, posting the third weekly decline in a row, while applications for refinancing declined 2 percent. Unadjusted, purchase applications were just 1 percent above the level...

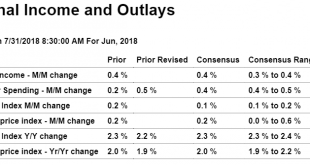

Read More »Personal income and spending, Pending home sales

The benchmark revisions were substantial and the data now paints a very different picture: Highlights Easing inflation pressure along with healthy consumer vital signs is the message from the personal income & outlays report for June. Both price indexes, the overall and the closely watched core rate which excludes food and energy, posted only marginal 0.1 percent gains in June with year-on-year rates favorable, at 2.2 percent overall and at 1.9 percent for the core, both...

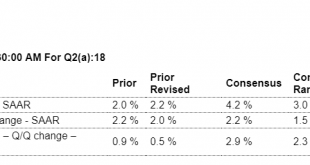

Read More »GDP, World trade

So the savings rate puzzle, where consumption was exceeding income, has now been reconciled with large upward revisions in personal income. And looks like the credit expansion that supplied the income and drove the spending was from non-residents. The next monthly consumption and income releases will bring it all up to date: Highlights Leading a report that speaks to the risk of overheating, consumer spending drove GDP significantly higher in the second quarter, to a 4.1...

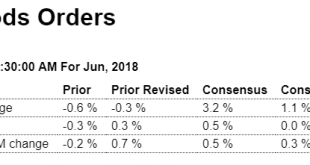

Read More »Durable goods, Trade, Inventories, Apartment survey

The tax cuts helped the economy though they were relatively small and largely low multiple, but tariffs are tax increases and work to reduce real consumption if income doesn’t also adjust. Also, there could have been some front running ahead of the dates the tariffs go into effect. This adds volatility to the data. Highlights Helping to give a 1.0 percent boost to durable goods orders, aircraft orders did in fact rise sharply in June but still not nearly as much as expected...

Read More » Heterodox

Heterodox