New Deal democrat has a post up. I hope you read it as it is some of the best commentary on the internet abut Labor, Employment, Unemployment, plus the basis for each. I read him each day as I post his dialogue. It is excellent. So as you are waiting for me to post a couple of more commentaries, you should read his commentary. I should be back by noon at the latest. Good night and see you all tomorrow. Bill...

Read More »The un(der)employment rate leads wage growth: 2023 update

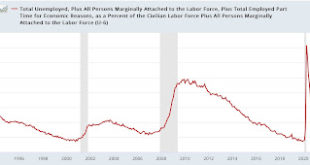

The un(der)employment rate leads wage growth: 2023 update – by New Deal democrat I had already planned on taking an updated look at wage growth today, but there was a little flutter on twitter about job openings and last week’s Q1 wage and benefits data, so that sealed the deal. To wit: as I used to write many times during the last expansion, wage growth is a long lagging indicator. It tends to increase only after unemployment (or even...

Read More »March JOLTS report shows labor market about halfway to pre-pandemic normalization

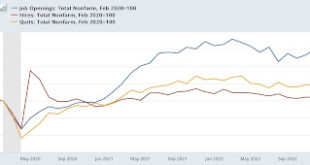

March JOLTS report shows labor market about halfway to pre-pandemic normalization – by New Deal democrat The title of this piece is an important to clue the relative nature of this morning’s Job Openings and Labor Turnover report for March. For the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase...

Read More »A mixed picture on real personal income, savings, and spending in March, and real total sales in February

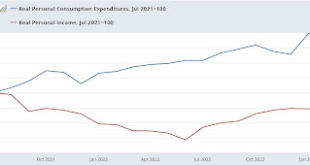

A mixed picture on real personal income, savings, and spending in March, and real total sales in February – by New Deal democrat As I’ve indicated a number of times recently, right now I consider the report on personal income and spending co-equal to the employment report as the most important monthly data. For March, it was a mixed bag. Nominally, personal income rose 0.3%, and personal spending was unchanged. Because the applicable...

Read More »Leading components of Q1 GDP paint a mixed picture

Leading components of Q1 GDP paint a mixed picture – by New Deal democrat As you probably already know, real GDP increased 1.1% at a seasonally adjusted annualized rate in Q1. This doesn’t necessarily mean that the economy improved throughout the period. The median GDP for the quarter where post WW2 recessions have begun was +2.4%, and there are reasons to believe that the reason for the positive number in Q1 was big January gains. We’ll find...

Read More »Are home sales bottoming?

Are Home Sales Bottoming? – by New Deal democrat For the past few months, I have speculated that home sales were bottoming. This morning’s report on March new home sales put an exclamation mark on that idea.New home sales increased 57,000 in March (from a February level downwardly revised by -17,000) to 683,000 annualized (blue in the graph below). The increasing trend in sales from the bottom of 543,000 last July at this point seems crystal...

Read More »The last dissent of Thurgood Marshall: the Rule of Law vs. the transitory Edicts of 5-4 Court majorities

The last dissent of Thurgood Marshall: the Rule of Law vs. the transitory Edicts of 5-4 Court majorities – by New Deal democrat Daniel Kiel at the TPM Cafe, on the supreme differences between Clarence Thomas and his predecessor, Thurgood Marshall, writes: “Thurgood Marshall, … in his final opinion before retiring after a quarter century on the court, [ ]warned that his fellow justices’ growing appetite to revisit – and reverse – prior...

Read More »The economic tailwind from last autumn’s declining gas prices is probably over

The economic tailwind from last autumn’s declining gas prices is probably over – by New Deal democrat On Wednesday I discussed how gas prices, with an assist from higher stock prices leading to stock options being cashed in, was the primary reason why the coincident indicators hadn’t rolled over yet. I wanted to explore that a little more: was the boost from lower gas prices going to allow for a “soft landing,” or a “modified limited...

Read More »Coincident indicators hold on, mainly due to improvement in gas prices YoY

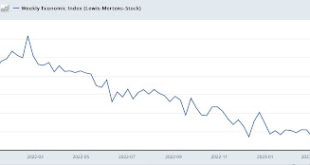

Coincident indicators hold on, mainly due to improvement in gas prices YoY – by New Deal democrat I’ve been paying particular attention lately to the coincident indicators, because the leading indicators have telegraphed a recession for about half a year – so why isn’t it here yet??? A good representation of coincident indicators remaining positive is the Weekly Economic Index of the NY Fed: It looked on track to turn negative at the...

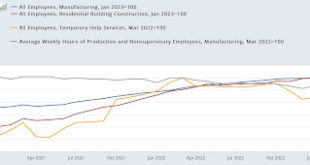

Read More »Scenes from the March employment report 1: Leading sector indicators

Scenes from the March employment report 1: leading sector indicators – by New Deal democrat There’s no significant economic news this week until Wednesday’s CPI report, and as a side note, I might be offline for a day or two later this week. In the meantime, today and tomorrow let’s take a look at some of the important information from last Friday’s employment report. Today, I’m taking a look at the leading employment sectors and several...

Read More » Heterodox

Heterodox