Simple commentary. Just started to receive information on increases. Gasoline is a no brainer. We drive a fuel efficient vehicle and do five over as opposed to what others do. It is interesting to hear the complaints. Thirty-gallon gasoline tank plus fast driving and you are getting into some serious money. You can only tell them if they will listen. Most will not and get belligerent. Saudi Arabia and Russia have agreed to extend their voluntary...

Read More »New Deal democrats Weekly Indicators for September 11 – 15 2023

Weekly Indicators for September 11 – 15 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The only significant change in any metric is that manufacturing, as measured by the average of the new orders sub-indexes of the regional Feds’ monthly reports is on the very cusp of improving from negative to neutral, due to a big improvement in the New York region. That improvement probably reflects the...

Read More »Not Stepping Aside – What Do We Do?

Democrats are good at killing themselves politically in elections. We are also good at not pushing back when our candidates are under fire. Instead, we find excuses to promote others as substitutes. Or, we take our voting to other extremes such as voting for Disney characters, the family dog or cat, themselves, etc. You do not believe such? Twenty-sixteen was the year of the “Others” vote which put a potential criminal and now an indicted...

Read More »Industrial production, the King of Coincident Indicators

Has industrial production, the King of Coincident Indicators, been dethroned? – by New Deal democrat Industrial production in the post-WW2 era was the King of Coincident Indicators. In the past 20 years, it may have been dethroned. To wit, in August production increased 0.4% to a new post-pandemic high, but only 0.1% above its previous high last September. Meanwhile manufacturing production also increased, by 0.1%, but is still -0.9% below...

Read More »Real retail sales continue to be weak

Real retail sales continue to be weak; continue to forecast weakening jobs reports – by New Deal democrat As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy. Nominally, retail sales rose 0.6% in August. So did consumer inflation, and the difference rounded to -0.1% for the month. Here’s what the past 2.5 years since the 2021 stimulus...

Read More »mRNA vaccines “an unsafe medication?”

This just blows me away every time I read one of these articles about what people are thinking about Covid vaccines. And then there is some pseudo-authority who is reinforcing the false paradigm on whether the vaccines works. “Sick, sick, sick,” Digby’s Hullabaloo, digbysblog.net Florida Surgeon General Joseph Ladapo calls the mRNA vaccines “an unsafe medication”. This is incorrect and irresponsible. Someone should ask Ron DeSantis if he would...

Read More »United Auto Workers Go on Strike

The action by the United Auto Workers is part of a burst of labor activism attempting to reverse a decades-long trend. The trend as noted in the following graph. How the Latest Labor Strikes Are Attempting to Reverse Decades-Long Trends, The New York Times, David Leonhardt. (If you are having issues linking to this article to read the rest of it, you can subscribe to NYT and can read a few articles for free.) Some of the story (you can...

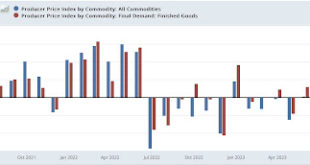

Read More »Economic tailwind from falling commodity prices has likely ended

The economic tailwind from falling commodity prices has likely ended – by New Deal democrat [Note: I’ll post on the August retail sales report later today.] Two days ago in my PPI and CPI overview, I wrote; “I am most interested in whether the producer price report tells us that the big decline in commodity prices is over. There have only been two increases in commodity prices in the past 12 months [ ] I suspect we’ll get #3 [on...

Read More »Being Polite

I am seeing issues with commenting. I want to touch on the topic a bit. Being off topic. Attacks on the poster rather than discussing the article. Long copy and pastes to specific articles. Too many of them also. Open threads can be “reasonably” used for such. Be polite in your comments. Joel and I are open to comments. We do not critique how you write something, its wording, etc. We may agree or disagree. When a comment goes awry, off...

Read More »Open Thread September 15, 2023, Will Union Auto Workers Strike?

The deep roots of the UAW’s current dissatisfaction share much with those taking labor actions to fight back after decades of rising inequality: The pay of typical workers has lagged far behind more-privileged actors in our economy, and the reason for this growing inequality is an erosion of workers’ leverage and bargaining power in labor markets. Open Thread September 9, 2023 Where do Americans mingle the most? Angry Bear....

Read More » Heterodox

Heterodox