from Asad Zaman This is the 9th Post in a sequence about Re-Reading Keynes. In chapter 2 of General Theory, Keynes wishes to develop a theory of employment. He claims that classical economics does not have a theory of employment, because it assumes that all resources will be fully employed. But the theory that unemployment will always be 0% – except for frictional – is not a theory which can explain observations of high and persistent unemployment. Taking this post-Depression observation...

Read More »Housing starts, Chicago Fed, Trump cuts

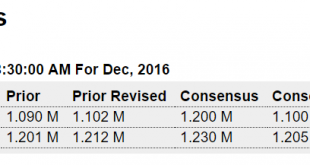

As previously discussed, no homes are built without prior permits, which are going nowhere: Highlights Housing starts extended their wild ride of volatility in December, up 11.3 percent in the month to a 1.226 million annualized rate which beats the Econoday consensus for 1.200 million. But the rise is confined to multi-unit starts which jumped 57 percent to a 431,000 rate, a contrast to the 4.0 percent decline to 795,000 for single-family starts. Permits, which are subject...

Read More »Mind the growing gap

from David Ruccio Oxfam’s headline-grabbing numbers are bad enough: “Eight men are as rich as half the world.” But the international organization has presented an even more serious and severe indictment of current economic arrangements—which can’t be glossed over by merely encouraging those at the top to pay more taxes. In the background paper, “An Economy for the 99 Percent” (a follow-up to last year’s “An Economy for the 1%“), Oxfam researchers both document the existence of grotesque...

Read More »Mtg apps, Redbook retail sales, Industrial production, Housing market index, CPI, Euro zone and US sectoral balances

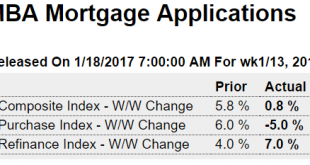

Back down again, in spite of Trumped up expectations, and going nowhere: Highlights Purchase applications for home mortgages fell a seasonally adjusted 5.0 percent in the January 13 week, while applications for refinancing rose 7 percent. Unadjusted, the purchase index increased 25 percent compared to the previous week, however, taking the year-on-year comparison up 17 percentage points from the prior week to minus 1 percent, a strong recovery but still sharply below the...

Read More »Catalyst’s Malick, unhappy about my reporting on US influence, hits back with false claim

from Norbert Haering In a news piece on rediff, one of India’s most popular news-sites, Badal Malick, CEO of the US-Indian organization Catalyst, explains via a friendly journalist, what Catalyst is doing and that my writing on Catalyst and on Washington’s meddling in the fight against cash in India was bogus. He did not convince me. Maybe he will convince you. To very briefly summarize my piece “‘A Well-Kept Open Secret: Washington Is Behind India’s Brutal Demonetisation Project‘”(...

Read More »The Economist on Diversity and Development

I was looking for information on how cultures affect growth and stumbled on this 12.5 year old article in The Economist: Diversity and development might seem to sit oddly together. But they are intimately linked, and the report seeks to show that they are not related in the way many people assume. The UNDP’s press release says unambiguously that “there is no evidence that cultural diversity slows development”, and dismisses the idea that there has to be a...

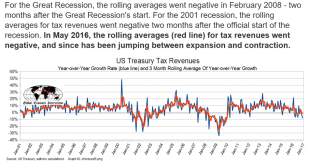

Read More »Euro zone trade, Tax receipts, Trump comments

Strong euro stuff! Eurozone Trade Surplus Widens Ahead Of ExpectationsThe Eurozone trade surplus rose to €25.9 billion in November 2016 from €22.9 billion in the same month of the previous year, above market consensus of €22 billion. Exports increased 6 percent while imports went up at a slower 5 percent. Considering the first eleven months of the year, the trade surplus increased to €248.2 billion, compared with €214.3 billion in the same period of 2015. Weak US economy...

Read More »Open thread Jan. 17, 2017

Tags: open thread Comments (16) | Digg Facebook Twitter | ...

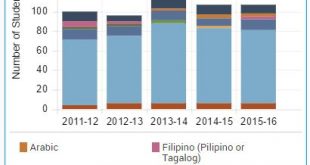

Read More »Education – Close to Home Edition

This email just arrived from the Long Beach Unified School District (LBUSD), where my son is currently enrolled in one of the elementary schools: Long Beach Unified is conducting a survey of all students, staff and parents on the culture and climate of our schools. The surveys, all of which are available for review on our website, are an important part of our accountability plan. Your input is very valuable so please watch your in-box tomorrow for an email titled...

Read More »Trump and Economics

from Peter Radford I don’t want to spend much time on Trump and his version of economics primarily because I am not sure what it is. Nor, I think, does he. One thing worth mentioning is that there is an unprecedented disconnect between the economics profession and the incoming President. Just about every economist I know says that Trump will be bad for the economy, and that the best we can hope for is that his notoriously poor attention span will prevent him from doing much. For a much...

Read More » Heterodox

Heterodox