“We’re gonna launch an investigation to find out. And then the next time, and I will say this: Of those votes cast, none of ‘em come to me, none of ‘em come to me. They would all be for the other side. None of ‘em come to me. But when you look at the people that are registered: dead, illegal and in two states, and in some cases maybe three states. We have a lot to look into.” — Donald J. Trump I regret to inform you that the nincompoop quoted above is President of...

Read More »Auto sales, Deficit news, Budget news, Germany news, Japan news

Looks like a weak start for 2017: From WardsAuto: Forecast: January Forecast Calls for Low Sales, High Inventory The U.S. automotive industry is expected to a have a slow start in the new year, with January light-vehicle sales down 4.4% from like-2016. … The resulting seasonally adjusted annual rate is 17.0 million units, well below the 18.3 million in the previous month and 17.4 million year-ago.…December inventory was 9.2% above same-month 2015, the biggest year-over-year...

Read More »Mtg purchase apps, Consumer debt comments

Note the trend: Don Schlagenhauf, chief economist for the St. Louis Fed’s Center for Household Financial Stability, and Lowell Ricketts, the Center’s senior analyst, analyzed consumer credit data and found that a decline in housing-related debt offset growth in other types of consumer debt during the third quarter. “The latest data suggest that overall growth may have stalled, despite robust student and auto loan borrowing,” Schlagenhauf and Ricketts wrote. ...

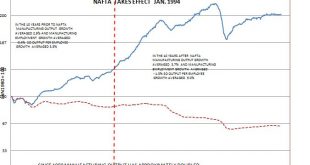

Read More »NAFTA and MANUFACTURING EMPLOYMENT

Spencer England | January 25, 2017 8:24 am President Trump is not alone in blaming NAFTA for the decline in US manufacturing employment over the last several decades. Many people on all sides of the political spectrum believe the same thing. But as this chart demonstrates the economic data tells a very different story. In the decade after...

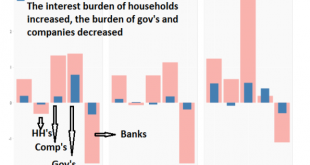

Read More »A case for low Eurozone interest rates

As far as I’m concerned, the ECB does not yet have to increase interest rates – as households still have to be able to refinance many billions high rate loans. As mister Draghi has shown, using sectoral balances, households have, unlike companies and governments not yet profited from low rates and QE! Individual EU countries have to reign in the housing market, though. Below, I’ll share some thoughts about this (as I’m a member of the ECB shadow council who gives advice on this, and I am...

Read More »Redbook retail sales, PMI Markit manufacturing, Richmond Fed Manufacturing Index, Existing home sales, Trump budget director, CIA on Trump, Mnuchin on $, Euro area surveys

Still back to the lower, pre mini spike levels. Industrial production was up due to elevated utility bills, which might explain why retail sales are low: Highlights Same-store sales growth continued the glacial pace of the prior week and was up just 0.3 percent year-on-year in the January 21 week, a sharp deacceleration from the 2-percent plus growth seen in the final weeks of December. Versus December, month-to-date January sales were down 3.5 percent, more than twice the...

Read More »Open thread Jan. 24, 2017

[unable to retrieve full-text content]

Read More »College and the American Dream (3 charts)

from David Ruccio The American Dream has all but collapsed under the weight of growing inequality. It’s becoming increasingly difficult for the American working-class to sustain a decent standard of living, and their children are increasingly unlikely to be better off than they are. But those who hang on to the American Dream—or at least the selling of that dream to others—believe that sending young people to the nation’s colleges and universities is the solution. The problem, of...

Read More »Garrett Jones Reviews the Literature on Immigrant Success

Recently I put up a few graphs showing that the income of immigrants is correlated with the income of the country from which they hailed, and that this relationship is especially true for immigrants who have been in the US the longest Garrett Jones has been covering the same ground, and here he provides a bit of a review of the literature: Recently, a small group of economists have found more systematic evidence on how the past predicts the present. Overall, they...

Read More »Are negative interest rates dangerous? A debate between Thomas Palley and Adam Posen

Thomas Palley A negative interest rate policy (NIRP) appears revolutionary, but its justification rests on failed, pre-Keynesian “classical” economics. This claims that lower interest rates can always solve aggregate demand shortages and lead to full employment. Keynes discredited classical economics by showing that saving and investment might not respond, as assumed, to lower interest rates. Once all profitable investment opportunities have been undertaken, negative interest rates may...

Read More » Heterodox

Heterodox