Share the post "The Era of Irrational Apathy"Here’s a great post from Josh about the stock market’s general apathy that got me thinking about the macroeconomic picture. The post-crisis period has been a pretty extraordinary economic environment. What many people thought was a foray into a Great Depression style era has actually turned out to be a pretty amazing recovery. Check out some of these stats:One of the general themes of this blog has been the focus on all the bearish BS that people...

Read More »Your Best Investment

Share the post "Your Best Investment"Tadas is continuing his finance blogger wisdom series all week so don’t forget to go back and check them all out. Yesterday’s question was one of my favorites:Question: If you could (magically) impart one piece of wisdom to all investors what would it be?I said:“Your best investments are likely to be made outside of the financial markets.”People get this backwards every single day. In fact, I’ve argued that it’s the most backwards word in finance –...

Read More »1,000 Years Worth of Market Data

Share the post "1,000 Years Worth of Market Data"I love this post by Tadas at Abnormal Returns asking the following:“If we had a 1,000 years of market data what kinds of things would get validated? What things would lack support in the data?”There are so many good responses in there. But here’s what I said:“1,000 years worth of market data would certify that the financial markets did something in the past and that no one knows precisely what that means for the future.Imagine that – with...

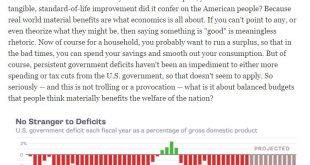

Read More »Chart of the Day – The USA is not a Corporation

Share the post "Chart of the Day – The USA is not a Corporation"Mary Meeker is out with her annual “Internet Trends” presentation and she continues to promote this very misleading view of the US government as a corporation. For instance, here’s a chart showing the “income statement” of the USA:Okay, let’s cut to the chase. Governments are not corporations. Corporations exist to increase shareholder value by earning more income. Governments exist to serve a public purpose that the private...

Read More »In Defense of Vanguard

Share the post "In Defense of Vanguard"Here’s an article criticizing Vanguard. I guess we need to get used to this. As low fee indexing continues to eat the world the high fee alpha salesman are going to have to step up their game or they’ll all go out of business. But this “takedown” is particularly bad. Let me explain.The article repeatedly refers to Vanguard as a non-profit even though the author, at one point, admits Vanguard is not a non-profit. Let’s clear this up. Vanguard is a mutual...

Read More »Why Do People Like Balanced Budgets?

Share the post "Why Do People Like Balanced Budgets?"Here’s a great question from Joe Weisenthal’s morning update:I’ve spilled a lot of ink over the last decade talking about debt, deficits and sectoral balances. My broader points have been largely proven right over that time:The US government does not operate like a household or business and operates with an inflation or currency constraint and not a traditional solvency constraint.The US government was never at risk of a solvency crisis...

Read More »Why I am an Optimist

Share the post "Why I am an Optimist"If you spend enough time managing money you learn that extremist views are extremely dangerous. Being a permabull is usually right in the long-term, but can expose you to getting crushed at times along the way. Being a permabear will look very right on rare occasions, but will crush you consistently in the long-term. And while both of these positions are dangerous they are dangerous in very different ways.I use a top-down perspective to understand just...

Read More »The All or Nothing Bias

Share the post "The All or Nothing Bias"Have you ever done something where the outcome turns out much better than expected and you said to yourself “man, what if I had only bet more on that outcome?” Of course this has happened to you because it’s happened to us all. Whether it was buying a single stock that did really well, placing a bet in a casino or buying the slightly better toilet paper (which, as it turns out, was worth a bigger investment all along).This is an exceedingly big...

Read More »Let’s Talk About the VIX (Again)

Share the post "Let’s Talk About the VIX (Again)"I’m getting a lot of questions these days about the low volatility we’re seeing in the stock market. So, step into my office and crack open an ice cold Bud Light. Just kidding, I don’t give people Bud Light in my office. I give them Coors Light.¹ Anyhow, a few years back I said that the VIX doesn’t really tell us much. Barry Ritholtz recently wrote a good piece on Bloomberg saying the same thing. But maybe there’s something to learn here so...

Read More »QE, Stock Buybacks and Other Stuff

Share the post "QE, Stock Buybacks and Other Stuff"Did QE work? That remains one of the most common questions in finance and economics. My answer is simple – it depends! I know, that’s not a super helpful answer, but hang around and let me explain in more detail.I want to use a simple analogy to analyze how QE works and whether it actually works. I’ve done this in the past, but I think it’s clearer in my mind now so hang in there. So, QE is a basic asset swap. We all know that by now. The...

Read More » Heterodox

Heterodox