In the EU, house prices are Increasing too fast (graph 1). Yes, I do know that the general price level is rising, too. And I do know that wages are increasing even somewhat faster than the general price level – which mitigates problems. While, a problem in its own right, in Italy and Greece house prices have been declining for years and are still declining. And almost nowhere the record levels of 2007 have been reached (graph 2). But that does not matter. House prices are increasing too...

Read More »Market myths and realities

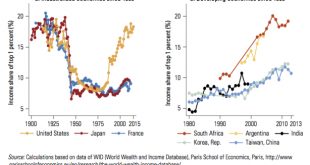

from Asad Zaman One of the core and central properties of markets is that they lead to increasing concentration of wealth at the top. This is because market allocations of goods and services respond to money, automatically conferring great power to those with wealth. For instance, market incentives lead to the production of luxury handbags and briefcases for plutocrats priced at $40,000+. According to the World Health Organisation (WHO), the price of one such bag can save more than 300...

Read More »Retail sales, Atlanta Fed, Consumer sentiment, Business inventories, Unemployment claims, Freight transportation services

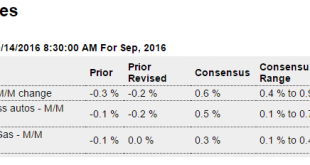

All numbers as expected. Notice the use of the word ‘solid’ for all the reports? And no one talking about year over year, which eliminates much of the seasonal factors and month to month volatility. Nor do they mention that these numbers are not adjusted for inflation, which pushes the year over year numbers down to stall speed. See charts below: Highlights Retail sales proved solid in September hitting the Econoday consensus across the board: total up 0.6 percent, ex-auto...

Read More »Blind leading the blind

from Peter Radford A few days ago David Ruccio posted an article titled “Crash and Learn” on the state of economics education. I want to elaborate a little further, although my usual skepticism on this subject does bridle a tad at the concept of economics education. Is that the same as “military intelligence”? Anyway, in that article is this quote: In Manchester, Diane Coyle also defends the basic methodology of economics. She says there is confusion among critics between microeconomics,...

Read More »Growth: weighting the evidence (with changing weights)

In growth accounting, 1+1 might sometimes add up to 1,5 instead of 2. With good reasons. Or at least: with reasons. Let me explain. Economists – and others – tend to look at production when they define ‘growth’. But we might as well look at consumption. But: what is consumption? It’s the use of stuff. And of services. But economists define it as the purchase of stuff. And services. Which leads to some problems. The value of purchases is, by definition, measured using prices. And prices...

Read More »Sherlock Holmes of the year — ‘Nobel prize’ winner Bengt Holmström

from Lars Syll Oliver Hart and Bengt Holmström won this year’s ‘Nobel Prize’ in economics for work on applying contract theory to questions ranging from how best to reward executives to whether we should have privately owned schools and prisons or not. Their work has according to the prize committee been “incredibly important, not just for economics, but also for other social sciences.” Asked at a news conference about the high levels of executive pay, Holmstrom said, It is somehow demand...

Read More »JOLTS, Mall closings

So does the fed somehow see this as ‘improvement’ and ‘solid’? More likely to me that the Fed gets criticized for waiting too long to cut. Not that it would matter, of course… Highlights In downbeat indications on the labor market, job openings fell a sharp 7.3 percent in August to 5.443 million at the same time that hiring, instead of rising, slowed by 0.9 percent to 5.210 million. The openings number is the lowest since December last year while the hiring number is more...

Read More »Taking on global poverty and inequality

from David Ruccio To read National Public Radio’s [ht: ja] article on the latest World Bank report on Poverty and Shared Prosperity: Taking on Inequality, you’d think the problem of global poverty was well on the way to being solved. Is that just wishful thinking? In terms of the headline numbers, the author of the article is correct: In 2013, fewer than 800 million people lived on less than $1.90 a day. That’s less than 11 percent of the global population. As recently as 1990, about 35...

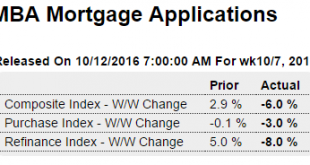

Read More »Mtg purchase apps, Small business indicator, Payouts and cash flow

Another bad one: It’s that other problems have become more important for these small businesses as conditions continue to deteriorate:

Read More »The Market and Nobels

from Peter Radford As I awake from my self-imposed slumber and re-survey the state of economics: Nothing has changed. This is predictable, and, I submit, is the most predictable phenomenon within the ambit of the discipline. Economics is in disrepute, and its current elite are determined to keep it there. The latest ersatz Nobel prize went to a couple of guys who theorize a lot about contracts. This is the kind of work that now dominates much of economics. Tinkering with mathematics,...

Read More » Heterodox

Heterodox