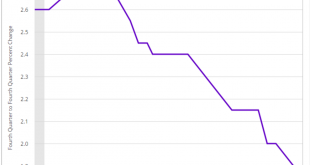

So growth and employment prospects are lower than those of their prior meeting, when they didn’t raise rates. And their forecasts continue to decelerate: Fed Trims Interest-Rate, Growth Forecasts By Michael S. Derby Sept 21 (WSJ) — Federal Reserve officials cut their growth forecast for this year to 1.8%, from 2.0% in June, and held steady their view for next year at 2.0%. Notably, they lowered their long-run view on the economy’s growth rate to 1.8% from 2%. In their...

Read More »Phlogiston, the identification problem, and the state of macroeconomics

from David Ruccio The other day, I argued (as I have many times over the years) that contemporary mainstream macroeconomics is in a sorry state. Mainstream macroeconomists didn’t predict the crash. They didn’t even include the possibility of such a crash within their theory or models. And they certainly didn’t know what to do once the crash occurred. I’m certainly not the only one who is critical of the basic theory and models of contemporary mainstream macroeconomics. And, at least...

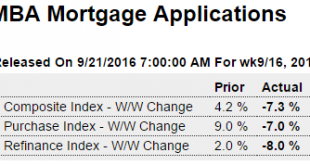

Read More »Mtg purchase applications, Architectural billings index

So much for last week’s glimmer of hope: Back down to recession levels:

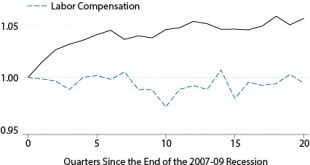

Read More »Mind the gaps: compensation and productivity (3 graphs)

from David Ruccio According to the norms of both neoclassical economic theory and capitalism itself, workers’ wages should increase at roughly the same rate as their productivity.* Clearly, in recent years they have not. The chart above, which was produced by B. Ravikumar and Lin Shao for the Federal Reserve Bank of St. Louis, shows that labor compensation has grown slowly during the recovery of the U.S. economy from the 2007-09 recession. In fact, real labor compensation per hour in...

Read More »The anniversary of Lehman and men who don’t work

from Dean Baker Last week marked the eighth anniversary of the collapse of Lehman Brothers, the huge Wall Street investment bank. This bankruptcy sent financial markets into a panic with the remaining investment banks, like Goldman Sachs and Morgan Stanley, set to soon topple. The largest commercial banks, like Citigroup and Bank of America, were not far behind on the death watch. The cascade of collapses was halted when the Fed and Treasury went into full-scale bailout mode. They lent...

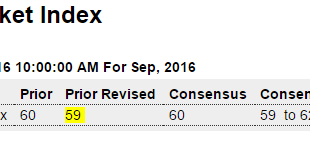

Read More »Housing market index, Redbook retail sales, Housing starts

Up a bit, but until permits increase not much chance of home building increasing: Been going from bad to worse: Highlights Redbook’s sample is not pointing to any September improvement for core retail sales. Year-on-year same-store sales rose only 0.2 percent in the September 17 week, about in line with August and noticeably lower than July — two months when the government’s ex-auto ex-gas reading posted 0.1 percent monthly declines. Rates in this report don’t always match...

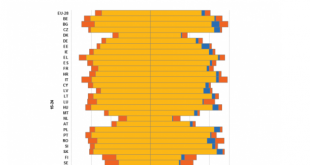

Read More »Are young men only watching porn nowadays? Not in Iceland (were they have jobs)

In the USA there is an amusing discussion going on about the decline of the participation rate of (young) men. some people state that this might be caused by digital amusement. Dean Baker rightly points out that we should not restrict this discussion to American not yet dad’s. I want to make the case that we should not even restrict this discussion to the USA. Below three graphs (source: Eurostat) which show that: A) The average participation rate in Europe increased, even after 2008 (the...

Read More »Rising tides and marginal productivity theory

from David Ruccio A constant refrain among mainstream economists and pundits since the crash of 2007-08 has been that, while the state of mainstream macroeconomics is poor, all is well within microeconomics. The problems within macroeconomics are, of course, well known: Mainstream macroeconomists didn’t predict the crash. They didn’t even include the possibility of such a crash within their theory or models. And they certainly didn’t know what to do once the crash occurred. What about...

Read More »Insider critiques of neoclassical macro models

Paul Romer has just published a devastating critique of DSGE (or, in his parlance, ‘Post Real’) macro models. He’s not the first important insider to write an article like this. Look here for Paul Krugman, ‘How did economists get it so wrong‘. Look here for Willem Buiter, ‘The unfortunate uselessness of most ‘state of the art’ academic monetary economics’. Look here for Charles Goodhart, ‘Whatever became of the monetary aggregates‘. And look here for the insider of insiders, Olivier...

Read More »US income inequality began to worsen after 1970

Exhibit 10 from The other half of macroeconomics and the three stages of economic development Richard C. Koo

Read More » Heterodox

Heterodox