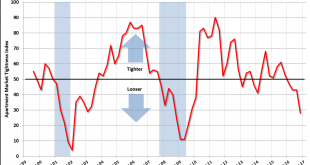

From the National Multifamily Housing Council (NMHC): Apartment Markets Soften in the January NMHC Quarterly Survey — Apartment markets continued to retreat in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. All four indexes of Market Tightness (25), Sales Volume (25), Equity Financing (33) and Debt Financing (14) remained below the breakeven level of 50 for the second quarter in a row. “Weaker conditions are evident...

Read More »Euro area current account, Trump comments

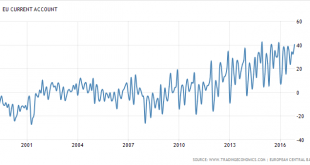

This is very ‘strong euro’ stuff, as in the longer term trade flows do rule: Euro Area Current Account Surplus At Nearly 1-Year High Eurozone current account surplus rose to EUR 40.5 billion in November of 2016 from a EUR 30.9 billion surplus a year earlier and reaching the highest since December of 2015. Considering the first eleven months of the year, the current account surplus rose by EUR 38.4 billion to EUR 355.8 billion; the goods surplus increased to EUR 372.6 billion...

Read More »The Group of Thirty might finally end its scandalous existence

from Norbert Häring The European Ombudswoman has announced that she will investigate the membership of the President of the European Central Bank (ECB), Mario Draghi, in the Group of Thirty. this is a shadowy forum of the most senior executives from large commercial banks and the most important central banks.The Group of Thirty meets behind closed doors without the press and without minutes taken. Some of the institutions are being supervised by the ECB. This group could come to an end,...

Read More »Protesting Donald Trump

When Barack Obama became President, Republicans in Congress pledged to oppose him tooth and nail. That was a bad idea. It implied that they were hoping the President would fail. This implies one of two things: either they wished ill for the country, or they were completely convinced that Obama was wrong and they were right on every important issue. Giving them the benefit of the doubt, we can assume hubris rather than dislike of country (or worse). But hubris...

Read More »Current concerns about the zero bound on interest rates

from Maria Alejandra Madi Much of the comments on the global financial and economic crisis have focused on the proximate causes and governance issues related to risk management, monetary policy and weak regulation. New political alignments allowed a process of global financial deregulations in the early 1970s. The political ascendancy of financial capital and extensive capital market liberalization, employment goals were abandoned in the economic policy agenda. Indeed, price...

Read More »Economics as science and ideology

from Peter Söderbaum Book review of Offer, Avner and Gabriel Söderberg, The Nobel Factor: The Prize in Economics, Social Democracy and the Market Turn, Princeton University Press, Princeton 2016. Since 1969 there has been a so called Nobel Economics Prize. It is not a normal Nobel Prize established by Alfred Nobel but rather a prize reminding us of the 300 year existence of the Central Bank in Sweden. The correct name is “The Bank of Sweden Prize in Economic Sciences in Memory of Alfred...

Read More »Open thread Jan. 20, 2017

[unable to retrieve full-text content]

Read More »Healthcare Chaos

from Peter Radford Here we are one day before the ascension of Trump to the White House and already the policy chaos has begun. To be fair to Trump this particular chaos is not necessarily of his own doing entirely. The Republicans in Congress are also responsible. So hell bent are they in expunging all things Obama from the record that they have charged into the valley of death known as health care reform. Or, in this case, un-reform. Having spent vast amounts of hours and taxpayer money...

Read More »Fuck You’s Inaugural Address

Sandwichman | January 20, 2017 1:18 am Dave Moss: What’s your name? Blake: Fuck you. That’s my name. You know why, mister? ‘Cause you drove a Hyundai to get here tonight. I drove an $80,000 BMW. THAT’s my name. Long before Alec Baldwin did his Saturday Night Live impression of Donald J. Trump, Trump appropriated Baldwin’s sadistic...

Read More »Uncovering where the econometric skeletons are buried

from Lars Syll A rigorous application of econometric methods in economics presupposes that the phenomena of our real world economies are ruled by stable causal relations between variables. Parameter-values estimated in specific spatio-temporal contexts are presupposed to be exportable to totally different contexts. To warrant this assumption one, however, has to convincingly establish that the targeted acting causes are stable and invariant so that they maintain their parametric status...

Read More » Heterodox

Heterodox