Weekly Indicators for October 30 – November 3 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. One way I keep track of the producer side of the economy is via the long leading indicator of corporate profits and the short leading indicator of the stock market. As is implied, the former has a long history of leading the latter. Except that the stock market turned down in 2022 before profits did and...

Read More »October jobs report: more deceleration, in the weakest report (except for June’s) since March 2021

New Deal democrat’s October Jobs report is again featured at Angry Bear. You can also pick-up the September 2023 Jobs Report from the link at the end of this report. This is the most complete monthly review on Unemployment Rate, average hourly earnings (minus management), which way job growth or decline is going, and a summary. NDd also writes at Seeking Alpha and does a Weekly Indicator Report there also. He has been writing at Angry Bear for a few...

Read More »September JOLTS report shows continued deceleration in all trends – except layoffs

September JOLTS report shows continued deceleration in all trends – except layoffs – by New Deal democrat All of the major metrics in last month’s JOLTS report for August improved, most slightly, but the decelerating trend continued. In this morning’s report for September, that trend continued, as most of the metrics improved or declined very slightly, but the trends remained intact. Here are openings (blue), hires (red), and voluntary...

Read More »New Deal democrats Weekly Indicators for October 23 – 27

Weekly Indicators for October 23 – 27 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. With half of reports in, Q3 profits for corporations have made a new all-time high. Meanwhile the stock market has made repeated new 3 month lows. The former is a long leading indicator, the latter a short leading indicator, so we shall see which one proves more accurate. And in case you haven’t noticed at the...

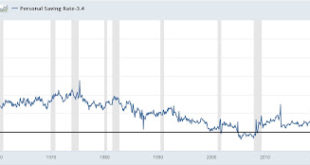

Read More »Spending soars, income stagnates, savings sink like the Titanic

Spending soars, income stagnates, savings sink like the Titanic – by New Deal democrat Real life intruded yesterday, so I didn’t put up any information about the Q3 GDP report. I’ll write in detail next week, but in the meantime there were 4 basic highlights: 1. Obviously it was an excellent report overall. 2. The long leading metric of real residential fixed spending also rose slightly, although as a share of real GDP it fell, so...

Read More »The bifurcation in the new vs. existing home market continues

The bifurcation in the new vs. existing home market continues – by New Deal democrat Last week we saw that sales of existing homes plummeted to a 28 year low, save for one month in 2010; but prices for the very limited number of such homes on the market rose 2.8% YoY. This morning we saw the exact converse happen with new home sales, which rose to a 12 month high of 759,000 annualized, up 83,000 from one month ago; while prices declined...

Read More »New Deal democrats Weekly Indicators for October 16 – 20

Weekly Indicators for October 16 – 20 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Obviously, the big story of the week was the surge in interest rates. The 10 year Treasury yield closed above 5% for the first time since 2007, and mortgage rates went above 8% for the first time since 2000! Hard to see how the economy can withstand that for very long (if it persists!). But meanwhile the...

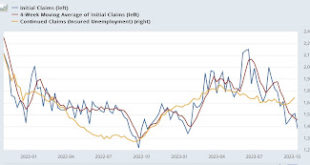

Read More »Initial claims on the cusp of turning lower YoY

Initial claims on the cusp of turning lower YoY – by New Deal democrat Initial jobless claims dropped below 200,000 last week for the first time since January, and not too far from the 50+ year low of 182,000 set in September one year ago. Specifically, they declined -13,000 to 198,000. The four-week average declined -1,000 to 205,750, the lowest since February. Contrarily, with the usual one-week lag, continuing claims rose 29,000 to 1.734...

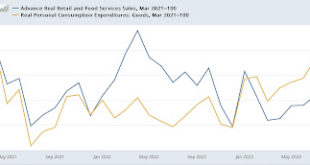

Read More »A big jump in motor vehicle sales highlights a good September for retail sales

A big jump in motor vehicle sales highlights a good September for retail sales – by New Deal democrat As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy. Nominally, retail sales rose 0.7% in September, and August’s already good 0.6% was revised upward as well. Since consumer inflation rose 0.4%, real retail sales rose 0.3% – still a...

Read More »New Deal democrats Weekly Indicators for October 9 – 13

Weekly Indicators for October 9 – 13 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The recent improvement in the short leading indicators has made its way through to the coincident indicators. But, given the importance of gas prices, whether the turmoil in the Middle East spreads out to affect oil producing countries is a major issue. As usual, clicking over and reading will bring you up to the...

Read More » Heterodox

Heterodox