Share the post "Are ETFs and Index Funds More Dangerous in a Bear Market?"Here’s an interesting claim I see more and more often:“The nature of ETFs and passive investment is worth noting. A vanilla S&P 500 ETF, for example, effectively puts company and sector fundamentals to one side and buys or sells 500 stocks at a time. This is fine in a rising market, but potentially dangerous in a falling market.”The basic thinking here is that an ETF or index fund is a mindless buying and selling...

Read More »Three Things I Think I Think – The Bubble Cometh?

Share the post "Three Things I Think I Think – The Bubble Cometh?"Here are some things I think I am thinking about:1. The Bubble Cometh? My general theory on this era has been simple – we had a big consumer credit crash which left corporations as the strong hands in the economy leading this recovery to look a lot more like the corporate boom of the 90’s than anything we’ve seen in the last 50 years. Yes, I know – the past rhymes and doesn’t repeat, but there are a lot of similarities between...

Read More »3 Things I’ve Learned Since the Financial Crisis

Share the post "3 Things I’ve Learned Since the Financial Crisis"The great thing about financial panics is that they teach you a lot about yourself and test the boundaries of existing thought which exposes the world to yearn for new understandings. The Great Financial Crisis was one of the most educational periods in finance and economics in modern times. But it’s funny to look back on the world because, as the old saying goes, the more things change the more they remain the same. While...

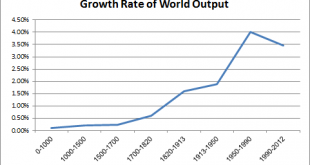

Read More »Why is US Economic Growth Slowing?

Share the post "Why is US Economic Growth Slowing?"I read a common narrative these days about how the US economy is slowing because it’s weakening, becoming less dynamic and less productive. I’ve countered some of this over time by arguing that yes, we’re slowing, but we’re just normalizing and actually stabilizing (in other words, the idea of “secular stagnation” is another case of short-termism). That is, if you look at the historical rate of growth you’ll find that the past 75 years were...

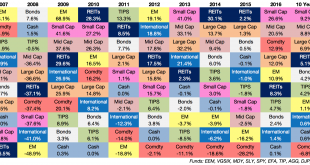

Read More »Factor Picking is the New Sector Picking

Share the post "Factor Picking is the New Sector Picking"One of the main points I always make during my active vs passive rants is that asset picking is becoming the new stock picking. You see, it used to be that alpha chasing active managers would pick stocks. The sales pitch was “I have a unique talent that will allow me to pick the best stocks so pay me a high fee to do that for you.”. That turned out to be a load of crap so the world changed a little. These alpha salesman then started...

Read More »The Problem of Our Time: Disunity and Hyperglobalization

Share the post "The Problem of Our Time: Disunity and Hyperglobalization"I am hearing the same comment a lot lately:“America is divided”It’s a strange thing for me to hear because if you study the history of America we’ve pretty much never been united. Yeah, we call it the UNITED States of America and there have certainly been moments of turmoil where we banded together uniquely and kicked the shit out of foreign threats. But aside from a few unique moments our history is mostly one of...

Read More »The Right Way to Use Economics as an Investing Tool

Share the post "The Right Way to Use Economics as an Investing Tool"The guys at Ritholtz Wealth knocked the ball out of the park with the Evidence Based Investing conference in Dana Point this year. Yesterday’s warm-up was Michael Mauboussin, followed by Rob Arnott who was followed by Jeff Gundlach. Inbetween all that amazingness was a set of incredible panels. I wish I could summarize it all. Hopefully Josh or Barry will do it at some point. I’ll do my part with a brief summary of some of...

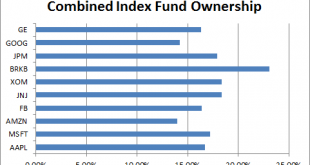

Read More »Are Index Funds Risky for Corporate Governance?

Share the post "Are Index Funds Risky for Corporate Governance?"Here’s a provocative piece in today’s WSJ about index funds and how they are bad for corporate governance. This is one of many articles in a long line of attacks on index funds in recent years. The other arguments, generally trotted out by high fee active managers getting crushed by the rise of indexing, aren’t all that convincing and at times totally wrong, but this one is intriguing so I wanted to explore it some more.¹The...

Read More »Walk it Back, Random Walker

Share the post "Walk it Back, Random Walker"Big news, nerds – Burton Malkiel has changed his mind. The investment legend, who has spent his entire life chastising alpha chasing active management, has moved over to the dark side. Malkiel, the Chief Investment Officer at Wealthfront has rolled out a new strategy that they’re calling “Passive Plus” indexing. The strategy is another name for Smart Beta which is another name for active deviations from market cap weighting. This is a big change...

Read More »Discipline vs Knowledge

Share the post "Discipline vs Knowledge"Here’s a great post by Ben Carlson discussing the inadequacy of knowledge. He discusses the fact that, despite increased awareness and knowledge of weight loss and health, humans are getting heavier and less healthy. It’s crazy to think that we can get smarter about something and yet the problem will become worse. How does this happen?Getting healthy is easy. You eat right and you work out. You can get as smart as possible about how to eat right and...

Read More » Heterodox

Heterodox