Share the post "Let’s Talk About Bond Fund Redemptions"Some of the bond pickers of the world were not very happy with my recent post talking about how bond funds are generally safer than owning individual bonds.¹ The most common response I saw was similar to this comment on Seeking Alpha about the risk of redemptions:Beyond diversification, you have the impact of potentially permanent capital impairment as a fund sells bonds in order to, say, raise money for even normal redemptions. This...

Read More »Let’s Talk About Bond Fund Redemptions

Share the post "Let’s Talk About Bond Fund Redemptions"Some of the bond pickers of the world were not very happy with my recent post talking about how bond funds are generally safer than owning individual bonds.¹ The most common response I saw was similar to this comment on Seeking Alpha about the risk of redemptions:Beyond diversification, you have the impact of potentially permanent capital impairment as a fund sells bonds in order to, say, raise money for even normal redemptions. This...

Read More »Robo Advisors Don’t Beat Traditional Index Funds

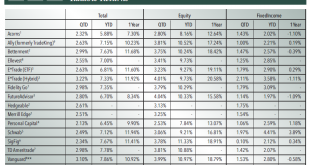

Share the post "Robo Advisors Don’t Beat Traditional Index Funds"Robo Advisors are all the rage these days. They’re heralded as being superior to other investment services because they use automation to streamline the asset allocation process. This is certainly true when compared to high fee active mutual funds, but the benefit of a robo is far less clear when compared to traditional passive index funds. I’ve stated on several occasions that Robos are just a different style of product...

Read More »Robo Advisors Don’t Beat Traditional Index Funds

Share the post "Robo Advisors Don’t Beat Traditional Index Funds"Robo Advisors are all the rage these days. They’re heralded as being superior to other investment services because they use automation to streamline the asset allocation process. This is certainly true when compared to high fee active mutual funds, but the benefit of a robo is far less clear when compared to traditional passive index funds. I’ve stated on several occasions that Robos are just a different style of product...

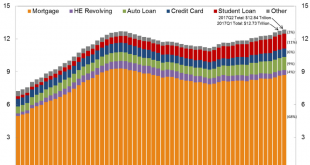

Read More »Why I’m Not Worried About Household Debt

Share the post "Why I’m Not Worried About Household Debt"The NY Fed released a new update on household debt today showing record levels. Now, at first glance you might be inclined to say “holy cow Batman, we’re on the brink of another 2008 repeat!”Well, not so fast though. When we look at a balance sheet we have to first look at both sides of that balance sheet. While the liabilities have surged so too have the assets. Household net worth is at a record high.Of course, household net worth...

Read More »Do Index Funds Increase Consumer Price Inflation?

Share the post "Do Index Funds Increase Consumer Price Inflation?"Active managers want you to think index funds are bad because they’re losing tons of money to low cost strategies. And as this trend gains momentum we’re seeing an increasing number of articles and research claiming that index funds are somehow bad. The latest one, this article in the Atlantic, wants you to think that index funds are causing monopolistic tendencies that lead to higher consumer prices. Let’s explore this...

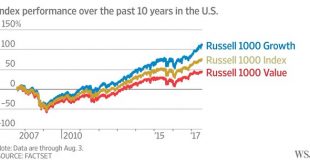

Read More »If You Own Stocks You’re a Value (and Growth) Investor

Share the post "If You Own Stocks You’re a Value (and Growth) Investor"I have a general theory about how good business operators think about their businesses:“All business owners think their business is a value and growth business.”What I mean by this is that entrepreneurs and good business owners pretty much always believe their business is selling below its intrinstic value and will provide growth in the future. I’ve run a number of businesses throughout my life and I never once said to...

Read More »Let’s Talk About “Maximizing Shareholder Value”

Share the post "Let’s Talk About “Maximizing Shareholder Value”"The idea of “maximizing shareholder value” (MSV) has been in the news a lot lately (see here and here). This is an idea generally associated with free market capitalism that states corporations should be run primarily for the purpose of maximizing the value they create for owners. This might not seem like a controversial idea, but many commentators argue that this mentality leads corporations to do bad things like overpaying...

Read More »The Best Investment Writing

Share the post "The Best Investment Writing"I am really excited to announce the first edition of The Best Investment Writing. This is a new collaborative book that takes the best writing from some of the best minds in finance. Meb Faber did an awesome job curating the best content from Jason Zweig, Gary Antonacci, Morgan Housel, Ben Hunt, Todd Tresidder, Patrick O’Shaughnessy, David Merkel, Norbert Keimling, Adam Butler, Stan Altshuller, Tom McClellan, Jared Dillian, Raoul Pal, Barry...

Read More »Three Things I Think I Think – Weekend Edition

Share the post "Three Things I Think I Think – Weekend Edition"I have been thinking about some stuff lately and I’d like to share with the group:1 – Howard Marks on the Everything Bubble. Here’s a typically good memo from Howard Marks. This is a pretty good summary:Just kidding. Kind of. The memo does read a bit like an angry old man screaming from his porch. Which is fine, because, isn’t this what all young men aspire to be when they’re old – someone who sits in a rocking chair with a...

Read More » Heterodox

Heterodox