March jobs report: leading sectors turn down in a pre-recessionary, but still quite positive, report – by New Deal democrat Unsurprisingly, my focus on this report, like the last few reports, was on whether residential construction jobs turned negative or not, whether manufacturing and temporary jobs continued on their downward trajectory, and whether the deceleration in job growth would be apparent. Some of the deceleration or decline...

Read More »February JOLTS report shows further relative weakening in the jobs market

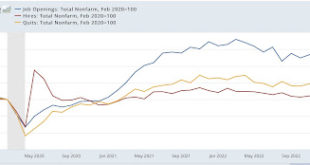

February JOLTS report shows further *relative* weakening in the jobs market – by New Deal democrat The February JOLTS report showed a weakening in almost all important trends. The strongest component of the entire series has been job openings. I tend to place lower significance on this, because there is ample evidence that companies have “gamed” this metric either to build up a bank of resumes, or else to suggest that their growth is strong...

Read More »Both manufacturing and construction continue to contract

Both manufacturing and construction continue to contract – by New Deal democrat As usual, we start the month with data on last month’s manufacturing activity, and the previous month’s construction activity. This month, both were negative. The ISM manufacturing index, which has had an excellent record as a leading indicator for the past 75 years, declined to 46.3, its lowest level since the pandemic recovery began. The new orders index,...

Read More »YoY house price gains continue to decline

YoY house price gains continue to decline – by New Deal democrat Today is a travel day so I have to keep this brief. On a monthly basis for January, prices rose 0.2% as measured by the FHFA house price index. But because that was far less of an increase in January last year, YoY house prices as measured by the FHFA index declined to +5.3%. This implies that by January next year OER as measured in the CPI will only be up about 2.1% – well...

Read More »Nobody is getting laid off, all systems are go

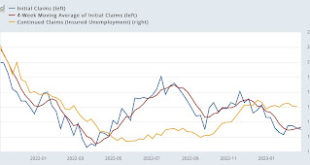

Jobless claims: the situation remains, ‘all system go’ – by New Deal democrat Initial jobless claims declined -2,000 last week to 190,000, while the 4 week moving average increased 1,750 to 193,000. Continuing claims, with a one week delay, increased 5,000 to 1,655,000. All of these remain excellent numbers: To repeat my meme over the past year, virtually nobody is getting laid off. It’s almost impossible to have an economic downturn with...

Read More »Housing prices continue to come down – like a feather

Housing prices continue to come down – like a feather – by New Deal democrat As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits and starts both peaked early in 2022, and house prices followed during the summer. This morning the FHFA and Case Shiller house price indexes for December showed continued declines both on a monthly and YoY basis, continuing to presage a similar decline in...

Read More »Durable goods orders: more deceleration, still no recession

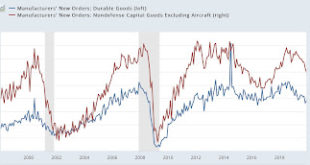

Durable goods orders: more deceleration, still no recession – by New Deal democrat I normally don’t pay too much attention to durable goods orders. That’s because they are very noisy. They don’t always turn down in advance of a recession (see 2007-08), although they may at least stall, and there are a number of false positives as well (see 2016) as shown in the graph below showing up until the pandemic: But in 2022 they were one of the last...

Read More »New home sales: a bright spot in the housing indicators

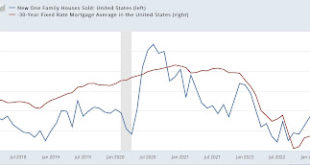

New home sales: a bright spot in the housing indicators – by New Deal democrat New home sales are very noisy, and are heavily revised, which is why I pay more attention to single family housing permits. But they do have one important value: they are frequently the first housing indicator to turn at both tops and bottoms. And it increasingly looks like new home sales have already made their bottom for this cycle. In January they rose a...

Read More »Strong upward revisions push real personal income to new highs

Strong upward revisions push real personal income to new highs, put 2 important coincident indicators firmly in expansion territory – by New Deal democrat Almost all of the news in this morning’s release for personal income and spending for January was positive. Nominally, personal income rose +0.6% and personal spending rose 1.8%. The deflator also rose +0.6%, making real personal income close to unchanged, and real spending (after...

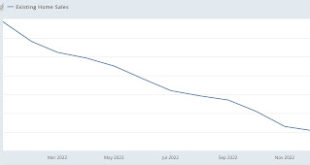

Read More »Existing home sales and prices decline further

Existing home sales and prices decline further, BUT . . . – by New Deal democrat Even though existing home sales make up about 90% of the total market, they have much less economic impact than new home construction. They are best used to confirm trends. In January they continued to confirm that sales have continued to decline, and prices, which follow sales with a lag, have joined in. January sales declined another -0.7% to 4.2 million...

Read More » Heterodox

Heterodox