Weekly Indicators for November 27 – December 1 at Seeking Alpha; plus a comment on the ISM manufacturing report – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The coincident data continues quite strong, and the long leading indicators are increasingly “less bad,” which is something that happens when recessions are beginning to ebb. As usual, clicking over and reading will bring you up to the virtual moment as to...

Read More »Forecasting a further upturn in the unemployment rate: what works?

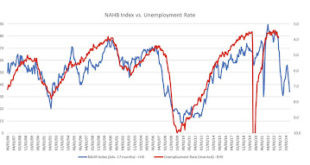

Forecasting a further upturn in the unemployment rate: what works? – by New Deal democrat Yesterday I read a post over at Seeking Alpha in which the author confidently predicted a recession in Q1 next year, based exclusively on the NAHB builder sentiment index. Here’s his accompanying graph, comparing builder sentiment with the unemployment rate 17 months later: In case you didn’t already figure it out, the graph forecasts a 7%...

Read More »Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates

Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates – by New Deal democrat Once again, this morning’s report on new single family home sales shows that the compete bifurcation of the new vs. existing home markets continues. Unlike existing homeowners, many of whom are shackled in place by 3% mortgages, new home builders can offer price incentives and downsize floor plans to increase...

Read More »New Deal democrats Leading Indicators November 24 2023

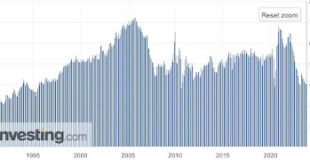

Why the Index of Leading Indicators failed – by New Deal democrat I have a post by the above title up at Seeking Alpha. The Index of Leading Indicators has persistently declined for 22 months, and is off by a level that in the past has been consistent with already ongoing, deep recessions. And yet the economy has continued to improve. Clearly there has been a misfire. The above article explains in more detail why I believe this has...

Read More »The Economy and “A Trump Thanksgiving”

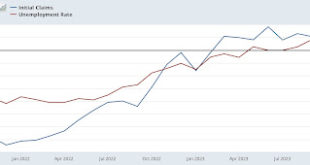

As suggested by New Deal democrat, the nation is experiencing an expansion of the economy which seems less likely to end in a recession. “There has been some commentary that continuing claims mean a recession is imminent or may even be underway. I am discounting that because initial claims have always signaled first, and also because continuing claims have been in the range of 25%-30% higher YoY for the last 6 months without worsening. Turning...

Read More »Initial jobless claims confirm benign employment conditions

Initial jobless claims confirm benign employment conditions – by New Deal democrat Initial claims declined -14,000 to 209,000 last week, and the four week moving average declined -750 to 220,000. With the usual one week lag, continuing claims declined -22,000 to 1.840 million: On a YoY basis, both weekly claims and their four week average were up only 4.6%. Continuing claims, which have been much more elevated YoY, were up 24.0%:...

Read More »Existing homeowners with 3% mortgages remain frozen in place, as sales fall to a new 28 year low

Existing homeowners with 3% mortgages remain frozen in place, as sales fall to a new 28 year low – by New Deal democrat October marked yet another month in the fully bifurcated housing market, in which most existing homeowners are frozen in place by their 3% mortgages, and buyers have turned to new homes (and in particular condos and apartments) instead. Existing home sales fell yet again, by 16,000 annualized, to 3.79 million, 45% down...

Read More »New Deal Democrats Weekly Indicators for November 13 – 17

Weekly Indicators for November 13 – 17 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. After a brief pause, the coincident indicators have continued to improve. There are now very few that are not positive. The spotlight therefore remains on the short leading indicators, as to which manufacturing has not declined enough to tip the economy into recession, and construction has not declined...

Read More »Real retail sales consistent with continued slow growth, aided by a continuing decline in commodity prices

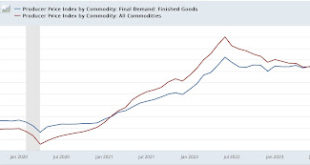

If you have been following NDd, you will note one of the biggest issues with the economy is supply chain. Most notably shortages of raw material, components, and finished products. Similar occurred in 2008 and my own belief is this is a recurrence of similar. I believe much of this could have been prevented. Beyongd that remark, I will let NDd tell you how falling costs impacts the economy. Real retail sales consistent with continued slow growth,...

Read More »Scenes from the October jobs report: soft landing vs. continued slow deceleration

Scenes from the October jobs report: soft landing vs. continued slow deceleration – by New Deal democrat First, an editorial note: economic news is light this week, so don’t be surprised if I play hooky for a day or two. That being said, let’s take a look at the most important trends, as I see them, from Friday’s employment report. The Big Question is, are we having a proverbial “soft landing?” Or is that just an illusory phase on...

Read More » Heterodox

Heterodox