This is a long one and a C&P. Other than putting it up at Angry Bear, I can not take credit for this one. What I can say is . . . they are not the first ones to accuse Supply Chain for much of the inflationary issues we have had as a nation. In 2008, automotive cut production and did not maintain orders with the supply base. When it started back up, we were chasing semiconductors, etc. Lead-times doubled. We have just gone through similar....

Read More »Real average wages and aggregate payrolls for nonsupervisory workers through January

Real average wages and real aggregate payrolls for nonsupervisory workers through January – by New Deal democrat With no new data today, to close out the week let’s update real average wages and aggregate payrolls for nonsupervisory workers. This is the best way, based on monthly data, to see how average Americans are doing financially. While average nonsupervisory wages increased 0.2% in January, consumer inflation increased more, at 0.5%,...

Read More »The #1 likely reason I suspect the economy has not gone into recession yet

The #1 likely reason I suspect the economy has not gone into recession yet – by New Deal democrat I’ve been reading increasing talk about the fabled “soft landing,” or alternatively, “rolling recession.” For example, over the weekend Liz Ann Sonders of Schwab told “Wall Street Week” that housing is already in a recession, but the larger services side of the economy was still in good shape. Let me start out by noting that the goods side of...

Read More »Updating some important coincident indicators

Updating some important coincident indicators – by New Deal democrat We returned to no more significant monthly data today. So here are some important coincident indicators I’ve been particularly following. Redbook consumer purchases only increased 4.3% YoY last week, the lowest number in almost 2 years. The 4 week average also declined to 4.7%, also a 2 year low: This strongly suggests that the January retail sales report, which will be...

Read More »The blockbuster January jobs report 2: revisions do not resolve discrepancies in the reports

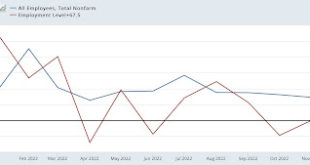

Scenes from the blockbuster January jobs report 2: revisions do not resolve discrepancies in the reports – by New Deal democrat Yesterday I wrote that the blockbuster January jobs report was essentially the result of two factors: (1) a very low number of potential applicants in the jobs pool with an unemployment rate well under 4% meant that employers were reluctant to let go of workers, which especially impacted the numbers, which particular...

Read More »Scenes from the blockbuster jobs report 1: in January, nobody* got laid off!

Scenes from the blockbuster jobs report 1: in January, nobody* got laid off! (*hyperbole) – by New Deal democrat There’s no important new economic data until Thursday this week. Meanwhile, there was lots to digest about Friday’s blockbuster jobs report, which I have now done, so I’m going to spend a couple (maybe 3!) days diving in to the details. Today I’ll deal with how seasonality and a very tight labor market were decisively important...

Read More »New Deal democrat’s weekly indicators for January 30 – February 3

Weekly Indicators for January 30 – February 3 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. While yesterday’s blockbuster jobs report dominated the monthly reports, several important weekly reports, notably the 4 week average of retail sales as measured by Redbook, and the temporary Staffing Index, weakened further to new post-pandemic lows. On the other hand, January tax withholding payments had...

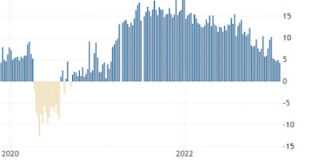

Read More »January jobs report: like a sports car at maximum acceleration

January jobs report: like a sports car at maximum acceleration – by New Deal democrat My focus on this report was on whether manufacturing and construction jobs turned negative or not, and whether the deceleration apparent in job growth would continue. Both of those were answered emphatically in the negative. Here’s my in depth synopsis. HEADLINES: 517,000 jobs added. Private sector jobs increased 443,000. Government jobs increased...

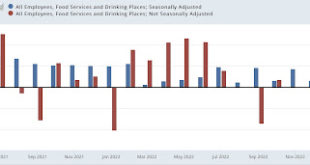

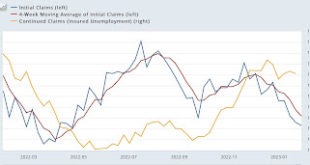

Read More »JOLTS and jobless claims: the labor market remains a strong positive

JOLTS and jobless claims: the labor market remains a strong positive – by New Deal democrat The message from the JOLTS report for December yesterday and jobless claims for last week today is that the labor market remains the strongest sector of the economy, with plenty of unfilled job openings, and almost no layoffs. Initial jobless claims last week declined -3,000 to 183,000, and the 4 week moving average declined -5,750 to 191,750. Both...

Read More »House price indexes for November: up like a rocket, down like a feather

House price indexes for November: up like a rocket, down like a feather – by New Deal democrat As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits peaked at the beginning of 2022, and starts followed several months later. This morning the FHFA and Case Shiller house price indexes for November showed continued declines from their seasonally adjusted June 2022 peak, and also continued...

Read More » Heterodox

Heterodox