Share the post "Let’s Talk About Shrinkage"There’s a lot of concern these days about shrinkage. No, not Seinfeld shrinkage. We’re talking about Federal Reserve Balance Sheet shrinkage and how the Fed might go about reducing the size of its balance sheet.When the Fed started expanding their balance sheet in 2008 during the financial crisis there was a great deal of outcry and misinformation floating around. I wrote about 10 billion posts on this trying to clear up the misunderstandings. Let’s...

Read More »The Evidence Based Investing Conference

Share the post "The Evidence Based Investing Conference"I am really excited to announce that I will be speaking on a panel at the upcoming Evidence Based Investing Conference in Dana Point, CA from June 25-June 27 hosted by the great people at Ritholtz Wealth. My panel is titled: “Is Economics an Evidence-Based Proposition?” Can investors make use of economic data in formulating strategies or managing expectations? Is economics an art or a science?The panelists will include Mark Dow, Tim...

Read More »(Another View on) The Slowdown in Lending: A Rorschach Test

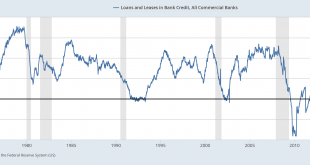

Share the post "(Another View on) The Slowdown in Lending: A Rorschach Test"A lot of ink has been spilled about the “decline” and even “collapse” in bank lending in recent months. Let’s take a closer look and see if we can’t find some pragmatic conclusions here.¹The Big Picture: Aggregate lending data tends to be noisy and it’s not at all uncommon to see sharp slowdowns in lending during expansions. That said, Total Lending is growing at 3.8% per year vs a ten year average of 4.4% so the...

Read More »The Biggest Myths in Investing, Part 10 – Forecasts are Useless

Share the post "The Biggest Myths in Investing, Part 10 – Forecasts are Useless"This is the tenth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. Smart asset allocation is really...

Read More »Why Capitalism Can’t Fix Healthcare

Share the post "Why Capitalism Can’t Fix Healthcare"I’m a staunch capitalist. I mean, I run a website called “Pragmatic Capitalism”. But here’s the thing – I know that capitalism isn’t a cure-all. It has to be implemented pragmatically. And while it works well most of the time there are times when capitalism isn’t the right answer. For instance, capitalism and national defense don’t work so great because producing things, blowing them up and losing your workforce in the process is a pretty...

Read More »The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage

Share the post "The Biggest Myths in Investing, Part 8 – More Information Will Give me an Immediate Advantage"This is the eighth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. The...

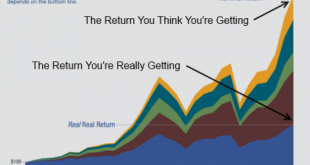

Read More »The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice

Share the post "The Biggest Myths in Investing, Part 7 – Fees are a Small Price to Pay for Expert Advice"This is the seventh instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. I’m not...

Read More »Learning to be a Good Loser

Share the post "Learning to be a Good Loser"I’ve spent a lot of my life losing at things. In fact, I’ve lost at so many things that I’ve gotten really good at it. I’d say I am a proficient loser. Which, in a weird way has really helped me improve my winning percentage over time. It seems strange, but by getting really good at losing you can improve the way in which you win.The reason why being a good loser makes you a better winner is counter-intuitive, but simple. Michael Maubboussin has...

Read More »The Biggest Myths in Investing, Part 6 – Gold is a Good Portfolio Hedge

Share the post "The Biggest Myths in Investing, Part 6 – Gold is a Good Portfolio Hedge"This is the sixth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. This one is really going to...

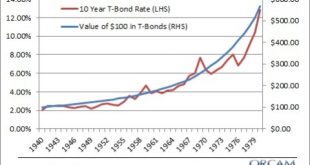

Read More »The Biggest Myths in Investing, Part 5 – Bonds Lose Value if Rates Rise

Share the post "The Biggest Myths in Investing, Part 5 – Bonds Lose Value if Rates Rise"This is the fifth instalment of a ten part series similar to what I did with “The Biggest Myths in Economics”. Many of these will be familiar to regular readers, but I hope to consolidate them when I am done to make for easier reading. I hope you enjoy and please don’t forget to use the forum for feedback, questions, angry ranting or adding myths that you think are important. This is a long one so hang in...

Read More » Heterodox

Heterodox