Dall'amico Giancarlo Bergamini, di cui mi permetto anche di citare una mail: "In breve, Willem Buiter sostiene che i mercati si trovano a livelli grotteschi di sopravvalutazione, in buona parte grazie alle politiche monetarie ultra-accomodative delle banche centrali. Ora che queste ultime stanno considerando di cessare, quando non ritirare, tali stimoli monetari, i mercati sono a rischio di significative correzioni (cali). La mia presentazione si riferisce al caso...

Read More »Central banks’ credibility problem

In a speech in London the other day, Peter Praet discussed the ECB's unconventional policy measures. I was there, and I have to say that he deviated considerably - and rather entertainingly - from the version of the speech on the ECB website. But his core message was still the same: "Rates are expected to remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases. So, no interest rate hikes for a long time to come.But that's not what...

Read More »Quantitative Easing (QE), changes in global liquidity and financial instability

New paper by Esteban Pérez. From the abstract: This paper argues that QE led to significant changes in the global financial system, which, are not conducive to greater financial stability. Through a policy of reserve accumulation, QE disconnected base money from the money supply and deposits from loans. Jointly with the deleveraging process of global banks, QE contributed to restrain the supply of bank credit growth throughout the world. Also global banks continued to expand their trading...

Read More »Schroedinger’s assets

In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of...

Read More »Keynes and the Quantity Theory of Money

"Best diss of the Quantity Theory of Money comes from Keynes", commented Toby Nangle on Twitter, referring to this paragraph from Keynes's Open Letter to Roosevelt (Toby's emphasis): The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output...

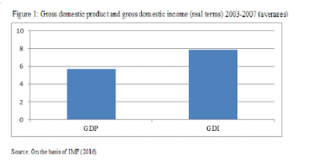

Read More »Latin American Corner: Quantitative easing, commodities, corporate debt and the paradox of debt

By Naked Keynes (Guest Blogger)The policy of quantitative easing (QE) pursued by the Federal Reserve following the fall of Lehman Brothers in September 2008 meant to lower long-term interest rates in the United States and boost expenditure had major effects on developing economies including in those of Latin America. As it is well know QE did not increase liquidity. The liquidity with which the Federal Reserve bought financial assets ended as excess reserves at the Federal Reserve balance...

Read More »The Central Bank as sugar daddy

Complex technical stuff indeed Pascal Blanqué and Amin Rajan complain about unconventional monetary policy, low or negative rates and Quantitative Easing, which they mostly blame on Greenspan and the excessive reliance on the lender of last resort (LOLR) function of the central banks (even though this precedes Greenspan). They say: The US example shows all too clearly that the longer such unconventional policy remains in place, the harder it is to exit. Most likely, ultra-low rates will...

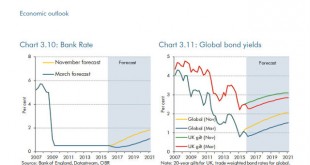

Read More »Bond yields and helicopters

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More »The changing nature of banks, post-crisis edition

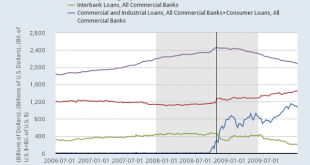

Courtesy of Dr. George Selgin comes this chart from FRED: Dr. Selgin has added a vertical line to indicate when the Fed imposed interest on excess reserves. I don't propose to discuss that here, since I have engaged in an interesting and spirited discussion with Dr. Selgin and others about it on both Forbes and Twitter. I am more interested in what else this chart shows. It is truly fascinating.The first thing to note is the fast rise in bank reserves from the latter part of 2008 onwards...

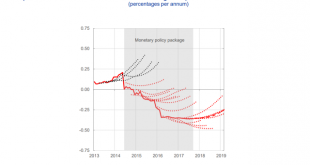

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

Read More » Heterodox

Heterodox