No one seems to know how much weight the Fed gives to this index: Highlights The labor market conditions index came in at minus 2.2 in September, extending its soft trend this cycle. Definition The Labor Market Conditions Index is an experimental indicator compiled by the Federal Reserve to track labor market activity. It is a broad composite with 19 components. Just my imagination that this has been decelerating since the drop in oil capex? My oil related comments: Any kind...

Read More »NFIB small business index, Hotel occupancy, Redbook retail sales

Went down when consensus expectations were for an increase: Note that it peaked and then fell when oil capex collapsed: The NFIB Index of Small Business Optimism dipped 0.03 points in September for the second consecutive month. Increased inventories fell seven points while hard-to-fill job openings plunged six points landing at 24 percent. Six of the 10 indices dropped, washing away the rise in expected business conditions. Interesting way of saying its going to be down from...

Read More »Hunger as the primary economic problem

You have until 30 October to submit to [email protected] a paper for the WEA online conference Food and Justice. from Asad Zaman If any group of concerned citizens would gather to discuss economic problems, it would seem natural to begin with the problem of feeding the hungry. Strangely enough, one would not encounter this problem within a standard course of study of economic theory at any of the leading universities throughout the world. This is due to two major mistakes made...

Read More »Consumer credit, Commercial Real Estate index

Nice move up vs last month but doesn’t move the year over year needle, and this series has a history of spikes up that are immediately reversed: A bit lower but too soon to suggest the modest uptrend is reversing:

Read More »“The Nobel prize in economics takes too little account of social democracy”

From today’s Guardian The Nobel prize in economics takes too little account of social democracyAvner Offer The Nobel prize in economics will be announced today. For economists, it is the pinnacle of reputation. When the word Nobel becomes attached to a winner’s name, his word acquires newsworthy authority (only one woman, Elinor Ostrom, has won the prize so far). The prize matters to everyone else too, because of market liberalism, which advocates marketisation, deregulation,...

Read More »“Children of the Great Recession”

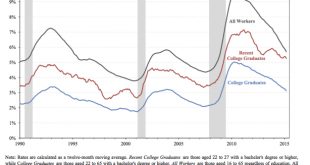

from David Ruccio In a recently leaked audio file (from a private fundraiser in February), Hillary Clinton referred to them as “children of the Great Recession. . .living in their parents’ basement,” who “feel they got their education and the jobs that are available to them are not at all what they envisioned for themselves. And they don’t see much of a future.”* Well, as it turns out, the children of the Great Recession, especially those who completed college in recent years, were right:...

Read More »Re-thinking Theoretical Economics – new WEA book

New paperback from WEA BooksA Philosophical Framework for Rethinking Theoretical Economics and Philosophy of Economics by Gustavo Marquesis now available from the Amazon pages listed below Here are links to the book’s pages on the various AmazonsUnited States $18.50, Brazil, Canada, France, Germany, India, Italy, Japan, Mexico, Spain, United Kingdom £14.25 This book argues that mainstream theoretical economics has been a basically misdirected effort at creating and exploring imaginary...

Read More »Jobs, Wholesalers sales and inventories, Atlanta Fed GDP forecast

Less than expected, July/August total revised down, earnings gain less than expected. Yes, unemployment was up because the labor force increased, but arguably it was functionally that large in the months before, etc, which means, functionally, unemployment had been that much higher all along, etc. etc. and all to my suspicions that the drop in the participation rate might be close to entirely cyclical, meaning the ‘slack’ might be equiv. to a headline unemployment rate well...

Read More »Crash and learn?

from David Ruccio The case for changing the way we teach economics is—or should be—obvious. It certainly is apparent to the students of Manchester University’s Post-Crash Economics Society and to the other 44 student groups, members of Rethinking Economics, pressing for pedagogical changes on campuses from Canada to Italy and from Brazil to Uganda. But as anyone who teaches or studies economics these days knows full well, the mainstream that has long dominated economics (especially at...

Read More »Jobless claims, Chain Store Sales, Fed comment, truck orders, Saudi pricing

This low, and not adjusted for population- tell me it’s not because they are much harder to get, thanks! Initial Jobless Claims Near Four Decade Low -5k to 249k in latest weekly survey. In the week ending October 1, the advance figure for seasonally adjusted initial claims was 249k, a decrease of 5k from the previous week’s unrevised level of 254k. The 4-week moving average was 253,500, a decrease of 2,500 from the previous week’s unrevised average of 256k. This is the...

Read More » Heterodox

Heterodox