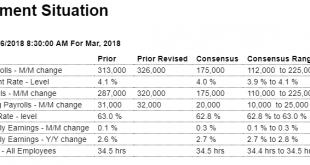

Highlights In mixed results, March payroll growth of 103,000 is well below expectations but wage indications from average hourly earnings do show a little pressure as was expected, up 0.3 percent on the month with the year-on-year rate up 1 tenth to 2.7 percent. The unemployment rate did not move down which was the consensus, instead holding steady at what is still a very low 4.1 percent. Looking first at payroll growth, February and January have been revised with a net of...

Read More »Small business jobs index, Balance of trade, Domestic vehicle sales

Small business jobs index down some and not looking good: Weak $ stuff:

Read More »Personal income and spending, Gross Domestic Income, Bank lending

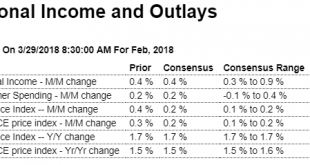

Everything pretty much as expected, more comments via the charts: Highlights Inflation data are inching higher while softness in spending is offset by strength in wages. The core PCE price index managed only an as-expected 0.2 percent gain in February though the year-on-year rate moved a notch higher to 1.6 percent, which is still subdued but just better than Econoday’s consensus. Overall prices also rose 0.2 percent with this yearly rate also up 1 tenth, at 1.8 percent....

Read More »Pending home sales, Trade, Profits

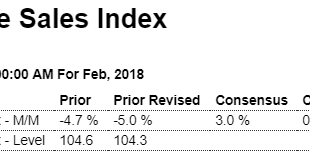

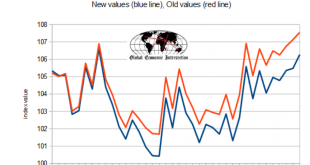

The second article reveals the year over year situation, which takes out seasonal factors: Highlights Existing home sales have been struggling to move higher but today’s pending home sales index will raise expectations for improvement. Pending home sales rose a sharp 3.1 percent in data for February though they follow an even sharper 5.0 percent revised decline in January. The Northeast has been showing life in recent housing data with February pending sales jumping 10.3...

Read More »Oil prices, Euro lending, Euro comment

Saudis could be targeting a euro price rather than a $US price? It’s their call! With capped national deficits the economy needs growing private sector deficit spending or a growing current account surplus to satisfy growing savings desires: Low inflation = weak currency??? :(

Read More »Vehicle sales, Industrial Production revisions, Tariff comments

Still looking very weak: From WardsAuto: U.S. Light-Vehicle Forecast: Sales Down Slightly; Inventory Declines to Match Demand A Wards Intelligence forecast calls for U.S. automakers to deliver 1.60 million light vehicles in March. … The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, higher than last year’s 16.7 million but slightly under last month’s 17.0 million. Read more at...

Read More »Current account, Existing home sales

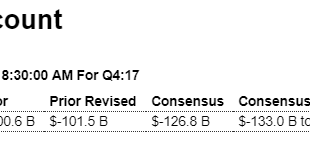

Q4 worse than expected and prior quarter revised lower, which means downward GDP revisions: Highlights The current-account deficit increased to a roughly as-expected $128.2 billion in the fourth quarter vs the third quarter’s slightly revised $101.5 billion deficit which benefited from $24.9 billion in hurricane-related insurance payments. As a percentage of GDP, the fourth-quarter deficit rose to a still moderate 2.6 percent from the prior quarter’s 2.1 percent....

Read More »Housing starts, Industrial production

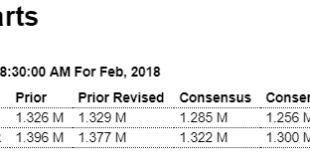

As previously discussed, the spike in multi family reported in Jan has reversed in Feb: Highlights Home sales turned lower in January as did housing starts and permits in February, and noticeably so. Housing starts fell 7.0 percent in the month to a much lower-than-expected annualized rate of 1.236 million while building permits fell 5.7 percent to 1.298 million which is also much lower than expected. Single-family homes are the key component in this report and permits fell...

Read More »Inventory to sales ratio, New economic adviser, Tax refunds

Still elevated: Didn’t take him long to sell out: Federal tax refunds have caught up which may have slowed spending in Feb:

Read More »Retail Sales, Fed Atlanta

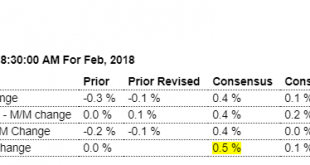

Worse than expected and now down for the last three months, not adjusted for inflation. And all in line with the narrative about personal income going flat and the falling savings rate: Highlights The big tax cut isn’t being passed to the nation’s retailers. Retail sales once again missed expectations badly, at minus 0.1 percent in February vs Econoday’s consensus for a 0.4 percent gain and a low estimate for a 0.1 percent gain. The job market may be high and confidence near...

Read More » Heterodox

Heterodox