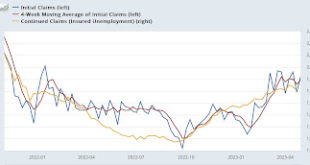

Jobless claims: yellow caution flag persists – by New Deal democrat In response to last week’s big jump in new jobless claims to 264,000, I wrote that it might be an outlier vs. the beginning of a rising trend. This morning claims fell back to their previous average range, at 242,000. The 4 week average declined -1,000 to 244,250, while continuing claims from the previous week declined -8,000 to 1.799 million: I’ve been paying particular...

Read More »A Fed nightmare? Housing permits and starts confirm improvement from bottom, multi-unit construction sets new record high

A Fed nightmare? Housing permits and starts confirm improvement from bottom, multi-unit construction sets new record high – by New Deal democrat Housing construction is perhaps the single most important method by which the Fed seeks to translate its interest rate policy into effects on the economy. To be blunt, the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of...

Read More »April industrial production looks great! – until you account for the March revisions

April industrial production looks great! – until you account for the March revisions – by New Deal democrat The second of this morning’s three significant economic releases was April industrial production, and here the revisions were very important. In April total production increased 0.5% from March, but March itself was revised downward by -0.5%, so the net result was unchanged. Manufacturing production increased 0.9% from March, but...

Read More »New Deal democrats Weekly Indicators May 8 – 12

Weekly Indicators for May 8 – 12 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. There was more slow deterioration in the coincident indicators, but interestingly a bounce in several of the short leading indicators, particularly in the weakness of the US$ (which paradoxically is a positive, because it helps exports and crimps imports). But the biggest news was in one of the twice a month...

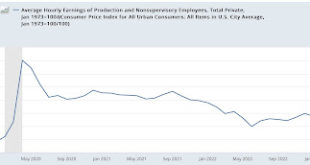

Read More »Real hourly and aggregate wages update; plus further comments on consumer and producer inflation

Real hourly and aggregate wages update; plus further comments on consumer and producer inflation – by New Deal democrat Let’s update some inflation-related information. First of all, real hourly wages for non-managerial personnel increased less than 0.1% in April. They are up about 3% from just before the pandemic, and also up a little over 1% since their June low last year: Note the graph above is normed to 100 as of the long-time...

Read More »Yellow flag from initial jobless claims turns a little more orangey

Yellow flag from initial jobless claims turns a little more orangey – by New Deal democrat Initial jobless claims rose 22,000 to 264,000 last week, while the 4 week average rose 6,000 to 245,250. Continuing claims, with a one week lag, rose 12,000 to 1.813 million: Note that both measures of initial claims are at their highest levels since late 2021. Continuing claims are also at those levels, although slightly down from three weeks ago....

Read More »Inflation ex-shelter increasing at 1.0% annualized rate since last June; core inflation with actual house prices only up 3.0% YoY

Inflation ex-shelter increasing at 1.0% annualized rate since last June; core inflation with actual house prices only up 3.0% YoY – by New Deal democrat Two months ago, I “officially” took the position that inflation had been conquered, and that, properly measured, the economy had actually been experiencing deflation since last June. With revisions, the “actual deflation” is no longer the case; but for the second month in a row since then,...

Read More »Credit conditions worsen, and likely to worsen further due to Debt Ceiling Debacle II

Credit conditions worsen, and likely to worsen further due to Debt Ceiling Debacle II – by New Deal democrat The Senior Loan Officer Survey, which measures credit on offer by banks, and the demand for credit by their customers, was released yesterday afternoon for Q1, and the news – unsurprisingly – was not good. Credit conditions not only tightened, but they tightened at a higher rate than they had in previous quarters, as about half of...

Read More »April jobs report: deceleration continues, with sharp downward revisions to previous months’ gains

April jobs report: deceleration continues, with sharp downward revisions to previous months’ gains – by New Deal democrat My focus for this report continued to be whether the leading sectors and other indicators continued to decline, and whether the pace of growth continued to decelerate. While the deceleration in growth did occur – and substantially so – the leading sectors were decidedly mixed, with some – notably the unemployment and...

Read More »Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow

Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow – by New Deal democrat Initial jobless claims rose 13,000 to 242,000 last week, while the 4 week average rose 3,500 to 239,250. Continuing claims, with a one week lag, declined -38,000 to 1.805 million: This is right in the range of the past 2 months. YoY initial claims are up 11.0%, the 4 week average is up 10.8%, and...

Read More » Heterodox

Heterodox